Top 10 Insights From Figma’s IPO Docs … That You May Have Missed

"Non-designers make up two-thirds of Figma’s 13+ million monthly active users."

Beyond the headline numbers—48% YoY growth at nearly $1B ARR and rock-solid unit economics—Figma's IPO filing reveals something more valuable: a blueprint for how software gets built, teams collaborate, and platforms scale in the modern economy.

Here are the hidden gems:

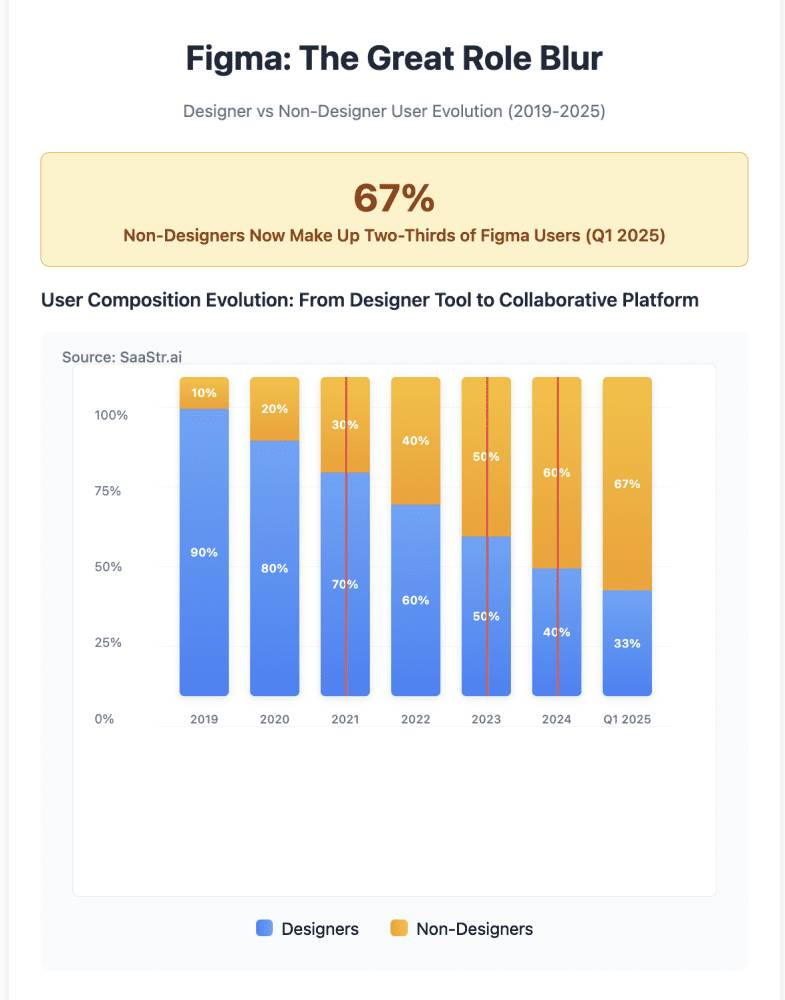

1. The Great Role Blur: Designers Are Now the Minority

Non-designers make up two-thirds of Figma’s 13+ million monthly active users. This isn’t just adoption—it’s a fundamental shift in who “designs” software. Figma has successfully expanded beyond its designer origins to become the collaborative workspace for entire product teams, validating their thesis that design is everyone’s job.

2. Customer Cohort Durability: 96% Gross Retention

While everyone focuses on the 132% Net Dollar Retention, the 96% Gross Retention Rate for customers above $10K ARR is remarkable. In an era of software consolidation and budget scrutiny, Figma has achieved near-permanent customer status—once teams adopt it, they don’t leave.

3. The Cohort Expansion Phenomenon: Multi-Year Growth Rates

Customer cohorts show remarkable durability and growth over time. The 2020 cohort achieved a 46% compound annual growth rate from initial purchase through March 2025—meaning customers don’t just stick around, they consistently expand their usage year after year. The 2021 and 2022 cohorts maintain 31% and 22% CAGRs respectively, showing sustainable expansion patterns across multiple vintage years.

4. The Developer Invasion: 30% of Users Write Code

Perhaps most surprising: developers represent ~30% of Figma’s user base during Q1 2025. This massive developer adoption through Dev Mode shows Figma successfully bridging the design-to-code gap—traditionally one of the most friction-filled handoffs in software development.

5. Multi-Product Stickiness Is Real: 76% Use Multiple Products

76% of customers use at least two Figma products, demonstrating genuine platform effects. This isn’t just feature bloat—customers are adopting FigJam for ideation, Figma Design for visualization, Dev Mode for development, and Figma Slides for alignment as part of integrated workflows.

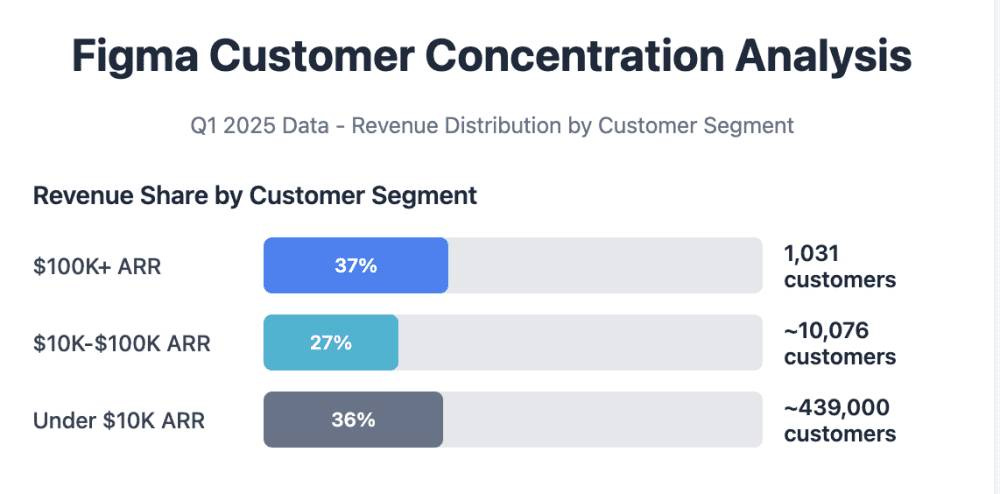

6. The $100K+ Customer Explosion: 47% Growth

The number of customers spending $100K+ annually grew 47% year-over-year to 1,031 customers as of Q1 2025. Even more telling: these large customers represent 37% of total ARR, showing Figma’s ability to expand within enterprises far beyond initial design team deployments.

The 80/20 Rule on Steroids:

Just 2.5% of customers (11,107 accounts) generate 64% of ARR

The top 0.2% of customers (1,031 accounts) generate 37% of ARR

This extreme concentration shows Figma’s ability to create massive value for larger organizations

7. The $10K+ Customer Concentration: 64% of ARR

Customers spending $10K+ annually represent just 11,107 accounts but generate 64% of total ARR as of Q1 2025. This extreme revenue concentration shows Figma’s ability to create significant value for mid-market and enterprise customers—a small number of deeply engaged accounts drive the majority of revenue, indicating strong product-market fit at scale and pricing power within larger organizations.

8. Global Usage vs. Revenue Arbitrage

Here’s a hidden growth lever: 85% of monthly active users are outside the US, but only 53% of revenue comes from international markets. This massive geographic monetization gap suggests significant pricing optimization and go-to-market expansion opportunities.

9. Fortune 500 Penetration: 95% Adoption Rate

95% of Fortune 500 companies used Figma as of March 2025, yet only 24% of Forbes Global 2000 companies spend more than $100K annually. This penetration-to-monetization gap indicates enormous expansion potential within existing enterprise customers.

10. The Organic Enterprise Pipeline: 70% Upgrade Pattern from Low End “Professional” Plan

70% of new Organization and Enterprise customers in both 2024 and Q1 2025 included at least one user who was previously on a Professional plan. This reveals Figma’s powerful bottoms-up sales motion—individual users and small teams naturally expand into enterprise-wide deployments, creating a predictable and low-cost customer acquisition engine.

The Meta-Learning: Platform vs. Product Thinking

The biggest insight isn’t any single metric—it’s how Figma has successfully evolved from a design tool to a collaborative platform for software creation. Their 180 feature updates in 2024, expansion into adjacent workflows (marketing with Figma Buzz, websites with Figma Sites), and deep AI integration show a company thinking in systems, not features.

This platform approach explains their remarkable expansion metrics: once teams adopt Figma for design, the platform’s collaborative DNA and workflow integrations create natural expansion into ideation, development, and even marketing—making Figma the operating system for digital product creation.

5 More Things You May Have Missed:

• The Adobe Breakup Windfall: Figma received a $1 billion termination fee from Adobe in 2023 when their merger was abandoned due to regulatory concerns, providing massive cash reserves for growth investments

• Hyperlocal International Expansion: Figma operates 9 offices across 7 countries with staff in 13 countries and 5 continents, yet their product is only available in 5 languages—showing focused geographic expansion with significant localization upside

• The Education Strategy: Figma’s Professional plan is free for all educators and students, while Organization plan is free for K-12—creating a massive pipeline of future professional users trained on Figma from the start

• Community-Driven Monetization: Users can now monetize content they create and publish on Figma’s Community platform (launched 2022), turning engaged users into revenue-generating partners in the ecosystem

• Four-Year CAGR of 53%: Beyond the headline 48% YoY growth, Figma’s four-year compound annual growth rate is 53%, demonstrating sustained hypergrowth over an extended period—rare for companies at their scale