The Latest SaaS IPO: OneStream. It's a Good One.

"$500m ARR. $5B+ Market Cap. 34% Growth. That's About as Good As It Gets."

So we’ve finally had another great SaaS IPO — OneStream. Just the third SaaS IPO since December 2021, OneStream is SaaS for CFOs and financial operations, a large but somewhat under-discussed category. SAP and Oracle are very strong here.

Founded back in 2010 (SaaS takes time!) with first customers launched in 2012, the metrics today are very strong:

$480,000,000 in ARR

Growing 34% (strong)

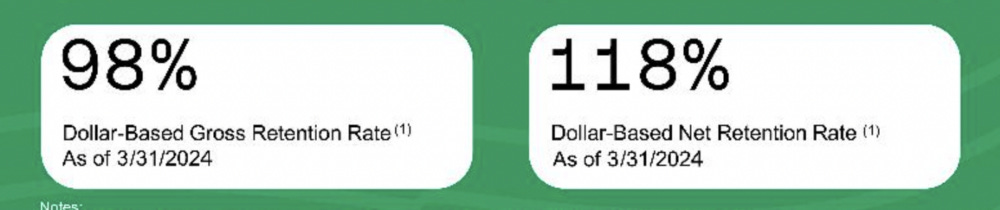

98% GRR (!) and 118% NRR

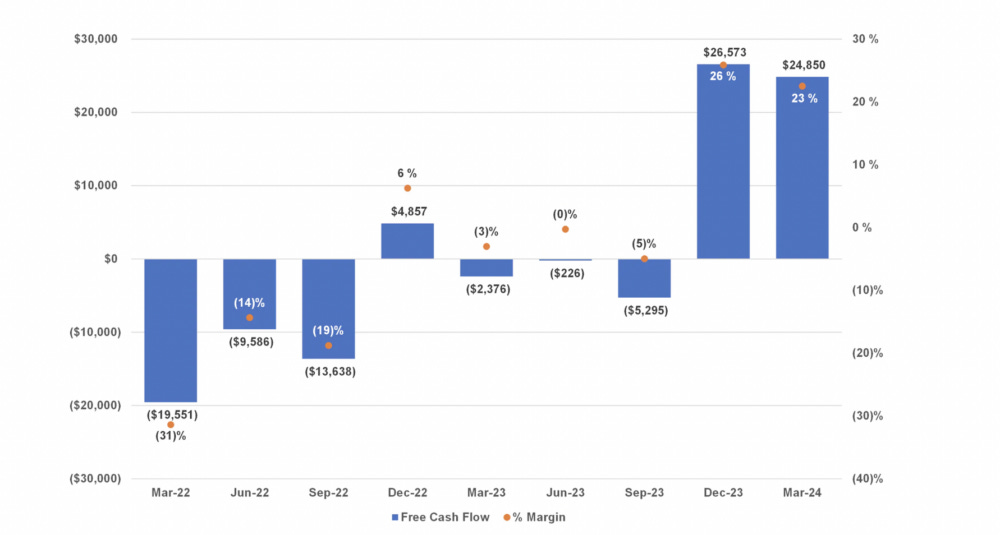

11% Free Cash Flow Margins, 20% the past 2 quarters

That’s the full package.

5 Interesting Learnings:

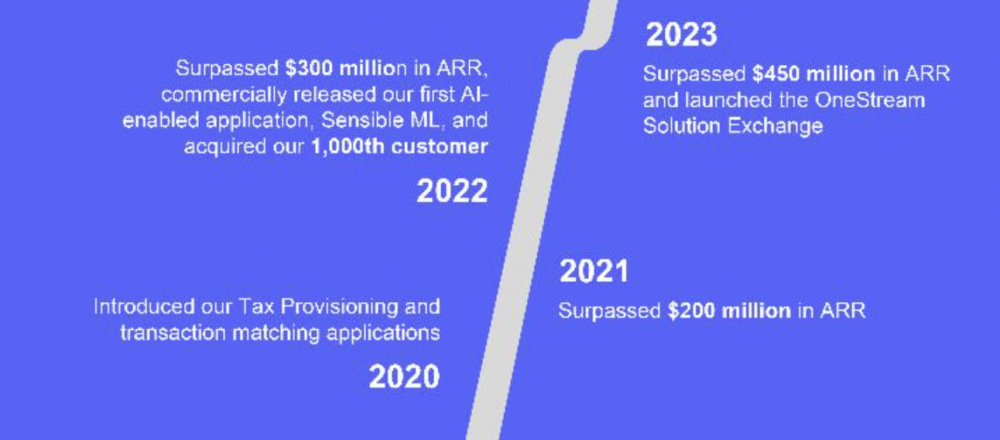

#1. Went from $100m ARR to $450m ARR in Just 3 Years (!)

Many slow down as they approach $100m ARR and especially $200m ARR. Not OneStream. It built up speed then, and wrnt from $100m ARR in 2020 to $200m in 2021 and $300m in 2022 and $450m in 2023! Goodness. Still, growth has now slowed to a top tier but more human rate of 34%

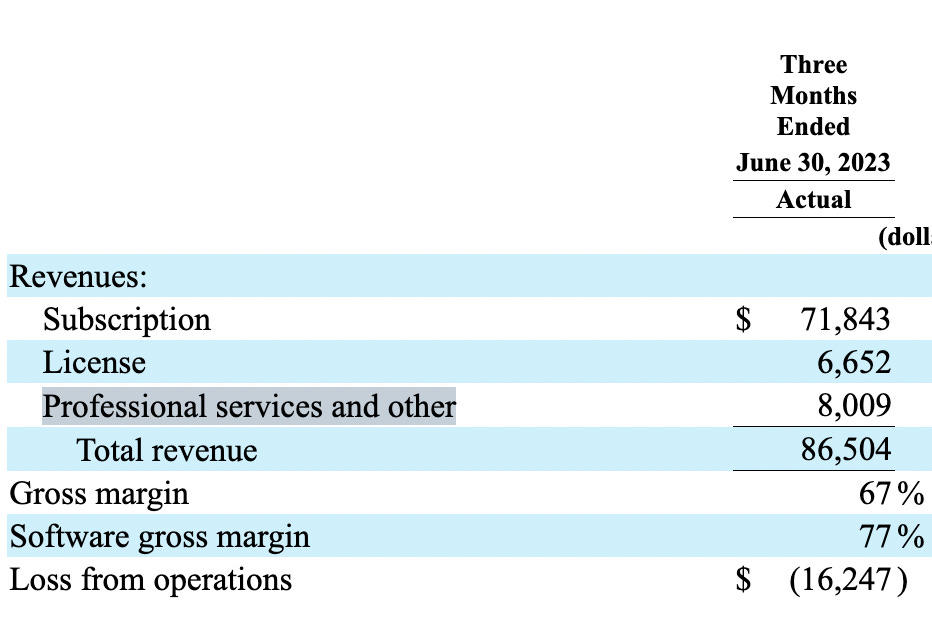

#2. Professional Services is 8% of Revenues

This seems pretty standard now in the enterprise. There’s no perfect answer here, but most enterprise leaders seem to try to keep lower-margin pro services under 10% of revenue — and have third parties do the rest.

#3. GRR of Stunning 98%

No one leaves. NRR is strong at 118%, but it’s the 98% GRR that makes the jaw drop. ServiceNow has similar GRR. Once you pick OneStream to manage your financial platform — you don’t leave.

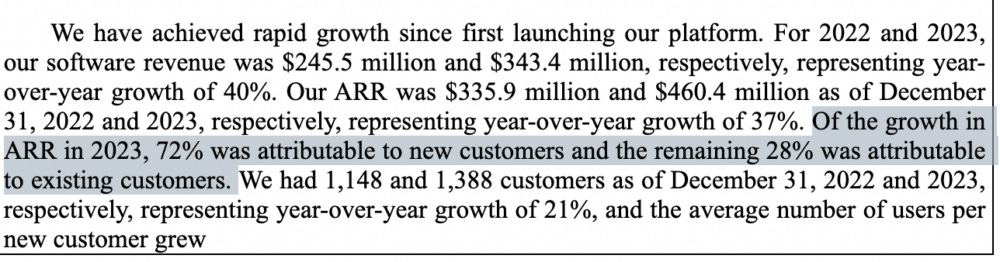

#4. 72% of Growth From New Customers, 28% From Existing

We can try to infer this from NRR numbers, but it’s super helpful to see a leader break this out. To grow 34%, OneStream is also adding +21% new customers a year.

#5. 1,388 Customers, So Average Deal Size of $325,000

A true enterprise playbook here. Again, OneStream is adding +21% new customers a year. SaaS leaders at scale need to add +20% new customers a year in general to stay in growth mode.

And a few other interesting learnings:

#6. 31% of Revenue From Outside U.S.

Pretty impressive to me at least considering how different accounting and legal frameworks are in different countries and jurisdictions.

#7. Broke Into Positive Free Cash Flow In 2024

OneStream was almost break-even in 2023, and then as it geared up to IPO, switched to 11% or so free-cash flow margins this year and 20%+ for past 2 quarters. OneStream switched to a much more efficient mode the year before filing to IPO. Did it trade off some growth? Possibly.

Meritech has a good summary here of their path to cash-flow positive

#8. Perhaps Most Impressively — It Was Bootstrapped For 8 Years, Up To ~$100m ARR and a $1B Valuation!

At scale, they eventually raised buy-out capital from KKR. But until that stage, it was 100% bootstrapped — with no external capital at all. Boom!