The Latest Napkin Reveal: What it Takes to Raise Capital with Christoph Janz, General Partner of Point Nine Capital

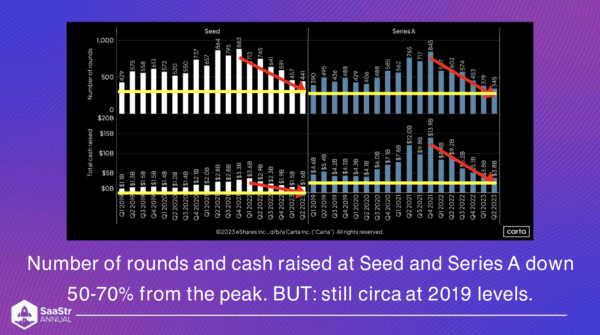

"The amount of capital is down 50-75% from the peak, depending on what you’re looking at."

Given the massive downturn that started 18 months ago, many SaaS founders are nervous about what it takes to raise capital in SaaS in 2023 / 2024.

Christoph Janz, General Partner of Point Nine Capital, shares what it takes to raise capital in SaaS, overall investment activity, and how to develop a convincing AI strategy.

The Proverbial Napkin

What does it take to raise capital in SaaS in 2023?

In 2016, Janz did research and tried to answer this. He put the results on the back of a proverbial napkin.

If you missed that part of history, this practice turned into writing it on a physical napkin.

Now, it’s time to create the 2023 SaaS funding napkin.

Before conducting the survey this year, the expectation was that the napkin could look like this…

“If you’re in AI, we’d give you money at any valuation. And if not, probably difficult,” says Janz. Of course, the actual results have a bit more nuance.

Keep reading to learn qualitative answers from investors and the implications those answers have for founders trying to raise a round in 2023.

Overall Investment Activity in 2023

We all know there has been a massive shift in the number of rounds and capital raised. The good news is that we’re still at the 2019 levels.

So, what happened is most of the craziness from 2020 and 2021 has been erased, yet we’re not back to the nuclear winter of fundraising in 2008.

Series B and Series C had a similar number of rounds, and the amount of capital is down 50-75% from the peak, depending on what you’re looking at.

It’s not much worse than 2019, and it wasn’t that bad then.

Pre-Seed

Looking at the data from Point Nine’s survey, each blue bar is one data point.

The median round size and valuation, as well as the median round size and valuation from Carta (U.S. data only), is quite a large range.

But if you look at where most data points and median are, you can see that most pre-seed round sizes were around 1.5M, and valuations were roughly at $5-10M.

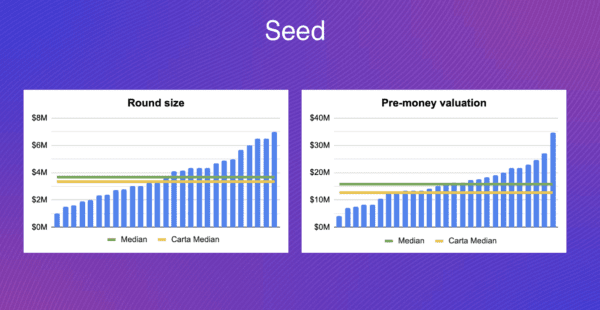

Seed

Most Seed rounds landed in the 4-5M range at $10-20M pre. At the Seed stage, investors also asked how much ARR companies had at the time.

Approximately half were pre-revenue, while the other half had some ARR between a couple hundred thousand to upward of $1-$1.5M.

Some of the info on growth rates at this stage isn’t relevant because there aren’t many companies that can look back 12 months and see any significant revenue by the time they raise a Seed round.

Series A

Most rounds in Series A were in the 5-15M range. This is a big range, so perhaps it’s not that helpful.

Valuations landed mostly in the $20-60M range. Again, a very broad picture.

As you can see, most companies, when raising A, are at around $1–$5M ARR. This might be more than you’d expect, and it’s more than what we’ve seen in previous years.

One of the takeaways here?

Investors have become more picky in this market and tend to wait a bit. Everything is slower, so companies have more ARR by the time they raise Series A.

Looking at the growth rates, more than half of those companies grew at more than 2x. But a significant number were growing at less than 2x.

This might be a function of the slowdown and the fact that Series A happens a bit later than usual.

The number of data points is somewhat limited, but a reasonable takeaway is that, compared to two years ago, Series A happens slightly later, with more ARR and slower growth rates.

Valuations haven’t changed much, so the multiples have been compressed.

Series B

Point Nine didn’t have a lot of data points for Series B but included data from Carta.

Most Series B rounds were roughly in the 10-40M range, and valuations were between $80-$200M.

Looking at ARR levels for Series B, most were around $6-12M in ARR. And interestingly, more than half are growing at less than 2x.

As with Series A, Series B rounds tend to happen later and have more ARR and less growth.

Every company had to reduce growth targets in the last 1-2 years. Investors still get excited by growth and want to see it even to consider an investment, but the expectations had to come down.

What Really Matters To Investors In 2023

What might be more interesting than numbers is what investors really care about — like capital efficiency, valuation, AI strategy, quality of the team, growth rates, etc.

Investors were asked to rate each of these factors based on what is more or less important than in previous years.

What’s clear from this picture is that more than 90% said capital efficiency has become more important than in previous years.

The vast majority said valuation has also become more important.

Half the investors want to hear a convincing AI strategy when talking to founders.

With all of this information, let’s try to look at how the next version of the napkin might look.

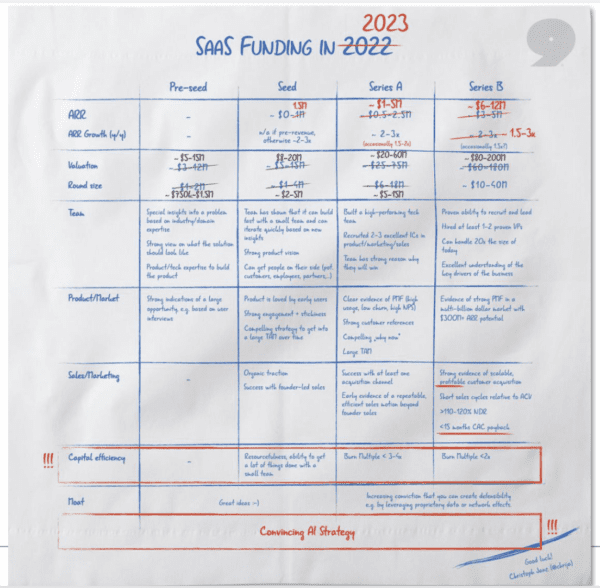

The 2023 SaaS Funding Napkin

There will be some updates to valuations and round sizes, plus ARR and growth rates.

But the clear takeaway and most important difference to 2022, and more to 2021, is an immense focus on capital efficiency, as well as an AI strategy that every investor will ask about if raising a round in 2023.

Finding The Right Balance Between Growth And Efficiency

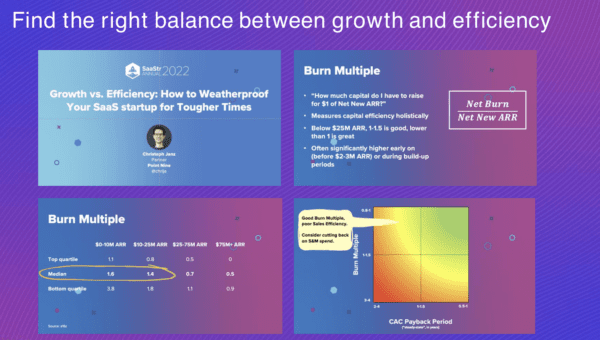

Finding the right balance between growth and capital efficiency has been more important than almost anything else over the last 18-24 months.

Up until 2020-2021, investors or the market as a whole rewarded growth at almost any cost.

That drastically changed when stock markets went down, and the big macro change started early last year.

Now, investors care much more about healthy and sustainable growth.

Companies need to pay more attention to factors like:

Burn multiple

CAC efficiency

The most important metric right now is likely the burn multiple. It tells you how much you have to raise in order to add a dollar of net new ARR and gives a holistic picture of the efficiency of your business.

If you’re in a relatively early stage, up to $25M ARR, and your burn multiple is 1-1.5, that’s pretty good.

If it’s lower, that’s great.

Early on, it might be significantly higher because you’re not adding as much net new revenue yet, but you have a lot of upfront costs.

There’s no one-size-fits-all answer to what is an acceptable burn multiple. It all depends on runway and other factors.

When Runway Is Dangerously Short

If you find yourself in a situation where runway is dangerously short and you think your burn multiple is too high, it’s time to start thinking about where you can save.

One metric to look at is the CAC payback period — how long it takes to recoup a dollar.

If marketing and sales spend is efficient, you don’t want to cut there because it could reduce runway.

A dollar in sales and marketing that becomes a dollar of cash flow within six months isn’t something you want to cut.

Investors Care About Valuations

Another factor that stood out was valuation. It’s no surprise when looking at a chart like this one showing Bessemer’s Emerging Cloud Index.

Although there’s been recovery in the last couple of months, it’s still down about 50% from the peak and has directly impacted valuations pre-IPO investors are willing to pay.

That trickles down to Series D, C, and B, but is less relevant at Series A because the rationale of investors is somewhat different.

If you try to remember what 2020 and previous years looked like, there were so many unicorns and decacorns and excitement and hype that made investors pay high valuations.

But if you look at the list of public SaaS companies today, there aren’t that many worth more than $5B.

That’s been quite a reality check and something investors are starting to consider.

Investors Want To Hear A Convincing AI Strategy

Last but not least, expect to be asked about your AI strategy.

If you’re not an AI native startup but SaaS that’s been around for a few years, investors will ask questions and may wonder if you’re just trying to sprinkle AI on your product or deck to make it look more desirable.

So, you have to have a convincing AI strategy.

Your strategy will depend on many factors, but you have to show that you understand what your customers want and have an idea and data on problems you can solve better with AI.

Think about:

How deeply AI is integrated into your product. The deeper, the better.

How you’ll win against openAI and other large foundational models

How you’ll win against incumbents in your space

So far, the learning is that bigger SaaS companies are fast to embrace AI.

They aren’t dinosaurs that didn’t manage to move to the Cloud.

Notion, Zendesk, Hubspot, and other major players are pretty fast to leverage this relatively new and emerging tech, so you’ll have to think about what your edge is against these big companies.

As you think about your AI strategy, consider what will make your product much more valuable and defensible in the long run.