The Hidden Data: What SVB's 2025 State of the Markets Reveals That Every Founder Needs to Know (But No One's Talking About)

"The Further Rise of YC: Incubators and Accelerators Now Account for 24% of All VC Deals"

So SVB still is the #1 bank for tech companies in Silicon Valley and they have a ton of data. Their latest 1H'25 report has some interesting learnings:

10 Unexpected Learnings from SVB's 2025 State of the Markets Report

Beyond the AI boom headlines, the 1H'25 data reveals surprising shifts that could reshape how we think about venture capital, startup operations, and the innovation economy.

While much attention focuses on AI's dominance in venture funding, Silicon Valley Bank's latest State of the Markets report contains several counterintuitive findings that challenge conventional wisdom about startups, venture capital, and the innovation economy. Here are the 10 most unexpected learnings that every founder and investor should understand.

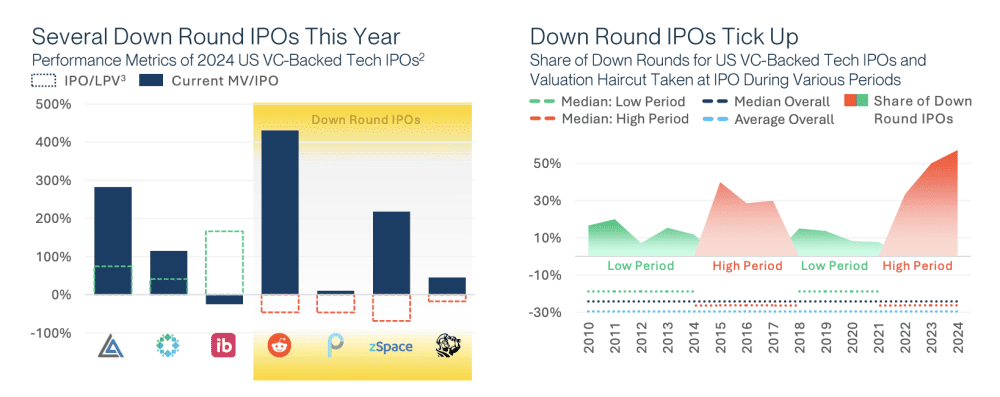

#1. Four Out of Seven IPOs in 2024 Were Down Rounds – And That's Actually Normal

The Surprise: Despite investor hand-wringing about "down round IPOs," 57% of the 2024 VC-backed tech IPOs priced below their last private valuation – but historically, this isn't unusual and doesn't predict poor performance.

Why It Matters: The narrative that companies avoid going public because of down rounds misses the bigger picture. Successful companies like Block have taken down round IPOs only to soar past previous private valuations. The data shows down rounds comprised 30-50% of IPOs even during "good" periods.

The Implication: The obsession with avoiding down round IPOs may be keeping quality companies private longer than necessary. Public market performance matters more than IPO pricing relative to private rounds.

#2. Incubators and Accelerators Now Account for 24% of All VC Deals

The Surprise: Despite being largely overlooked in venture discourse, startup launch programs accounted for nearly a quarter of all US VC deals.

Why It Matters: These programs have become the "front door" to the venture ecosystem, particularly outside traditional tech hubs. In some states, incubators attract up to 40% of all VC deals. They're not just launching companies – they're democratizing access to venture capital.

The Implication: The path to venture funding is changing. Rather than trying to network directly into top-tier VCs, many successful companies are taking the accelerator route first.

#3. Only 25% of US Tech Unicorns Are Actually IPO-Ready

The Surprise: Despite having 646 tech unicorns worth $2.4T collectively, only about 160 companies meet basic IPO readiness criteria (>$100M revenue, >15% growth, >-25% EBITDA margin). And that's not really good enough.

Why It Matters: The unicorn herd keeps growing with few exits, creating a massive liquidity overhang. The average unicorn is now 10.3 years old – just four months younger than the average age of tech IPOs.

The Implication: We're sitting on a powder keg of private company value that needs liquidity solutions beyond traditional IPOs. Secondary markets and alternative exit strategies will become increasingly important.

#4. Most VC Funds Take 16-20 Years to Actually Return Capital

The Surprise: Despite the "8-12 year fund cycle" conventional wisdom, top quartile funds don't actually return meaningful capital for 16-20 years.

Why It Matters: This is forcing LPs to completely rethink their investment strategies and cash flow planning. Some funds are changing their Limited Partner Agreements to reflect this new reality.

The Implication: The venture ecosystem's liquidity timeline is much longer than anyone admits. This affects everything from GP compensation to LP allocation strategies.

#5. Defense Tech Has Quietly Become a Major VC Category

The Surprise: Defense tech VC investment jumped 2x in 2023 and stayed at that level in 2024, with 15 active unicorns now valued at $50B collectively.

Why It Matters: Wars in Ukraine and Israel demonstrated the impact of technologies like drones on modern warfare. This isn't just about geopolitics – it's about a fundamental shift in how governments and VCs view defense technology investing.

The Implication: Defense tech is emerging from the shadows as a legitimate venture category. General Catalyst even named defense a key strategy for their recent $8B fund.

#6. The Top 10% of VC Funds Raised as Much as the Bottom 90%

The Surprise: Venture fundraising inequality has reached extreme levels, with the top 10% of firms capturing the vast majority of LP dollars. The top 10 firms alone captured 22% of all fundraising.

Why It Matters: This concentration is leading to market entrenchment, with the same large funds dominating year after year. It's creating a bifurcated market where mid-sized funds are getting squeezed out.

The Implication: The VC industry is consolidating rapidly. Small, specialized funds and mega-funds are thriving, but mid-sized generalist funds are struggling to differentiate.

#7. Bankruptcy Filings in Silicon Valley Are Surging

The Surprise: Despite all the talk about "landing softly" and "extending runway," bankruptcy filings in Silicon Valley counties are on a clear upward trend through 2024.

Why It Matters: The data on "troubled debt deals" shows more startups having difficulty with debt repayments – levels not seen since the early pandemic period. Companies are reaching the end of their options.

The Implication: The "soft landing" narrative may be overly optimistic. A wave of company failures could be coming as extended runways finally reach zero.

#8. Revenue Multiples Are Disconnected from Interest Rates

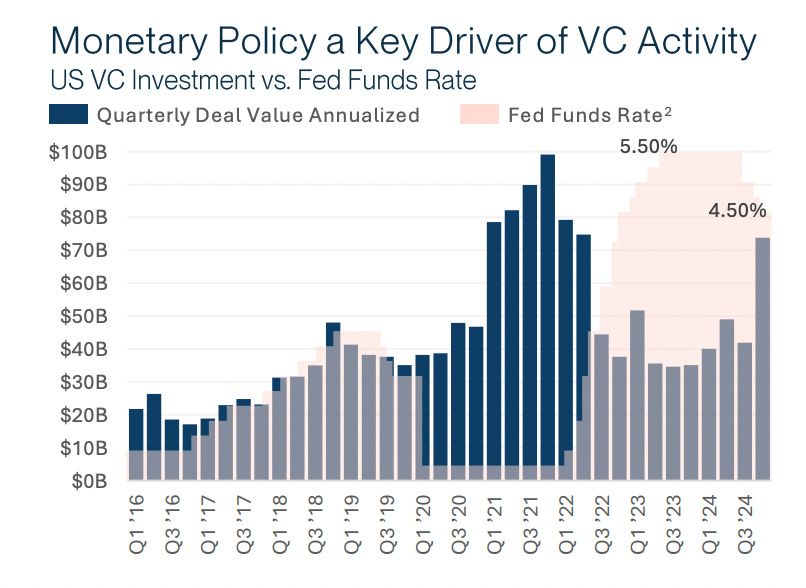

The Surprise: While everyone expected lower interest rates to boost valuations, the correlation between rates and VC activity may be weaker than assumed. Supply and demand dynamics matter more than macro rates.

Why It Matters: The report shows that VC investment has been highly correlated to rates, but in a moderate interest rate environment, rates will likely play a smaller role – similar to 2017-2019.

The Implication: Founders and investors betting on rate cuts to revive the market may be disappointed. Company fundamentals and sector dynamics matter more than macro conditions.

#9. International Developer Talent Is Reshaping SaaS Economics

The Surprise: About 60% of companies already outsource app development, and India is expected to overtake the US in number of developers by 2030. US developer salaries are showing signs of weakening.

Why It Matters: The global talent arbitrage is real and accelerating. Combined with AI tools that make developers more productive, this is fundamentally changing SaaS unit economics.

The Implication: SaaS companies that don't adapt their talent strategies to this global reality will find themselves at a significant cost disadvantage.

#10. Secondary Markets Are Seeing Record Volume Despite Price Discounts

The Surprise: Secondary transaction volumes are elevated even though prices are typically 40-50% below last private round valuations. 73% of investors still haven't participated in secondaries.

Why It Matters: With $1.4T in unrealized returns and limited exit activity, GPs, LPs, and employees are hungry for liquidity. Secondary markets are becoming a release valve for this pressure.

The Implication: Secondary markets may become a much larger part of the venture ecosystem. Companies should start thinking about liquidity programs earlier, and investors should expect secondary transactions to become routine.

The Meta-Learning: Markets Are More Complex Than Headlines Suggest

Perhaps the biggest unexpected learning is how many important trends are happening beneath the surface of the "AI boom" narrative. While artificial intelligence is undoubtedly reshaping venture capital, the innovation economy is simultaneously undergoing shifts in:

Capital structure (debt vs. equity)

Geographic distribution (incubators democratizing access)

Time horizons (longer fund cycles, older unicorns)

Talent markets (global arbitrage accelerating)

Liquidity mechanisms (secondaries growing rapidly)

For founders and investors, the lesson is clear: success requires understanding not just the headline trends, but the subtle structural changes reshaping the entire innovation ecosystem. The companies and funds that recognize and adapt to these unexpected dynamics will have significant advantages in the years ahead.