Scaling to $5B with Cockroach Labs’ CEO Spencer Kimball’s Formula for Sustained Growth and Resilience

"Your first investor is like a lifelong marriage"

Whether you’re going from nothing to something or already scaling and thriving beyond $10-100M, healthy, sustainable growth in SaaS is on every founder’s mind.

Cockroach Labs’ CEO Spencer Kimball shares hard-won lessons from scaling from $0 to $5B and his time as an angel investor for more than 80 different startups.

He’ll walk you through the three stages of growth:

0-$1M — From nothing to something

$1M-$10M — Building, innovation, and customers

$10M-$100M+ — Scaling and thriving

And what sustainable growth strategies you can implement (and pitfalls to avoid) wherever you’re at in your SaaS journey.

Ideas Are Cheap. It’s All About The Execution.

How do you build something that has a real shot at making it?

“You avoid building it in a bubble,” says Kimball.

It’s very tempting to believe that your ideas are precious, but the best ideas are arrived at by multiple people at the same time.

Ideas are cheap, yet there’s a tendency for people to get cagey with them in the early days, holding them close and making VCs sign NDAs.

You don’t want to do that. You want to get as much feedback as you can about your idea so you can make it better.

Are there potential competitors? Look into them and figure out how to refine and differentiate your idea.

0-$1M — From Nothing To Something

Within each growth stage, Kimball shares three themes of advice.

For those in the very early days, not yet at $1M, we’ll answer these three questions.

What matters most when raising in early rounds?

How much does culture matter in SaaS, and how do you build one that pays dividends?

How do you provide equity to early employees?

What Matters Most When Raising In Early Rounds?

Some questions Kimball hears frequently are, “Should I raise a seed, preseed, or series A?” And his answer, like many answers in startups, is it depends.

How hot is the space, and what is the product category?

How good is the team?

How far along is the product idea?

VCs expect more than 20% in those early stages because of the risk, making seeds expensive.

To answer this question, focus on how much you really need to get to that stage where you have product market fit.

Optimize for the credibility of the VC, the firm, and the partner in early rounds.

People often say that your first investor is like a lifelong marriage. And as someone who scaled a company to $5B, Kimball says this sentiment is true.

Credibility is crucial for:

Subsequent rounds of funding.

Potential employees who are risk-takers and paying attention to your partners.

The health of your business long-term.

You want an intelligent investor and an advisor because they’re in it for the long haul. The more helpful knowledge they can impart on you as you scale, the better off everyone will be.

How Much Does Culture Matter, And How Do You Build One That Pays Dividends?

We hear this everywhere — culture is everything.

And it’s for good reason.

Company culture is a difficult thing to get right because it’s intangible, yet you have to establish it early.

What does company culture do for a company?

It’s the ties that bind people, the human connections that are necessary to get through the hardships that every startup faces.

Kimball worked for Google for a decade and loved the culture. When he left to start a different business, he thought the culture would naturally come with him.

It didn’t.

Instead, he had a team of people who worked hard, but when everything was done, everyone went their separate ways.

So he sat down with his partners at Cockroach Labs and wrote a manifesto on culture before building any product.

You need to establish culture early because it will scale with you if done correctly.

How To Provide Equity To Early Employees

Early equity is the way to go for Kimball.

He created a system with rules of thumb from VCs about how much equity you should give to early employees.

They created an open and transparent model, comparing equity and their positions in a spreadsheet to avoid surprises.

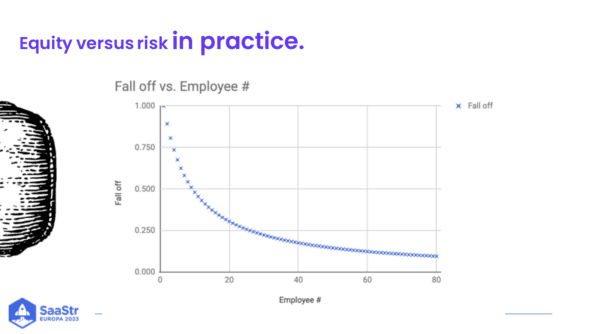

The chart above shows equity vs. risk in practice.

There was a 1x factor for the first employee, and then it falls off.

The first 20 employees would have 10% equity.

The next 20 employees would have an additional 5%.

Next 40 employees? An additional 5%. So an exponential fall off.

This works well in the early days but probably won’t last you until the 80th employee.

$1M-$10M — Building, Innovation, and Customers

Now, it’s time for the next stage of sustainable growth in SaaS, typically B and C at product-market fit and getting early customers. You’re finding the repeatability of your sales motion.

The three topics of advice covered for organizations in the $1M-10M range are:

Building a cloud service vs. open source.

Building a go-to-market function from scratch.

Getting the most out of board meetings.

Building A Cloud Service vs. Open Source

“Building is easiest when you have a tight focus,” shares Kimball.

But should you build a cloud service vs. open source?

Cockroach Labs is open source, and, in 2015, it was inconceivable to think of a sophisticated database that wasn’t open source. That would have been counterproductive.

They had open cores and created enterprise features around it to protect the business model until it got torpedoed by AWS early on.

What are the benefits of building open source?

If you have a well-tended community, you can have an asymmetric information advantage, plus a lot of participation from the community doing bug fixes, adding new features and integrations, and support.

Open source attracts huge players like Meta, Apple, and Goldman Sachs because they want to reap the benefits without paying for the true scale they anticipate.

What are the downsides of building open source?

It has significant costs, and you’re up against exploitative behaviors from cloud service providers.

It can also be challenging to manage these communities. They’re fragile at first.

And big players like Apple want support and not your enterprise features because they want to control costs at massive scales and demand huge amounts of leverage over your product roadmap.

So the not-so-simple answer here is if you’re starting from scratch in 2023…

You should only ever consider doing both open-source and cloud services simultaneously.

If your potential set of customers that need and want your product isn’t willing to use a cloud service yet, you should probably start with open source.

Otherwise, the reality is that cloud services have a faster time to value.

Building A Go-To-Market Function From Scratch

You’ve built a technical product, and now you need to build a go-to-market function from scratch.

If you’re a technical founder, this can be challenging.

The first thing you need to get right is your Ideal Customer Profile.

You’ll rarely be the first product in any category, so you need to define a niche in your category where you can dominate.

Is there anywhere you can be 10x better than someone else?

Look for a small part of a larger TAM, but one you believe will be far more important over time.

You might feel constrained, but if you’re talking to or building for everyone, you aren’t talking to or building for anyone.

The takeaway?

As an early CEO and founder, get out there and understand your customers and their pain points.

If you’re talking about your product and its awesome features, you’re doing it wrong.

Getting The Most Out Of Board Meetings

Your early board is composed of investors, which is why Kimball’s biggest piece of advice for those in the $0-$1M range is to choose based on intelligence and credibility.

VCs are good pattern-matchers with huge amounts of information about the ecosystem. They know the common patterns for success and failure, plus they have valuable intel on competitors.

But typically, they don’t have operational experience, or it’s been a long time since they did.

So how can you get more out of board meetings at your company?

Consider the right time to bring on an independent person with operational experience.

Set goals, even at the early stages.

Compose a succinct briefing document before every meeting to include:

An analysis of what happened in the past quarter, the goals that were set, how you measured up, and what the hypotheses are for failing or meeting those goals.

Your plan for the next quarter and major resources and expenditures required to meet those next quarter goals.

Looking back quarter after quarter for years, you’ll have incredible documentation of your journey. These briefing documents are great for successive rounds of funding and perfect for catching up new executives.

$10M-$100M — Scaling And Thriving

Now we’re at series C and beyond — the time of scaling and thriving. You’ll notice an evolution in how you approach customers, board meetings, and leadership.

The three lessons learned and sustainable growth strategies for those at $10M-$100M are:

How to scale sales and marketing from a systems perspective.

The absolute importance of putting your customers first.

How your role as CEO and Founder changes as you grow

How To Scale Sales And Marketing From A Systems Perspective

Early on, your sales function is intuitive. But eventually, it becomes engineering. Early go-to-market leaders that roll up their sleeves won’t scale far with you.

You’ll want a leader who is a manager and can do early scaling.

Many founders appoint a really successful account executive to the role of VP of Sales or a Sales Manager — a common mistake.

Account Executive and VP of Sales are two vastly different things. One is an independent contributor, and the other is coaching.

And let’s say you have 10-20 sellers. Now, it’s a revenue function, and to have a healthy, high-performing revenue function, you need a very precisely defined segmentation.

You should have a good forecasting methodology for how each quarter will go and total visibility to slice and dice all segmentations across the customer set.

The biggest takeaway here is…

Sales ceases to be an intuitive process anymore. Everything must cascade in the organization with a tight process, accurate forecasting, and complete accountability.

The Absolute Importance Of Putting Your Customers First

Your biggest priority in series C and beyond is to own customer success. Your customers come first. If they’re failing, you’re failing.

You want to understand what problems you’re solving for customers. But there are many ways this aspect of building a business is obscured.

Short-term thinking in sales can hurt you.

This is where good sales leaders and managers are critically important. You want to walk away from deals that aren’t a good fit. A customer has to be successful with your product before it’s revenue.

Engineering is where customer success is horribly underrepresented.

People put product managers as a layer of interaction between engineers and customers, but engineers need to watch the customers experience success and friction. If they build in a silo, they build incoherent user experiences.

Founders and CEOs need to avoid getting buried in the increasing complexity of scaling an organization.

You need to be out there on customer calls — early ones and later ones. Your single most important role is to sell your vision internally and externally. And you can’t do that without understanding your customers.

How Your Role As CEO and Founder Changes As You Grow

Early on, someone shared three jobs for the CEO with Kimball.

You have to keep money in the bank.

Sell the vision internally and externally.

Fire yourself by hiring people to do jobs better than you when you aren’t keeping money in the bank and selling the vision.

At a certain point, your company reaches a stage where you aren’t doing actual work anymore, at least not the work you did in the beginning.

Your job now is to lead a team of executives so they can define the strategy, determine actions to take, drive accountability, measure success, and iterate.

You are the leader of that now. If you started out programming, the transition to not programming anymore might be difficult. But it’s necessary.

3 Takeaways for Sustainable Growth In SaaS

If there are only three things you take away from Kimball, it’s this…

Seek advisors, not investors. You want partners who will take you from seed to scale.

Build your culture. You’re running a marathon, and culture is the foundation of that.

Stay curious and stay close to customers and the product.