Palantir: The Greatest Enterprise Software Company Of All Time Ever? Could Be.

"Palantir did $1.41 billion in Q4 revenue, up 70% year-over-year. That was their highest growth rate as a public company. Ever."

Yes, the valuation is insane. 142x earnings. ~86x revenue. Michael Burry is short. The stock is down 15% this year.

But the numbers Palantir just put up are unlike anything we’ve ever seen from an enterprise software company. Not even from Salesforce. Not from ServiceNow. Not from Snowflake. Not from anyone. Palantir is still smaller than most of these leaders, so time will tell. But for now, it just might have had the Greatest Quarter Ever.

Let’s walk through it.

Palantir is becoming one of the greatest software companies in history.

#1. 70% Revenue Growth. At $5.6B Run Rate. Accelerating.

Palantir did $1.41 billion in Q4 revenue, up 70% year-over-year. That was their highest growth rate as a public company. Not their highest when they were small. Their highest ever.

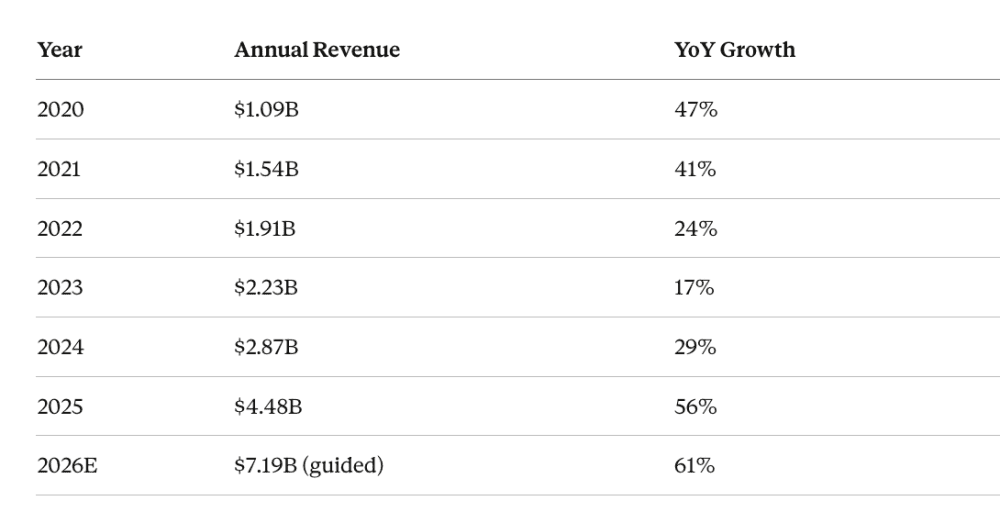

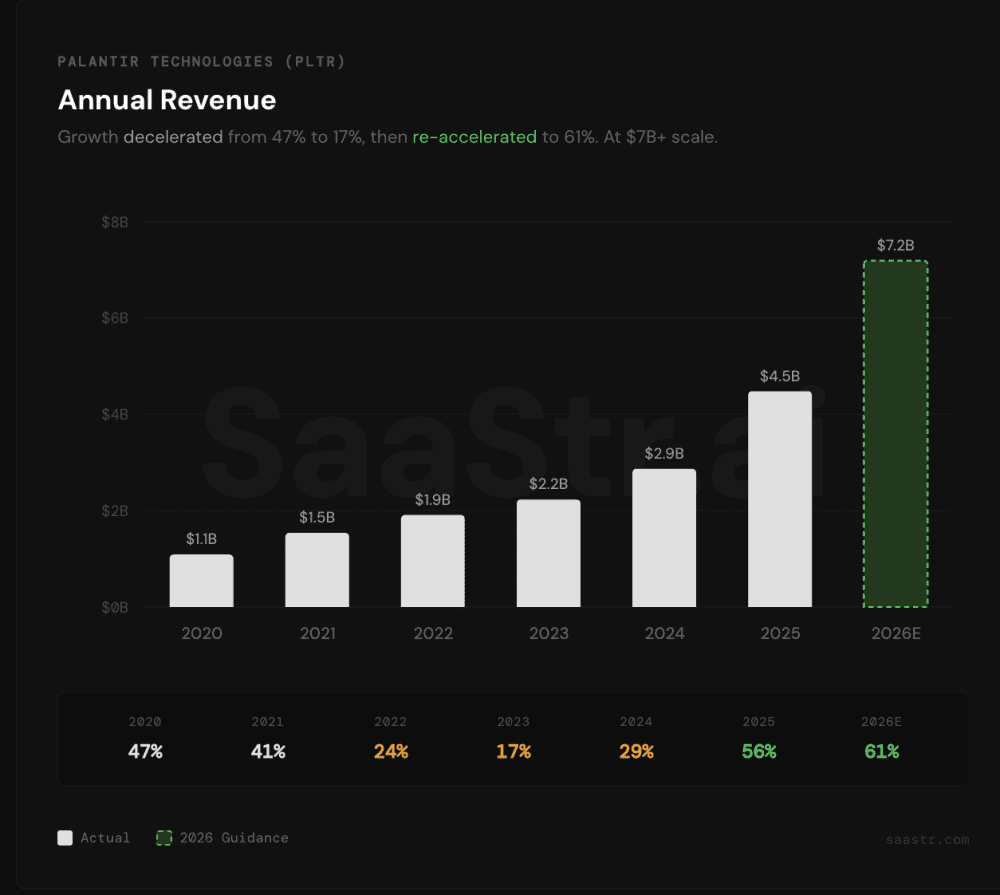

Here’s the revenue trajectory:

Growth went from 17% in 2023 to 29% in 2024 to 56% in 2025 to a guided 61% in 2026. At multi-billion dollar scale. The growth is accelerating. That’s not how enterprise software works. The law of large numbers is supposed to kick in. Deceleration is supposed to be inevitable. Palantir is defying all of it.

The consensus estimate for 2026 was $6.27 billion. Palantir guided to $7.19 billion. A 15% beat on the guide alone. The Street wasn’t even close.

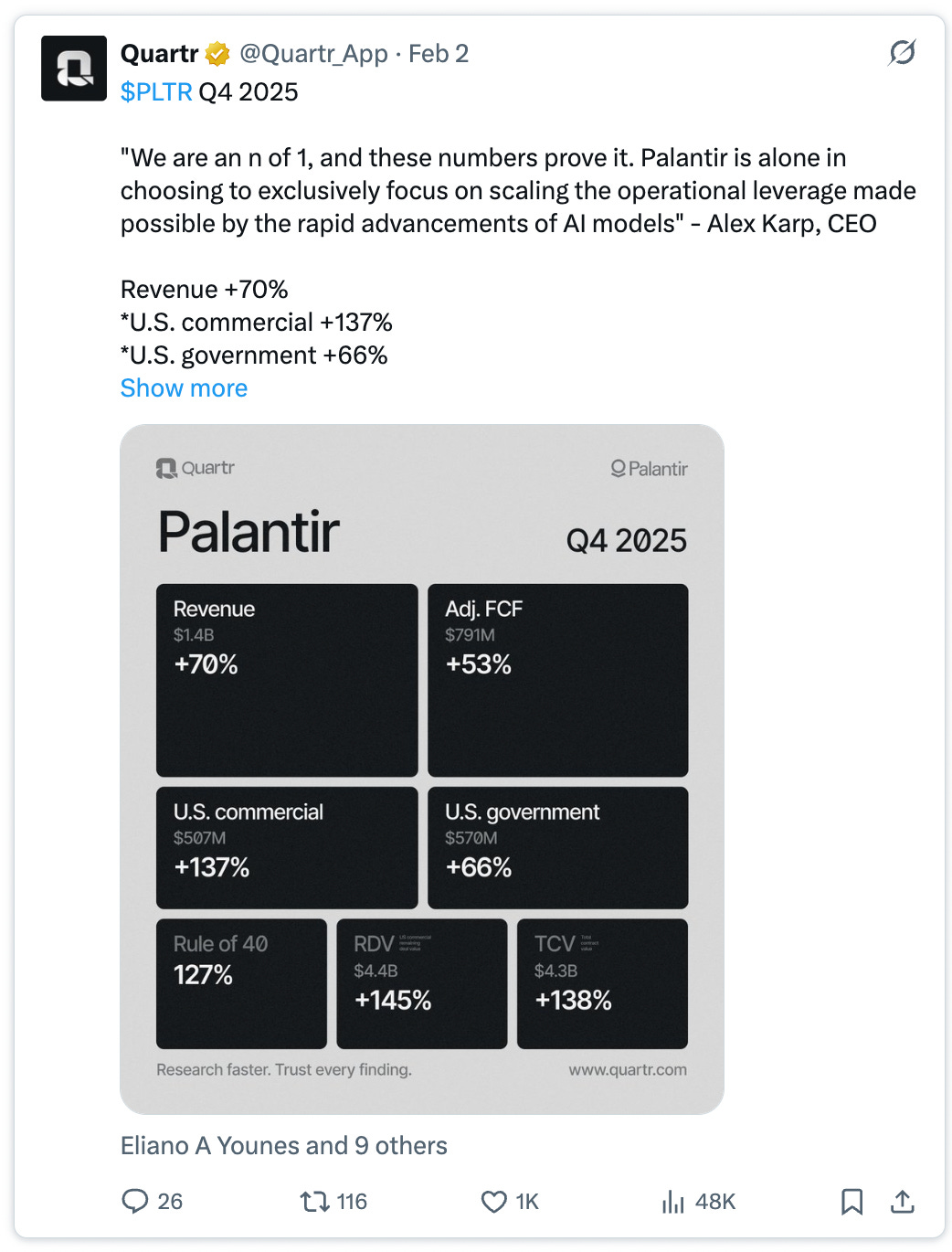

#2. Rule of 40? Try Rule of 127.

The “Rule of 40” — revenue growth rate plus profit margin should exceed 40%. Good companies hit 40-50%. Great companies hit 60%. Elite companies occasionally touch 70-80%.

Palantir posted 127.

70% revenue growth + 57% adjusted operating margin. A year ago this number was 81. Two years ago it was in the 50s. Their investor presentation shows a competitive chart of every enterprise software company with $1B+ in revenue. They’re all clustered together. Palantir is in a different quadrant entirely. Alone.

#3. The U.S. Commercial Business Is the Real Story

U.S. commercial revenue grew 137% year-over-year to $507 million. At $2B+ annualized run rate.

The 2026 guide? U.S. commercial revenue expected to exceed $3.14 billion. That’s at least 115% year-over-year growth. Still more than doubling.

The expansion numbers back it up. A utility company went from $7 million ACV in Q1 2025 to $31 million ACV by year-end — 4x expansion in three quarters. An energy company went from $4 million to over $20 million ACV in the same period. A healthcare company did two bootcamps over the summer and signed a $96 million deal before year-end. An engineering services firm saw demos in the fall and signed an $80 million deal.

These aren’t typical enterprise land-and-expand motions where you go from $50K to $200K over 18 months. These are $4M-to-$31M-in-9-months expansions. $96M deals closing within months of first engagement. I haven’t seen velocity like this at this scale before.

U.S. commercial customer count grew 49% year-over-year to 571. Net dollar retention hit 139%, up 500 basis points sequentially. Existing customers spending 39% more year-over-year before counting new logos. And management noted that NDR excludes revenue from customers acquired in the last twelve months — which is exactly where the most explosive growth has been. So 139% actually understates the real expansion dynamics.

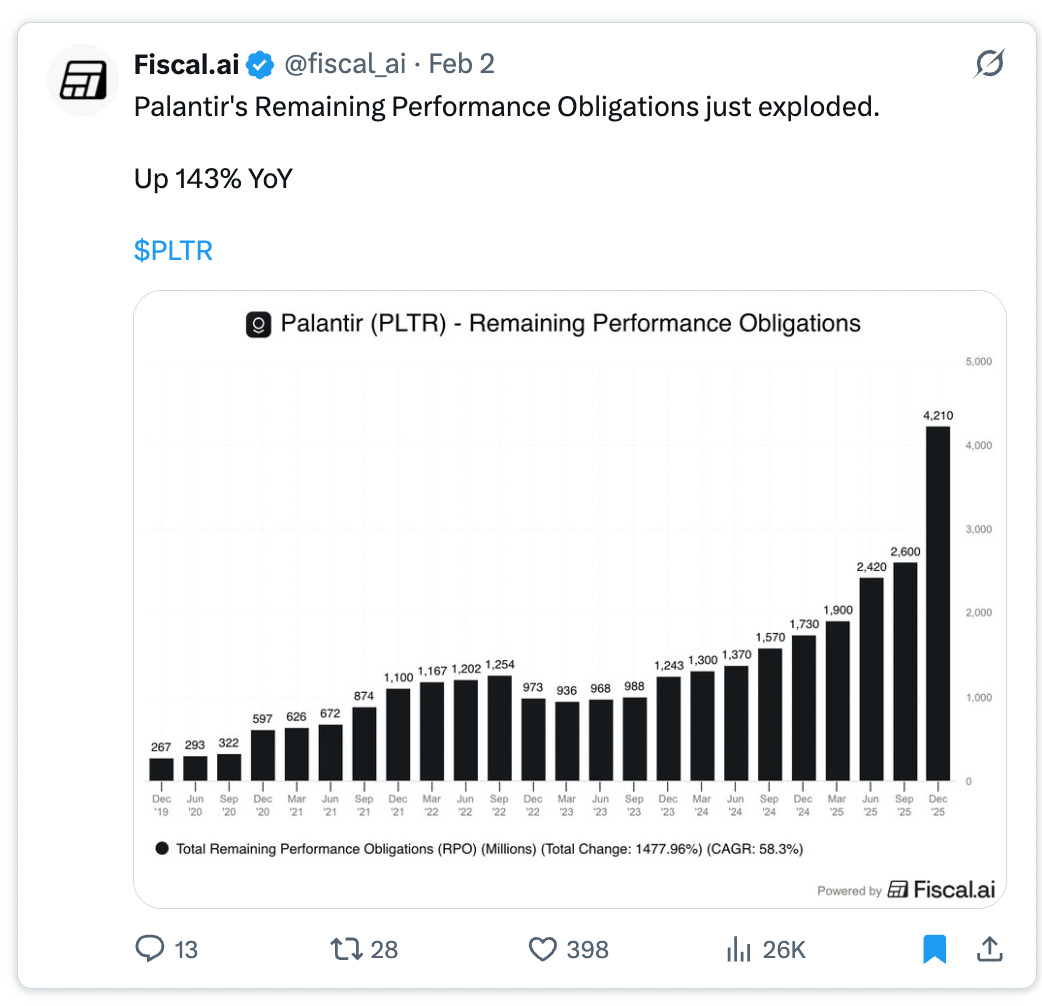

#4. The Backlog Is Massive and Getting Bigger Fast

Look at the RPO chart at the top of this post. Remaining Performance Obligations went from $267 million in December 2019 to $4.21 billion in December 2025. That’s 1,478% growth. A 58.3% CAGR over six years.

The recent acceleration is what matters most. RPO went from $1.57 billion in September 2024 to $4.21 billion in December 2025 — up 168% in five quarters. It grew 62% sequentially in Q4 alone. Total remaining deal value hit $11.2 billion, up 105% year-over-year.

Total contract value booked in Q4 was $4.3 billion, up 138% year-over-year and beating the prior quarterly record by more than $1.5 billion. Commercial TCV was $2.6 billion, up 161% year-over-year and 83% sequentially.

They could stop selling entirely for over two years and still have $11+ billion of contracted work to deliver.

#5. Profitability at Scale

This isn’t a “growing fast but burning cash” story.

Q4 numbers: $798 million in adjusted operating income at 57% margin. $575 million in GAAP operating income at 41% margin. $609 million in GAAP net income at 43% net margin. $791 million in adjusted free cash flow at 56% margin. $7.2 billion in cash on the balance sheet. Zero debt.

Full year adjusted free cash flow was $2.27 billion, a 51% margin, up 82% year-over-year. The 2026 guide is $3.9-$4.1 billion in adjusted FCF. Four billion dollars in free cash flow at a company growing 61%.

GAAP net income went from $79 million in Q4 2024 to $609 million in Q4 2025. Nearly 8x in one year. Even after $170-220 million per quarter in stock-based compensation. On a fully-loaded GAAP basis, this company is very profitable.

Their cash pile now sits at $7.2 billion.

#6. 61 Deals Over $10 Million In a Single Quarter

Palantir closed 180 deals worth at least $1 million in Q4. 84 deals over $5 million. 61 deals over $10 million.

The top 20 customers now average $94 million each in trailing twelve-month revenue, up 45% year-over-year. They’re landing big and expanding fast.

So Is This the Greatest Enterprise Software Company Ever?

It’s a big claim. Salesforce created the modern SaaS category and is far larger. Microsoft is an $80B+ cloud business. ServiceNow is one of the most consistent compounders in software history.

But find me another enterprise software company that has ever put up all of these numbers simultaneously:

70% revenue growth at $5B+ scale

57% adjusted operating margins

43% GAAP net margins

137% growth in its commercial segment

139% net dollar retention

Rule of 40 score of 127

Revenue growth accelerating into its fifth year as a public company

Guiding to 61% growth for the following year

You can’t. It hasn’t happened before.

Salesforce was never this profitable at high growth. ServiceNow was never growing this fast at multi-billion scale. Snowflake had explosive growth but never came close to this profitability. Palantir is combining the growth profile of a hypergrowth startup with the margin profile of a mature platform company — at what will be $7B+ in revenue.

Why AIP Is Working

The Palantir thesis always made skeptics uncomfortable because it sounded too abstract. A platform that takes any AI model and operationalizes it across an enterprise. That makes workforces more productive. That turns data into decisions at production scale.

The results have settled the argument. The bootcamp model — where Palantir shows up and proves value in days — is generating $80M and $96M deals within months. One customer went from 100 users and 4 use cases to 16,000 users and 280 use cases. That’s not a pilot. That’s a company rewiring its entire operations around Palantir.

Palantir doesn’t build the AI models. They build the layer that makes the models useful in production. What they call “commodity cognition” — the idea that as AI models get cheaper and better, the value accrues to whoever can operationalize them fastest. That layer, it turns out, is worth an enormous amount of money.

The Valuation Challenge

At ~$140/share, Palantir trades at roughly 142x expected earnings. Even with the blowout guide, you’re paying about 21x 2026 revenue. It’s one of the three most expensive stocks in the S&P 500 on a P/E basis.

For all the execution quality, there’s a real question about how much is already priced in. The stock is still up ~80% over the past year even after the pullback. And international growth remains weak — international commercial revenue grew just 8% in Q4. Karp basically said the company is so busy in the U.S. that it’s deprioritizing international for now.

The stock will have to grow into this valuation. That requires sustained execution at a level no enterprise software company has maintained for more than a few years.

Can Acceleration At This Scale Last in the Age of AI?

Could Palantir be the greatest enterprise software company of all time? After this quarter, I can’t dismiss it. The combination of growth, profitability, expansion velocity, and AI platform leverage is genuinely unprecedented.

There are two scenarios from here:

1. This is the real thing. Palantir has built the definitive AI operating system for the enterprise, and the $7.2B 2026 guide is the beginning of a march toward $15-20B+.

In that world, the current valuation looks reasonable or even cheap in hindsight.

2. This is a cyclical peak. AI spending normalizes, government budgets tighten, commercial customers hit diminishing returns, and growth decelerates hard.

In that world, 142x earnings gets painful.

What Palantir delivered this quarter is the single most impressive quarter I’ve ever seen from an enterprise software company. Full stop. If they keep anything close to this pace through 2026, the “Greatest Ever” question stops being hypothetical.

They’ve earned the right to ask it.