We did a deep dive on 20VC x SaaStr this week with Mike Cannon-Brookes, co-founder and CEO of Atlassian. Atlassian just put up an incredible quarter of accelerating growth (23% at $6.4B ARR, with RPO growing to 44%). And yet the markets aren’t showing anyone much love. Mike was honest and reflective on just what’s happening to B2B and SaaS in the Age of AI.

There’s so much noise about “software is dead” and “agents replace everything” that founders are losing the plot. Mike’s running a $6B+ revenue business that’s accelerating — 26% cloud growth, 44% RPO growth — in the middle of the supposed SaaS apocalypse.

So let’s break down what Mike actually said, and what it means for the rest of us.

1. “Software Is Dead” Is a Stupid Statement. Full Stop.

Mike didn’t mince words here. The idea that software as a category is going away is, in his words, “ludicrous.”

His argument is simple and hard to refute: businesses have always bought pre-built technology solutions. They didn’t write everything in assembly language before, and they’re not going to build everything from scratch with LLMs now.

Will every B2B company make it through the next 5–10 years? Absolutely not. Will many of them grow and prosper? Absolutely. Is that any different from the last 10 years? No.

Mike pulled up Atlassian’s old competitive docs from 2005, 2010, 2015. A huge chunk of those companies don’t exist anymore — merged, acquired, or gone. That’s just how the technology industry works. AI doesn’t change the fundamental pattern. It just accelerates it.

The takeaway for founders: stop listening to the “SaaS is dead” crowd. The real question is whether your company is good enough to win in the next era.

2. “You Just Have to Be Good.” That’s the Whole Strategy.

This was my favorite line from the conversation and I think it deserves to be tattooed on every B2B founder’s forehead.

When asked how Atlassian thinks about competing with Anthropic for CIO budgets, Mike’s answer was deceptively simple: “We have to be good.”

Not “we have to pivot to AI.” Not “we need to become an agent platform.” Just: we have to be good. We have to deliver more value to our customers than the alternatives.

Atlassian has 10,000 people in R&D. They’re using Claude Code internally. Their inference costs are going down while they ship more AI features. Some features are 1,000x cheaper to run than when they first launched them. Their gross margins have improved over the last six or seven quarters while deploying more AI.

That’s what “being good” looks like in practice. It’s not a platitude. It’s an execution standard.

3. The Revenue Stacking Problem Is Real — and Most People Don’t Understand It

Anthropic projects $149B in ARR by 2029. OpenAI projects $180B. That’s ~$350B between two companies in a $700B global software market.

Mike made a point that almost nobody talks about: the revenue stacking is complicated.

When Atlassian spends money on Anthropic, they actually pay AWS, and then AWS pays Anthropic. When Cursor does a billion in revenue, a big chunk of that is the same billion as Anthropic’s revenue. The individual revenue numbers don’t just add up cleanly.

So when you see these massive projections and panic about where the budget comes from — remember that a significant portion is double-counted across the stack. The actual net new spend enterprises need to allocate is smaller than the headline numbers suggest.

That said, even with stacking, the numbers are enormous. As Rory pointed out: Anthropic becoming $150B and OpenAI becoming $180B is basically saying two new Microsofts showed up in four years. You better believe in TAM expansion, or the math gets really uncomfortable for everybody else.

4. Product & Engineering Is the Island of Stability. Everything Else Is at Risk.

We’ve been saying this at SaaStr and Mike’s experience at Atlassian confirms it: every category outside of engineering and product is at existential risk of shrinking seats.

Workday said it publicly — even they’re seeing headwinds on seats because Fortune 500 companies just aren’t hiring like they used to. The data from Pave shows no category has been more decimated in hiring than customer support.

But engineering? Nobody is cutting their engineering teams. Not yet at least. Even if they are hiring very differently in the Age of AI. We are in a renaissance of software creation. I was at Replit the other day — 300 million in revenue, 300 people, 11 in go-to-market. The rest? Engineers. That’s not a company cutting R&D headcount.

Mike’s framework for understanding this is genuinely useful: think about whether a function is input-constrained or output-constrained.

Customer support is input-constrained. You have X customers asking Y questions per day. Make the team more efficient and you need fewer people. Legal is similar — you can’t create more legal problems just because your lawyers got faster.

Engineering is output-constrained. The roadmap is never finished. You can always create more. Make engineers more productive and you just build more software, faster. The headcount doesn’t shrink — the output explodes.

If you’re selling to input-constrained functions, your per-seat revenue is going down. If you’re selling to output-constrained functions, you’re probably fine.

Plan accordingly.

5. The Real Problem with Public SaaS Metrics Is a Composition Problem

One of the sharpest observations in the conversation: the reason public SaaS growth rates look so bad isn’t necessarily because individual companies are failing. It’s a composition problem.

For about 15 years, the median public SaaS growth rate held around 30%. But that wasn’t because every company grew at 30%. It was because when a company slowed below 10%, it got taken private by PE, and a new company IPO’d at 60% growth to replace it at the top of the index.

That cycle broke. No new high-growth SaaS companies have IPO’d in years. PE has hoovered up a ton of mid-tier companies. Big tech is acquiring more aggressively. Companies like Stripe and Figma are staying private much longer because they don’t need to go public.

So what you see in the public market index is this weird survivor set — too big for PE to buy, too small for big tech to acquire, with no new high-growers being added at the top. Of course that average looks bad. But it’s not necessarily a statement about the health of B2B software overall.

The lesson: don’t confuse the declining public SaaS index with the death of SaaS. They’re measuring different things.

6. Being a Public Company Makes You Better — But You Have to Play Offense Too

I loved Mike’s take on the public vs. private company dynamic. His answer wasn’t defensive. It was almost counterintuitive.

“We’re a better company because we’re a public company. We’re better at forecasting. We’re better at planning. We’re better at executing.”

The trap, he says, is when you let financial discipline replace strategy instead of complementing it. You still have to invest aggressively in AI and new products. You still have to compete. You still have to go into new areas — Atlassian just shipped a customer service product. Their service collection business could go public by itself.

The private companies have the luxury of not marginal-costing every decision. Their CMOs don’t have “pesky public market investors” asking about profitability. That creates a real asymmetry. But Mike argues the discipline of public markets is actually a long-term advantage — you just can’t let it make you timid.

7. If You Don’t Enjoy It Anymore, That’s Okay — But Be Honest About It

Mike shared something that really resonated. His co-founder Scott Farquhar retired a year and a half ago after 23 years. Mike starts work at 5 AM every day now. He’s working harder than ever.

And his advice to the SaaS founders he’s been counseling (he called it “SaaS therapy”) was refreshingly direct:

First, accept reality. Stop pontificating about whether AI is going to change things. It already has. Go build something.

Second, ask yourself honestly: do you still enjoy this? Not “do I enjoy every minute of every day” — that’s not realistic. But over a 90-day average, over a year, would you choose this job again today?

If the answer is no, that’s fine. You built something amazing. Hand it off thoughtfully and go do something you enjoy. That’s not weakness — it takes more courage to step away than to hang on collecting a paycheck until the board forces you out.

If the answer is yes, then get to work. We’re going to create our way out of this, not hide in a hole and wait for it to pass.

CEO for 24 Years in the Age of AI

Mike Cannon-Brookes has been building Atlassian for 24 years. He’s seen every “this time it’s different” moment the tech industry has produced. And his message is clear:

B2B software isn’t dead. It’s changing. The companies that will win are the ones that accept reality, invest aggressively in AI, maintain execution discipline, and — critically — are actually good at what they do.

If you’re a founder reading this and feeling anxious about the AI transition, here’s your to-do list:

Figure out if you’re selling to input-constrained or output-constrained functions

Stop reading “SaaS is dead” takes and go ship AI features your customers actually want

Make sure your inference costs are going down, not up

Ask yourself honestly if you still want to do this

If yes, start at 5 AM tomorrow

The era of autopilot SaaS growth is over. But if you have 350,000 customers, great distribution, engineers who can build, and a product people love? That’s a pretty good starting point to build a company.

You just have to be good.

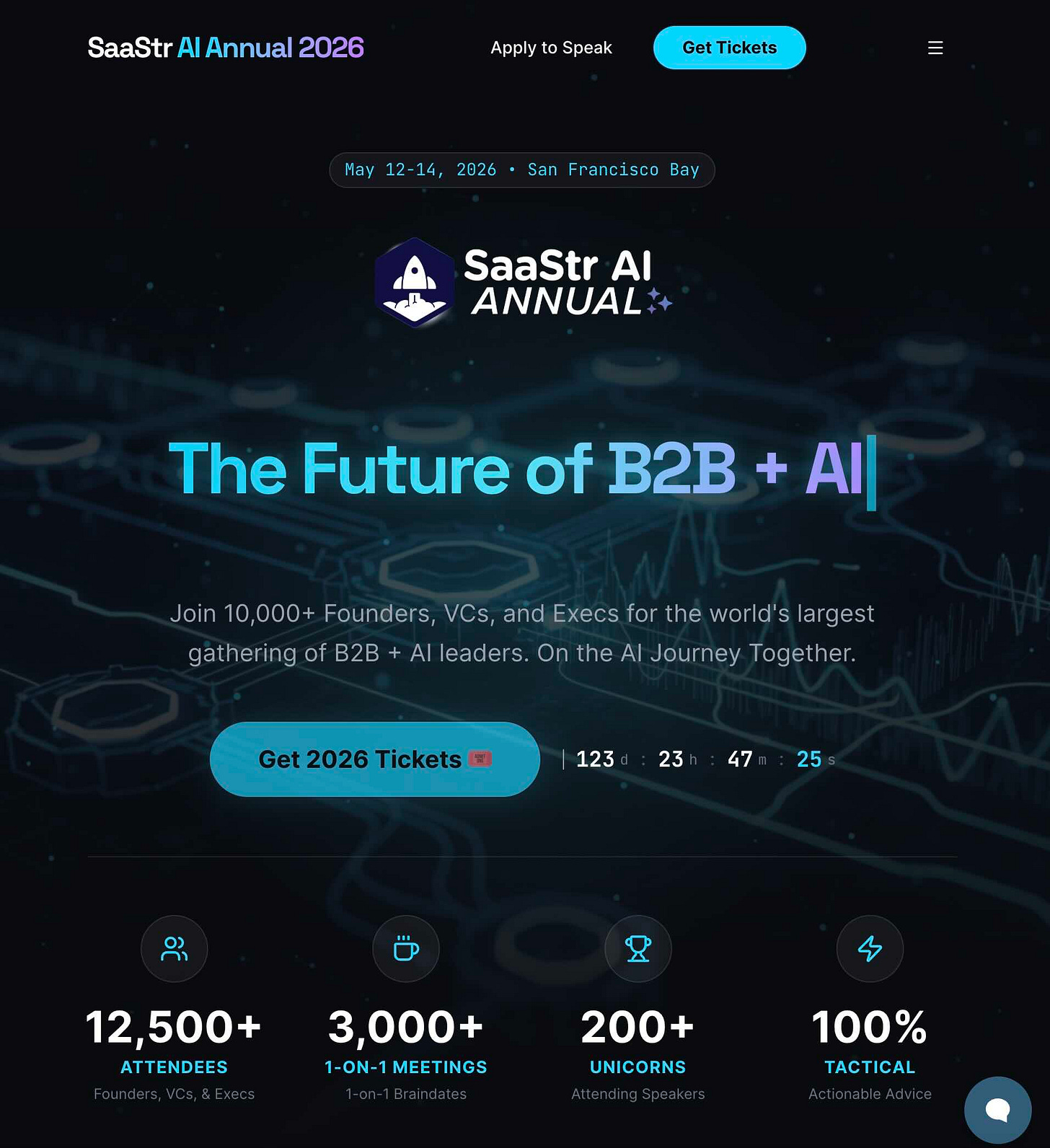

Want to learn how to WIN in the AI Era in B2B? Join 10,000 of us at SaaStr AI 2026 May 12-14. We'll give you the playbooks to win in AI + B2B in 2026.