If You Want to Get Funded – Make It Easy On Them

"A slick deck and a thoughtful demo are a good start. But you can do more."

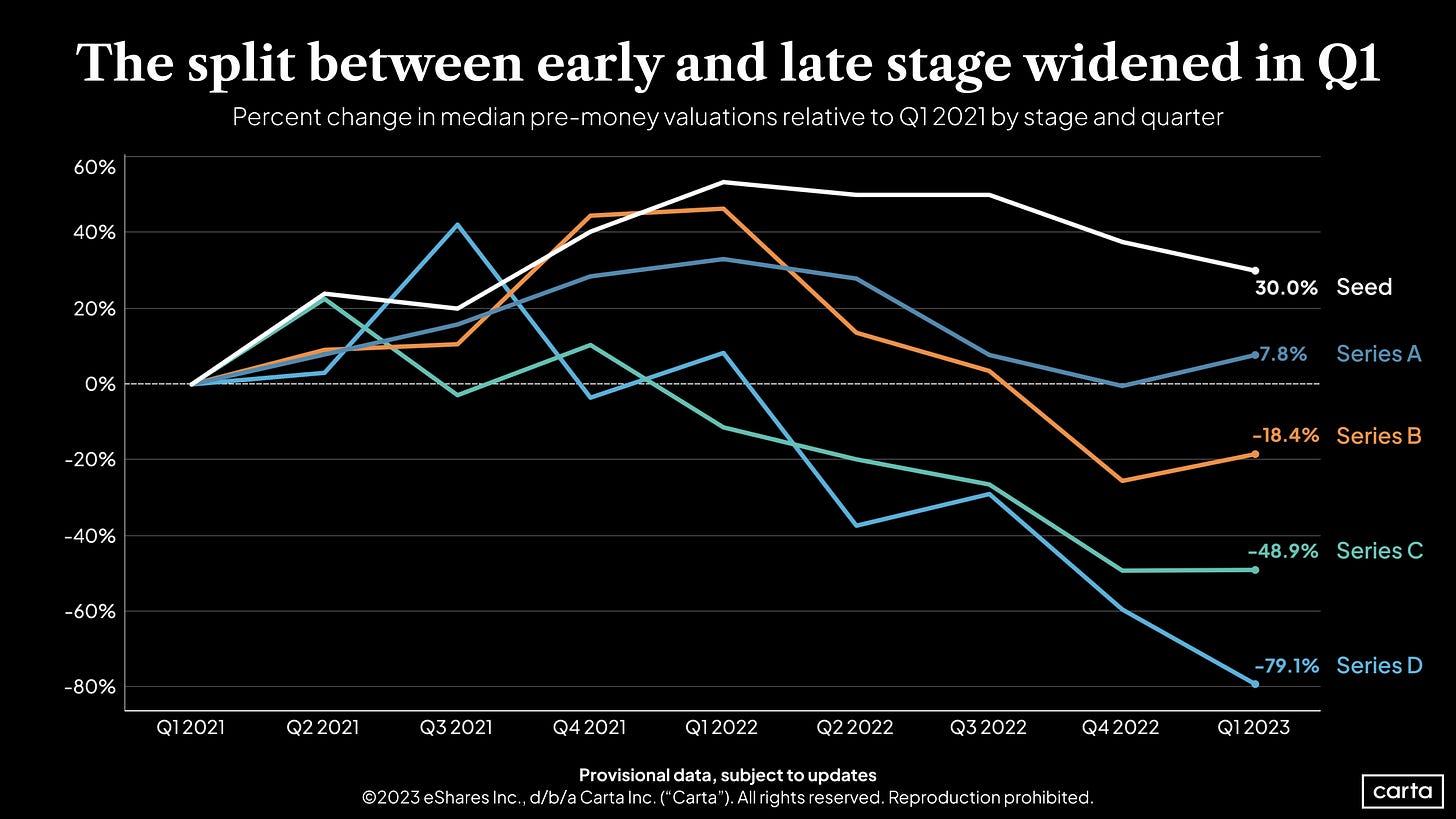

Fundraising is harder almost across the board. Valuations are down, growth rounds are down, it’s all harder, especially from Series A and later. You can see some of Carta’s latest data here:

But you can bend the odds. You can make it easier. Easier on the VCs to fund you.

What do I mean? Well, think about the average early-stage VC for a minute. You think all they do is look for startups like yours? No. It’s just a small part of what they do (albeit, I think, the most important part). They also have to spend a ton of time fundraising themselves. They spend a ton of time working with their existing portfolio companies. They have to do their own customer, er, LP meetings. They do speaking engagements, and are constantly trying to network — just like you. They have to debate and argue amongst themselves — entire Mondays can be completely shot here. And most importantly, now that initial pitches are all over Zoom, VCs are meeting with 2x-5x more startups than they used to. There just isn’t time anymore to dig in when it doesn’t immediately click.

A slick deck and a thoughtful demo are a good start. But you can do more.

You gotta make it Easy.

How? Have the full package, ready to go, on Day 1. At least, put as much of it together as you can:

Share the Deck upfront. The more detailed, the better. Fundraising is so fast and furious these days, you just bend the odds if you share the deck ahead of time. The more details, the better. The goal should be a VC should want to fund you just reading the deck.

A Partly Complete Team – Relative to Your Stage. Just because you and your cofounder are great, that’s often not enough. At least break out who is handling all the key functions, and how and when you are hiring to fill them: Sales lead, Marketing lead, Product lead, Engineering lead. You can wear multiple hats in the beginning. But you need 3/4 of these covered, one way or another. One gap is OK, you can fill it later, with the capital. But 2 is too many. And make it clear how you have the bases covered — with experience. You may have a key missing piece here. If so, go bring that piece onto the team now, if you can. Or at least, make it clear a search is underway and you know what you are looking for.

A Clear Path to $100m+ in ARR. Probably even $1B in ARR. Using comps in particular. Explain how — if the stars align — there’s a clear path to a $100m+ business. Not saying it’s easy, or that you have it all figured out now. Of course, you don’t. But a clear path. With comps. Explain it crisply, in 1 slide, in 20 seconds. How many customers will you need? At what pricing? Who are the 2-3 public SaaS and companies most similar to you? How big are they, and how fast are they growing? Who’s the #1 competitor? How much share would you need to grab from them, or add to the market, to become a unicorn? Just show the math here. As Tomasz Tunguz said in our recent Workshop Wednesday, VCs need to know you have the vision and path to build a public company:

Crystal Clear Context within a Big Space. Explain clearly, immediately, crisply, how what you are doing is Big, in a Big Space. The real reason it’s a $100m+ ARR opportunity is because you are playing in a $10B+ space. Make it clear what that space is. Are you the next Datadog? The next Zoom? The next Workday? Not the same, but the next one like it? Great. OK, at least that’s clear.

A Fully Baked Financial Model — Including Crystal-Clear MRR and Operating Metrics. You need a baked financial model, that includes sales and marketing costs, scaling over time, headcount, and comparison to comps, and when you’ll need the next round(s). Both bottom up and top down. And call out clear metrics that you are counting on — ACV, # Customers Over Time, Cost of Sales & # of Reps, etc, etc. It doesn’t matter that’s it’s 100% correct. It matters you’ve thought it through and understand what it will take to get there. And make sure the model builds properly, and intelligently, to that $100m+ number above. Don’t have comps? Go search EDGAR and find the SEC documents of comps. Find the best comp and learn from it. And make absolutely sure I can figure out your MRR in 60 seconds. Not just phony metrics like “projected bookings” or “quarterly numbers”. That shows weakness as your primary metric. Lead with trailing and projected MRR first. Bookings second. And no crazy aggregated quarterly metrics. Loser companies hide their MRR in quarterlies.

Strong Case Studies. If you have no customers, get proto-customers. Potential customers, talk to them, and summarize how they’d use your product. But if you’re raising venture capital, you probably have at least 10 customers. Present the best case studies so it’s clear what you are saying is true in practice.

Deep and Thoughtful Understanding of the Competitive Landscape. A clear appreciation and respect of what has come before, and a true understanding of how to succeed in spite of competition, will show your intelligence in the space (or reveal your inadequacies quickly). Also, this saves investors time. Don’t make investors do competitive research. Be honest and direct here, so they don’t have to feel like they need to do 20 hours of research before they can lead forward. This clearly violates the Easy philosophy. They may not bother, and just pass instead.

This edition is sponsored by SAP.

Customer References Ready to Go. If you get investor interest, and even have 10 customers, the very first pre-success … make sure it’s super easy to go write a check. Have 5+ customer references ready to go, on a sheet, on a list. Even better, have a lot of detail about each one, and basically do the diligence call for them before they do it themselves. Yes, you’ll have to ask your customers for them. And yes, if these first 10-20 customers are happy … some will be happy to help. Send them a logo sweatshirt and a big Thank You afterward.

Know and Share Your Churn and NRR. Every public SaaS company now shares its NRR. You need to do the same. Hiring churn doesn’t help.

Your Personal References and LinkedIn Ready to Go. If the rest goes well, any VC is going to want to hear from folks that at least the CEO + next most important founder are rockstars. Make sure your last boss, whatever you’ve got, is good to go to say you are simply outstanding. Make sure your seed investors, if you have them, are on board. Make sure your LinkedIn reflects your skills as a leader. Get it ready to go. Or things will stall out here fast.

Can you get funded without the above ducks in a line? Sure … if you are super hot, you barely need anything. But in SaaS that’s not usually the case in the early days for most Seed, Series A, and even many B rounds.

The thing is, a Great Deck isn’t enough to get funded. A Great Idea is a dime-a-dozen. A Great Team, without the right coverage, and without a big enough and focused-enough target, is insufficient. You need to go further. You Need To Make It Easy.

I know you’re doing this with your product (at least I hope so) — Easy to Try, Easy to Use. And I know you’ll do the same with your customers — Easy to Buy. Do it for your prospective investors, and I guarantee you, it will go 10x better.