From $5M to $100M: How to Scale a Multi-Product Startup with Lattice CEO Jack Altman (Video + Podcast)

"The wrong way to build multiple products is… building random products you think your buyer might want."

One of the open secrets behind a lot of great SaaS companies is going multi-product. Jack Altman, CEO and co-founder of Lattice, firmly believes that many more companies should be multi-product, and many should go multi-product earlier than they think.

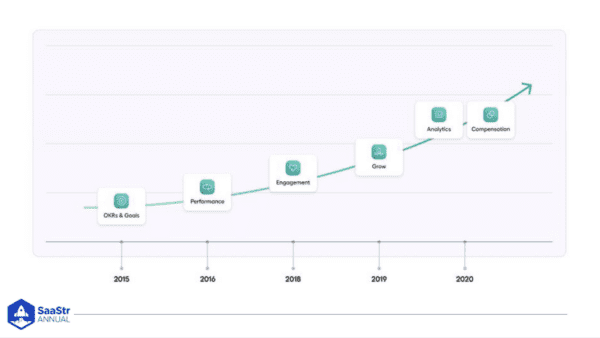

Lattice has launched four product suites in the last eight years, and the ideas that drove their growth apply to most companies today.

Many of you are familiar with this visual, most likely created by an investment firm. This showcases a narrow segment of a niche market, and it’s missing a lot of startups.

Any startup in any reasonable category likely has dozens of competitors, and Altman believes the best strategy to compete in 2023 and beyond is multi-product.

What Caused This Crowded Software Market?

We’re so many years into the Cloud, and here we are at hundreds of billions in annual Cloud spend and growing at 6x over eight years. That’s unbelievable!

Naturally, demand is going to lead to a ton of supply.

Beyond basic economics, there are micro reasons, at a company level, why things have changed.

It has become much cheaper to build software — You can build high-quality products cheaply in your dorm room with a laptop.

We have better tooling and systems — The shoulders we’re all standing on compared to the past are incredible. Libraries and great integrations out of the box mean better products, cheaper and faster.

Access to capital is better — Anytime a good idea is there, money comes in so people can build early teams and great products.

Startups are no longer fringe. There are a lot of smart people from other industries coming into tech, so talent looks different.

We now have a backdrop where it’s cheaper, easier, and faster to build high-quality products. Markets are more crowded than ever, so building multi-product companies is the best way to compete.

Lattice’s Timeline For Going Multi-Product — It’s Not Easy

Lattice started in OKRs and performance and expanded out to other products.

The wrong way to build multiple products is…

Building random products you think your buyer might want.

What to do instead?

Think of the user journey and the people who are using your products. What else exists chronologically in their day? Take them on a journey through their day with your products.

For Lattice, you maybe onboarded the company, set them up with goals, and do 1-on-1s with a manager to go through a quarter and get feedback.

The customer journey applies to every software category, and it guides your roadmap with more holistic solutions for your customers.

Why share this timeline?

Because it took years between each of these products. It didn’t come quickly, and it’s really hard work.

What was so helpful about being multi-product?

On the demand side —

Your customers might need 19 things, and each needs 14 vendors. If you can handle multiple things with one solution, you’re going to get a deeper data connection to products tied together.

The cost of ownership tends to be cheaper, but generally, when buying multi-product, you get cheaper overall than if you were paying for individual SKUs. It’s much less taxing for employees.

On the supply side —

GTM gets more efficient, and the cost of selling net new customers is unbelievably higher than selling to existing customers.

You also get product advantages through data integrations becoming much stronger, and you get shared UX patterns, so usage gets easier.

On top of that, if you have elements you can copy, you can build new products faster.

The Impact Of The Second Product Can Be Surprising

The way Lattice saw things happen in the funnel was surprising because the impact of the second product wasn’t always what they expected.

There are advantages beyond higher pricing, with higher pricing being the smallest advantage.

Think about the growth curve inflecting more at the top of the funnel with more leads. There were more reasons to talk to customers and more touch points with people.

There were better conversion rates once in the funnel. The second product attracted many people who didn’t need the first one, but they did need the second.

With the second product, Lattice had a higher price point per customer, which everyone expects, but it doesn’t always happen.

The second product had better retention. Customers want to stay longer because there are more touchpoints in their systems and workflows.

When Lattice launched its engagement product in 2018, it had a humongous lift with almost double the quarterly booking rate overnight.

But when they pulled it open, only 20% of the lift was explained by higher pricing. And almost all of it was lifted by better conversion rates and more leads.

“When you build these products, every part of the funnel stands a chance to improve, and it all compounds,” says Altman.

The Logistics of Going Multi-Product

GTM only exists on the back of a product that real customers need.

Taking it to market will be unique because every company, product, and competitive landscape is unique.

What’s worth thinking about when building multiple products?

Building new teams.

What are ways to set ARR goals and other targets? There are many cases where ambitious goals help you and other times where attaching ARR goals isn’t helpful. What are those incentives?

Who is going to do the selling? Will you have an overlay team that only sells the new product, or will you enable your entire sales force? This question exists whether you have 2, 12, or 50 sales reps.

One thing to note…

Surprisingly, you would think or expect to see more velocity on cross-selling because you have the relationship.

Many companies find that it actually comes more easily on the net new side than on the cross-sell side.

That’s not true for every product, but it’s worthwhile to keep in mind because you won’t always get it right.

Instead, focus on getting to market quickly and then go back to that zero-to-one mindset.

Making customers successful

One point to remember is the difference in maturity curves on different products.

Your first product will be battle-tested and hardened in the wild. You’ll have real product feedback and know how to talk about the product and sell it.

The new thing has zero maturity and is a day-one project.

Generally, you have to go back to the reason why a startup can compete with a big company.

How can a startup compete with a big company?

Usually, on the basis of individuals who are making up for the lack of all of that institutional experience with great care, attention to detail, and white-glove service.

When you can segment that out on the service side, you can get incredible results.

Marketing

It’s hard to evolve your brand and your story to customers. It took Lattice a long time after launching new products to get customers to know they had those new products.

You have to do product marketing and enable the sales force because if you’ve got a mini or full brand, customers will think of you as your first product.

Existing customers and distribution is the centrality of the advantage

Cross-selling and bundling are much more effective for the company because it’s cheaper and drives better retention.

But back to the maturity curve point…

It’s easier for everyone in your company to do the mature thing they already know how to do and not do the new thing.

It’s easier to sell a mature product and get more commissions, so you need to design incentives so that individuals want to make that happen.

The logistics of a multi-product company take a lot of thought, experimentation, and effort.

The Pitfalls Of A Multi-Product Company

Startups are full of pitfalls where a million things can go wrong. Finding that happy path is very challenging.

But in multi-product, you compound the surface area where things can get weird.

Some pitfalls to avoid are:

Clarity of ownership

When it comes to building and taking to market new products, having unbelievably clear ownership is essential, or everything gets tripped up.

When you build, you need to cordon off resources on the engineering product side and make clear who owns it.

There’s going to be existing draw for engineering and product resources on current products, so you need to figure out upfront who’s doing what and protect those groups because the natural pull goes against that.

Prepare for post-sales on new products.

If you’re not intentional here, things can get really challenging. Remember the maturity curve because when you launch this thing, all of a sudden, your customer base is going to pull hard to want to swoosh all of those resources to the first product.

You have to keep investing in the new product while getting back to the current product. The better the new product is doing, the more important it is not to defund it.

Keep leaning into the investment, and don’t let off the gas. Nothing gets off the ground that quickly, so keep separation once it’s launched.

The question of build vs. buy.

You know the next product category you want to get into, so fundamentally, you have two choices.

Build it yourself or buy another company.

The vast majority of the time, building is better than buying. Buying when small comes with a huge amount of overhead that’s hard to see.

You have to integrate the team, the culture, the product. You won’t have integrations, and generally, it’s more expensive and a huge distraction to the leadership team.

Buying is not the optimal path most of the time.

Acquisitions may make sense when:

You’re buying a true winner or number two in a category that will be too hard to compete into that’s strategically critical, and you’ve got enough scale to pull it off.

At a smaller scale, there are instances where different companies or teams have done a very complicated build that would take you a very long time. If you don’t have the expertise, you can acquire years worth of R&D and a team that knows how to build it.

Simplify everything.

Everything wants to get complicated once you’re multi-product — the way you’re building, the way you’re talking about GTM, commissions, etc.

The world is complicated, so wherever you can look for ways to make it simpler, do so.

Company resourcing.

A new product, both build and launch, can suck company resources at a rate you didn’t expect.

The only antidote is going in with some clarity of, “This is not that important, and I’m only willing to invest 10% or 40% of company resources.”

Or, this is a company bet, and you’re willing to invest 70% for a year. You can get trapped quickly, so having up-front clarity is important.

Key Takeaways

We are in an increasingly and extremely noisy SaaS market, which is natural, and it’s getting bigger and bigger each year.

Multi-product is the most powerful form of differentiation, given the context where building is cheaper than ever, and GTM is more expensive than ever.

When done well, it’s better for everyone — truly better for customers, a better GTM machine, and, ideally, better software.

Multi-product is the path that leads to better solutions for customers over time.

But it’s really hard. Get advice from people who have done it. Hire people who have worked in multi-product and prepare for a more challenging build.

The rewards are very high on the other side.