For Years, SaaS Outperformed Nasdaq. Now, It’s Underperforming

"Many enterprises are still clearly trying to just digest and deploy all the apps they bought from 2020-2022"

For Years, SaaS Outperformed Nasdaq. Now, It’s Really Underperforming

So it’s strange times in SaaS. On the one hand, many top leaders are growing at epic rates at scale:

Databricks is growing 60% at $2.4 Billion in ARR

Canva is growing 40% at $2.3 Billion in ARR.

Klaviyo is growing 39% at almost $1 Billion in ARR

But overall, SaaS is in a bit of a rut. The average public SaaS company is predicting growth below 20% for the first time, ever. And Salesforce is predicting single-digit growth going forward. Despite Gartner predicting overall, SaaS spend will grow 20% this year.

What’s going on? It may not be as clear as Twitter / LinkedIn think it is, but a few things are clearly happening:

Tech customers remain in a cut, cut cycle. They are still looking to cut seats, cut spend, and still cut vendors in SaaS. Non-tech customers are as well, but it seems particularly acute with classic tech “B2B2B” buyers. Even after several rounds of cuts, they are still looking to cut more. I would have though we’d be past this by now, but we aren’t. Salesforce, Asana, ZoomInfo, and other leaders are clear it isn’t getting any easier for them yet. Salesforce has been clear even there, customers are looking to downsize spend.

Budget being repurposed for AI. AI spend has to come from somewhere. It’s coming from even more cuts — to free up budget.

Price increases and inflation eating up budgets. Existing vendors aggressively raised prices in 2023 and into 2024. This eats up budget.

Post-ZIRP and high interest rates — maybe. To some extent. Does the downfall in SaaS multiples correlate with the rise of interest rates? For sure. But does this truly account for the stress in spend? Maybe. That’s not as clear. Nor is it magically clear that eventual cuts to interest rates will automatically lead to more spend.

Deployment fatigue. Many enterprises are still clearly trying to just digest and deploy all the apps they bought from 2020-2022, often at unprecedented rates.

The First VIP CRO+CEO Poker Night at SaaStr Annual!

So we had a “SaaStr Royale” casino at SaaStr Annual last year and it was a big hit, so we’re going to do an invite-only VIP version on September 11 for 100+ top CEOs and 100+ top CROs (and VP of Sales).

The goal:

The best CEOs never get a chance to know enough top CROs.

The top CROs really only get a chance to meet new CEOs when they are job hunting

It’s rare 200 of the best CEOs and CROs get together just to have fun and chat SaaS!

If you’re at a high-growth SaaS startup as a founder or CRO/VP Sales, feel free to apply here.

VCs Need You To Be a “Potential Fund Returner” When They Invest. But After? Expectations There Are More Nuanced

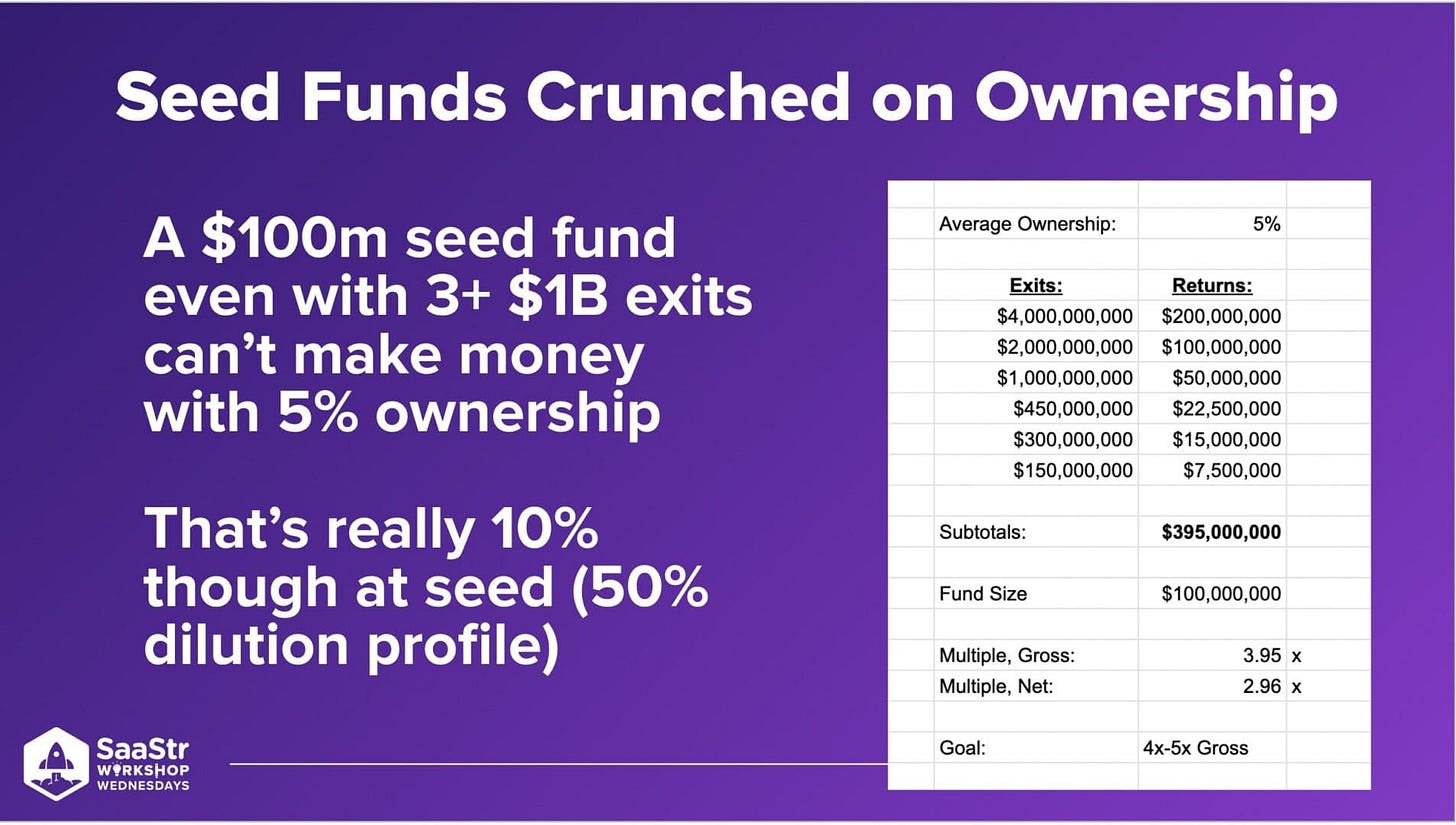

So venture capital turns out to be a pretty tough business. Imagine a $150m seed VC fund that buys 15% stakes in each startup. They write some follow-on checks, but ultimately, typically get dilutive to about 10% ownership.

Then one start-up in the fund is sold for $500m. An epic amount! How much does that return for the VC fund? $50m. A lot. But … but … it’s only 33% of the $150m fund.

And the job of the fund is to do at least about 4x “gross”, or to turn that $150m into $450m. So that $50m barely gets you 10% of the way there. And note while VCs are often well paid, they don’t make profits or “carry” unless the full fund is first returned. Until that $150m is payed back.

So you can see here, even a $500m “exit” isn’t a fund returner for a $150m fund. It’s not even close. It’s not enough. You need a bunch — in every fund.

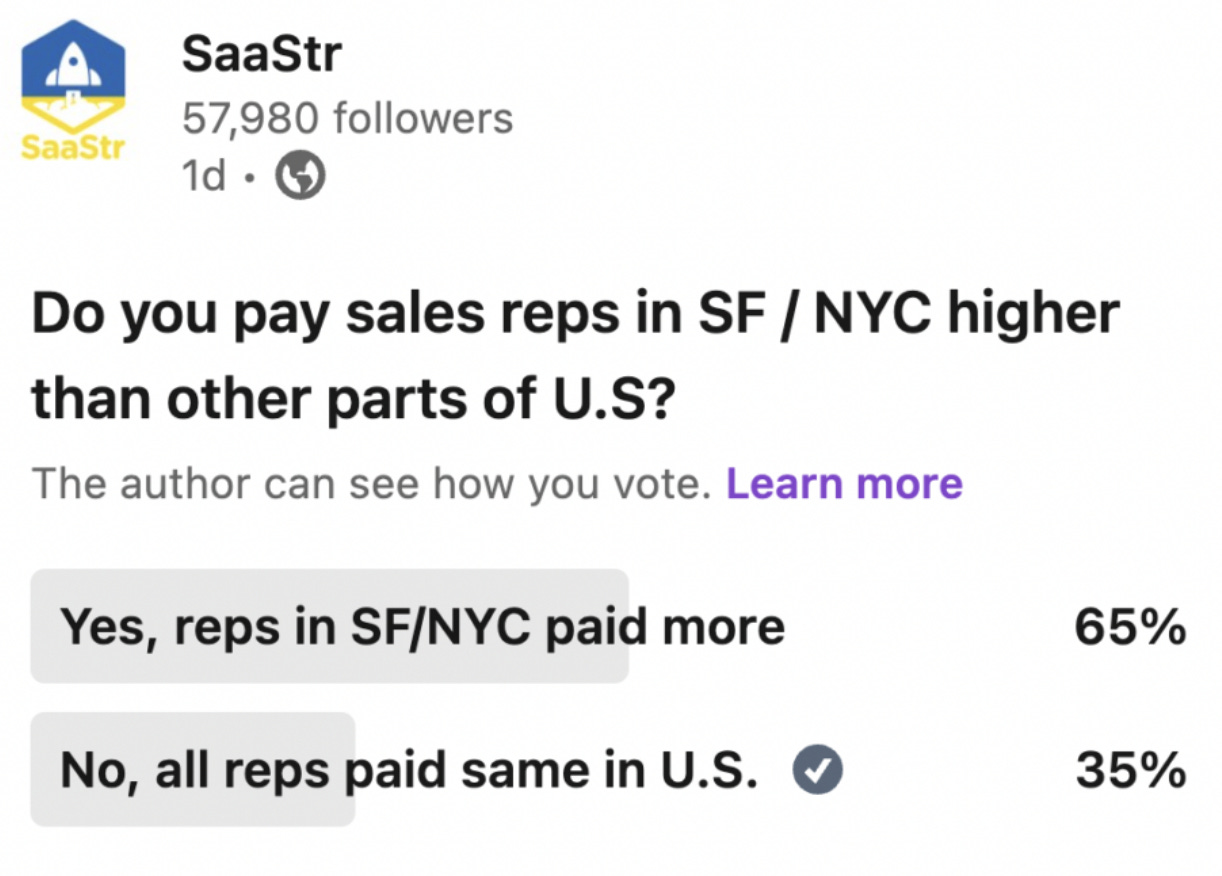

65% of You Pay Your SF and NY Reps More

So I wondered how many of us still pay sales reps in SF and NYC more than the rest of the country. Or put differently, pay reps outside of the top most expensive tech centers … less.

There are arguments on both sides on whether to pay reps the same everywhere across U.S. … or not:

SF and NYC are much more expensive in terms of cost of living. State taxes alone in CA are the highest in the country. Versus zero or very low in other parts of the U.S.

SF and NYC are the most competitive for sales talent. This is still true today, even with folks living everywhere.

And importantly, SaaS sales teams have traditionally scaled using “lower cost” centers like Atlanta, Phoenix, Portland, etc. to find a way to more cost-effectively scale sales.

But …

Shouldn’t you pay the best the same, wherever they are?

If it’s an inside role primarily on Zoom, and the rep can hit 100%+ of quota from Las Vegas, or Miami, or Tulum? Why pay them less?

It’s complicated.

The Best Way to Ensure a Smooth Transition When A New Team Member Takes Over a Customer Account

Add value in the first interaction. This is so rare.

There’s nothing more frustrating than getting a random email, “Hi, Tony is gone from the company. I know nothing about you, but I’m your new rep. Can we schedule a call?”

Find some way to add value. One great way is to demo upcoming features / an upcoming release.

“Hi, I’m Jason, your next account exec. I’d love to find a way to help even more. Can I show you or anyone on your team the new AI features we’re launching shortly? There’s no additional cost for them and based on what I can see, they may radically increase your efficiency.”

Not perfect. But much better.

A second, albeit riskier, way to add value is to set up a call asking for “honest feedback on how we’re doing.”

This works, too. Customers often just want to be heard. The “problem” is you might have to do something about it.

Do Spiffs Really Work in Sales? 70% of You Say “Not Really”

Most sales leaders and sales teams talk about using Spiffs to hit certain goals. To incent a certain revenue goal this month, to try to incent selling a new product, a new add-on, etc. Sometimes, to incent folks to help others on the team.

A spiff — an extra bonus for achieving a goal beyond just their core bookings targets.

“Let’s Do a Spiff!” comes up on many sales calls.

But … do spiffs work? I did a quick survey. Most of you said … Meh. 20% said they don’t work at all, and 49% said only a little. ut a moat.

Video of the Week

Fundraising In a Tighter VC Market, Advice for Hiring in 2024 and Much More with Jason Lemkin

To close out SaaStr Europa 2024, Jason Lemkin, SaaStr CEO and Founder took the stage to answer the audience’s most burning questions. AMA’s with Jason are wildly popular for his expertise and no-holds-barred delivery. Let’s find out what people are asking in H2 2024.

LISTEN TO THE LATEST

The Official SaaStr Podcast

New Episodes of the SaaStr Podcast with SaaStr, Box, and More!

SaaStr 749: The Lost Podcast Aaron Levie, CEO of Box, and Jason Lemkin, CEO of SaaStr, in 2013: "Thinking About $1 Billion in ARR"

SaaStr 748: Fundraising During A Downturn, Advice for Hiring in 2024 and Much More with SaaStr CEO and Founder Jason Lemkin

SaaStr 747: Top 10 GTM Mistakes Founders Make Again … and Again with SaaStr’s CEO and Founder Jason Lemkin

Listen on Apple Podcast, Spotify or Google Podcasts

@JASONLK

Tweets of the Week

Most budget comes from disruption. Who are you disrupting?

As a founder, very few will actually tell you the truth

If you’re not sure they truly want to do the job, Don’t make the hire

I recently did an analysis of my 20 best investments