Does It Matter How Fast You Get to $1B ARR, Within Reason? Probably Not. Comparing Figma, Palantir, HubSpot, Snowflake and More

"In the end, market TAM, business model, and post-$1B execution matter far more than exactly how quickly you get there."

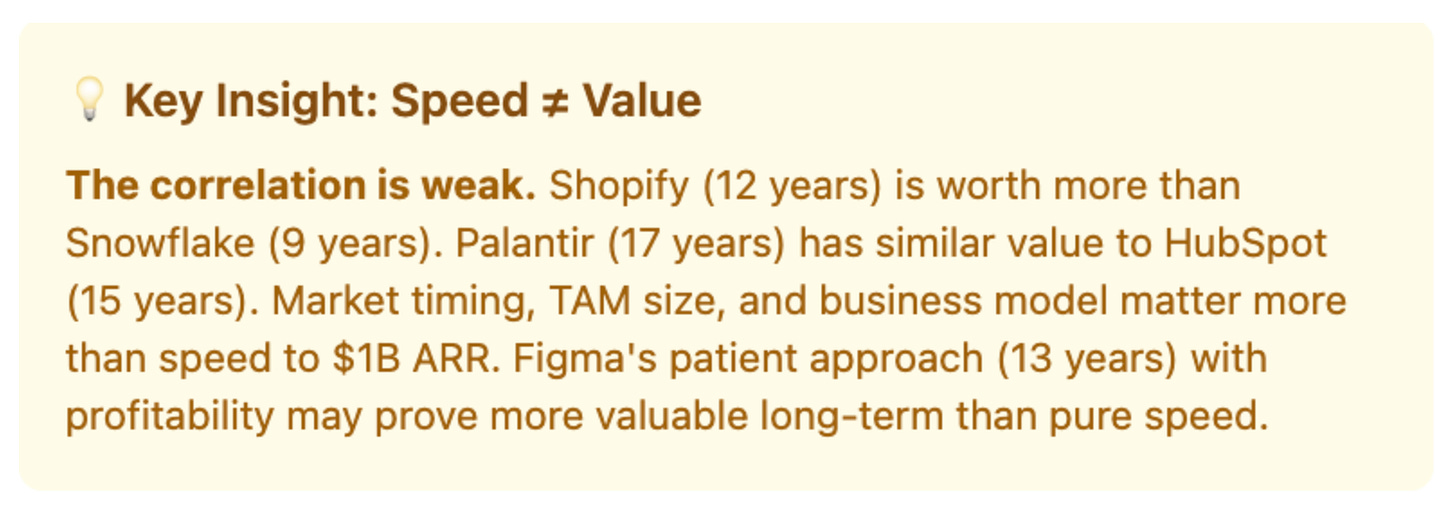

TL;DR: After analyzing 8 elite B2B companies that reached $1B ARR, there's surprisingly little correlation between speed to the milestone and current market value -- up to a point at least. These were all elite companies, of course. The best of the best is what it takes to get to $1B ARR.

But in the end, market TAM, business model, and post-$1B execution matter far more than how quickly you get there. Figma's patient 13-year journey with profitability may be just as or even more valuable than Snowflake's record 9-year sprint.

The Speed Obsession in B2B

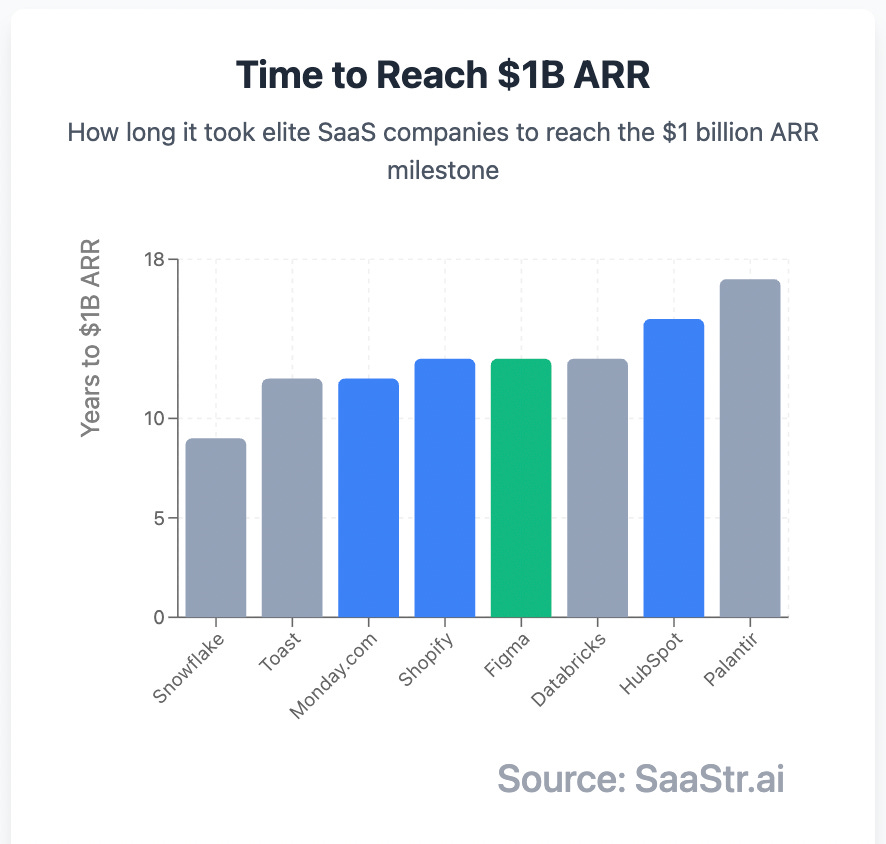

We are all obsessed with speed metrics. How fast can you get to $1M ARR? $10M? $100M? And the ultimate milestone: $1B ARR. We celebrate the speed demons—Snowflake hitting $1B in just 9 years, Zoom's rocket ship trajectory, the "fastest growing SaaS company ever" narratives.

But is it that simple?

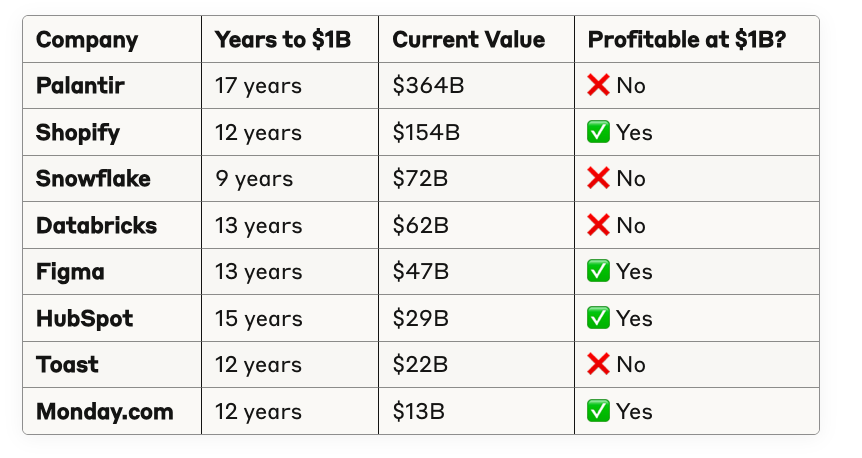

The Data: 8 Elite SaaS Companies at $1B ARR

We analyzed top B2B companies that reached $1B ARR, looking at their time to milestone and current market valuations:

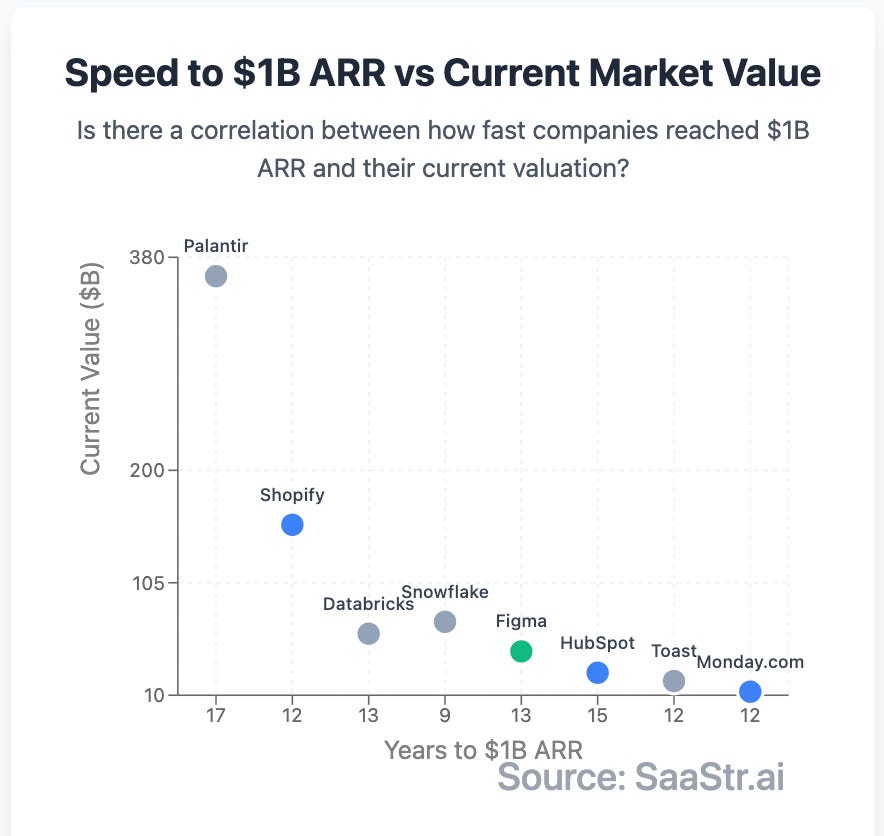

Speed ≠ Value

Here's what jumped out immediately: there's virtually no correlation between speed to $1B ARR and current market value.

Snowflake (fastest at 9 years) is worth $65B

Shopify (12 years) is worth $108B—the highest valuation

Palantir (slowest at 17 years) is worth $35B, similar to HubSpot at 15 years

If speed mattered, we'd expect to see Snowflake dominating valuations and Palantir at the bottom. Instead, we see the opposite.

What Actually Drives Long-Term Value

1. Market TAM Size

Shopify's $108B valuation isn't an accident. It serves the massive global e-commerce market—a TAM that dwarfs most other categories. When you're taking a percentage of every transaction in a trillion-dollar market, the math works differently than subscription software.

2. Business Model Scalability

Transaction-based models (Shopify, Toast) scale differently than pure SaaS subscription models. Shopify gets a cut of every sale its merchants make—revenue that grows with customer success without additional sales effort.

3. Market Timing

When you IPO and get valued matters more than when you hit internal milestones. Figma's 2025 IPO benefited from a market that values profitable growth. Palantir's 2020 IPO rode the peak of growth-at-any-cost sentiment.

4. Post-$1B Execution

What you do after hitting $1B ARR matters far more than how fast you got there. Can you maintain growth? Expand margins? Enter new markets? The companies sustaining 20%+ growth at multi-billion scale are the real winners.

The Profitability Advantage

Here's another fascinating pattern: only 4 of 8 companies were profitable when they hit $1B ARR. Those that were:

Shopify: $108B (highest value)

Figma: $47B (recent IPO success)

HubSpot: $37B (steady performer)

Monday.com: $13B (efficient growth)

The profitable companies average $51B in current value. The unprofitable ones average $39B. Correlation isn't causation, but it suggests that sustainable unit economics matter more than growth speed.

The Figma + Palantir Case Studies: Patience Can Pay Off

Figma took 13 years to reach $1B ARR—4 years longer than Snowflake. But consider what Figma achieved:

91% gross margins vs. Snowflake's ~70%

Profitable at scale with $44.9M Q1 net income

250% first-day IPO pop showing market confidence

$47B market cap despite being "slower"

Figma chose the patient path: building sustainable unit economics, expanding beyond design into a platform, and achieving profitability before going public. The market rewarded this approach with a premium valuation.

And Palantir took the longest of all.

But Different Markets Are ... Different

Not every B2B leader has the viral effects of Figma, nor the same ability to leadfrog competition based on product alone. Still, it's a reminder that perhaps growing 95% as fast as possible, but with more enduring revenue and more stability, in the end might be just fine.

It took Figma and Palantir many, many years to set themselves up for success. But set themselves up, they did.