Dear SaaStr: What's the Best Advice That Entrepreneurs Never Hear?

And How Do SaaS Companies Determine What to Price Their Product At?

Dear SaaStr: What's the Best Advice That Entrepreneurs Never Hear?

My list of top advice founders never hear:

Slow it down if you don’t have a great co-founder. We all get excited to “get going” with a start-up. But if your co-founder isn’t great, if they don’t have the right skills to complement yours, and/or if they aren’t committed enough … it won’t work out. More here: A Simple Commitment Test For You And Your Co-Founders | SaaStr

The mentors and investors that give you the best advice often don’t sugarcoat it. You have to develop a thicker skin as a founder. Investors and “advisors” that want something from you will often tell you what you want to hear, or sugarcoat their advice. But successful advisors, mentors and investors that just want you to succeed often don’t sugarcoat their advice. It can hurt a bit, but listen more to that advice.

How badly do you want it? Committing for 10 years with a great co-founder is key. It’s not enough to see it. To want to “do a start-up”. To have a great idea. You have to want it so badly you will it into existence. And then stay the course to grow it into something real.

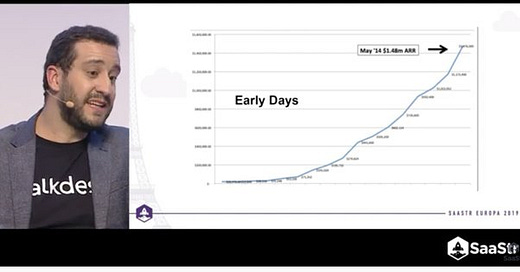

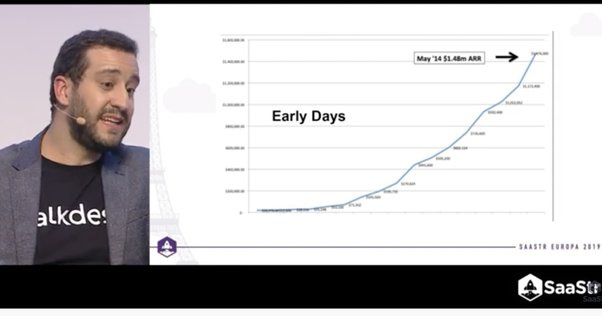

Many successful start-ups had $0 in revenue the first 2 years. How will you handle that? Tiago Paiva and I from Talkdesk, just valued at $10billion, discussing how the first 2 years he literally had to do any odd job he could get. $0 in revenue for the first 2 years. Watch it here: And only then … product-market fit. And only then … hypergrowth. Mailchimp started off inside of an agency. What if it’s $0 in revenue for 24 months? Or token revenue? More here: If You're Going to Do a SaaS Start-Up ... You Have to Give it 24 Months | SaaStr

Bad investors really can hurt you. How much value do VCs add? That’s an open question for the ages. But what is clear is a bad VC can seriously hurt your start-up. A bad VC will tell others not to invest. A bad VC will undermine your confidence. A bad VC will create a crisis of confidence in your syndicate. A bad VC will undermine the confidence of your VPs, when they don’t show up to the board meetings and/or undermine folks in public. I know you want that fancy brand, that investor that seems to be so cool, to have it all. But can you trust her/him? Start there. Start there.

A bit more here: The 10 Things I'd Tell My Younger CEO Self to Do Better Next Time | SaaStr and 10 Things Maybe Not to Do In The Earlyish Days | SaaStr

Dear SaaStr: How do companies determine what price to sell something at? What factors go into that decision?

Almost everyone starts with “Comps”. The pricing of comparable products.

If you have direct competition, then you know exactly what those comps are.

If you don’t have direct competion, at least there are apps that provide similar amounts of value to the same buyer. That’s enough to start with.

Then, you have to decide what to do with your top comp(s):

Anchor lower. Too low, and you may confuse the market. But say 20% lower than the Comps can signal you’re a new vendor that is a peer and is innovating but may not have full feature parity, etc. That’s OK.

Identical pricing. The goal here is to take pricing out of the equation. You price the exact same as your competition. One less piece of friction in the buyer process — IF your prospects and customers see you as providing similar value to the Comps.

Anchoring high. You price higher than the comps. This works if you are the more enterprise, the more valuable solution. Even if you are newer.

A bit more here:

The 3 Types of Day 1 Pricing: Low End of Normal. Identical. And Anchor High. | SaaStr