Asana: Now at $600,000,000 in ARR (!), Growing 34%

"Its 500+ $100k Customers Are Growing The Fastest — By Far"

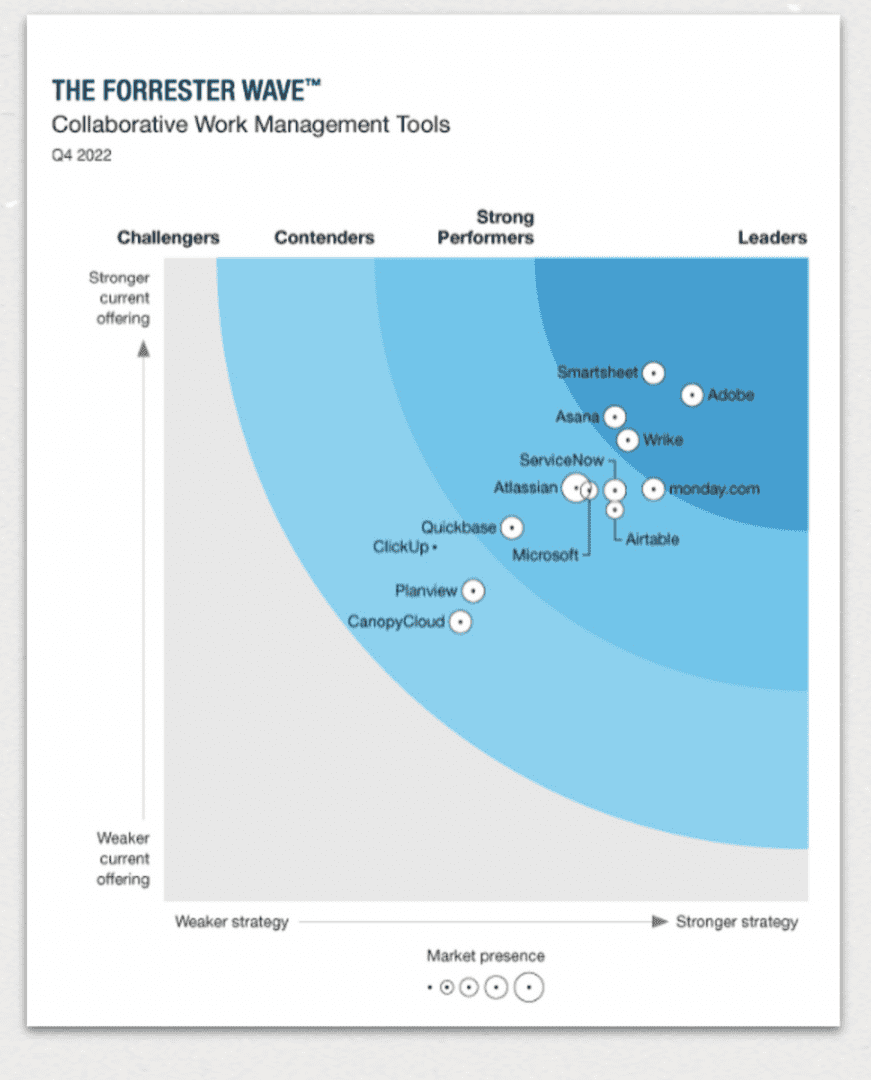

So one of my favorite categories to track and analyze in SaaS is project management. Why? Diversity of vendors and customers. There are so many leaders that have IPO’d (Asana, Monday, Atlassian, Smartsheet, etc) and so many that will (Notion, Clickup, Airtable, etc.). And so many different strategies, from more enterprise to more SMB, from more tech focused (Asana) to less tech focused (Monday). You can just learn so much.

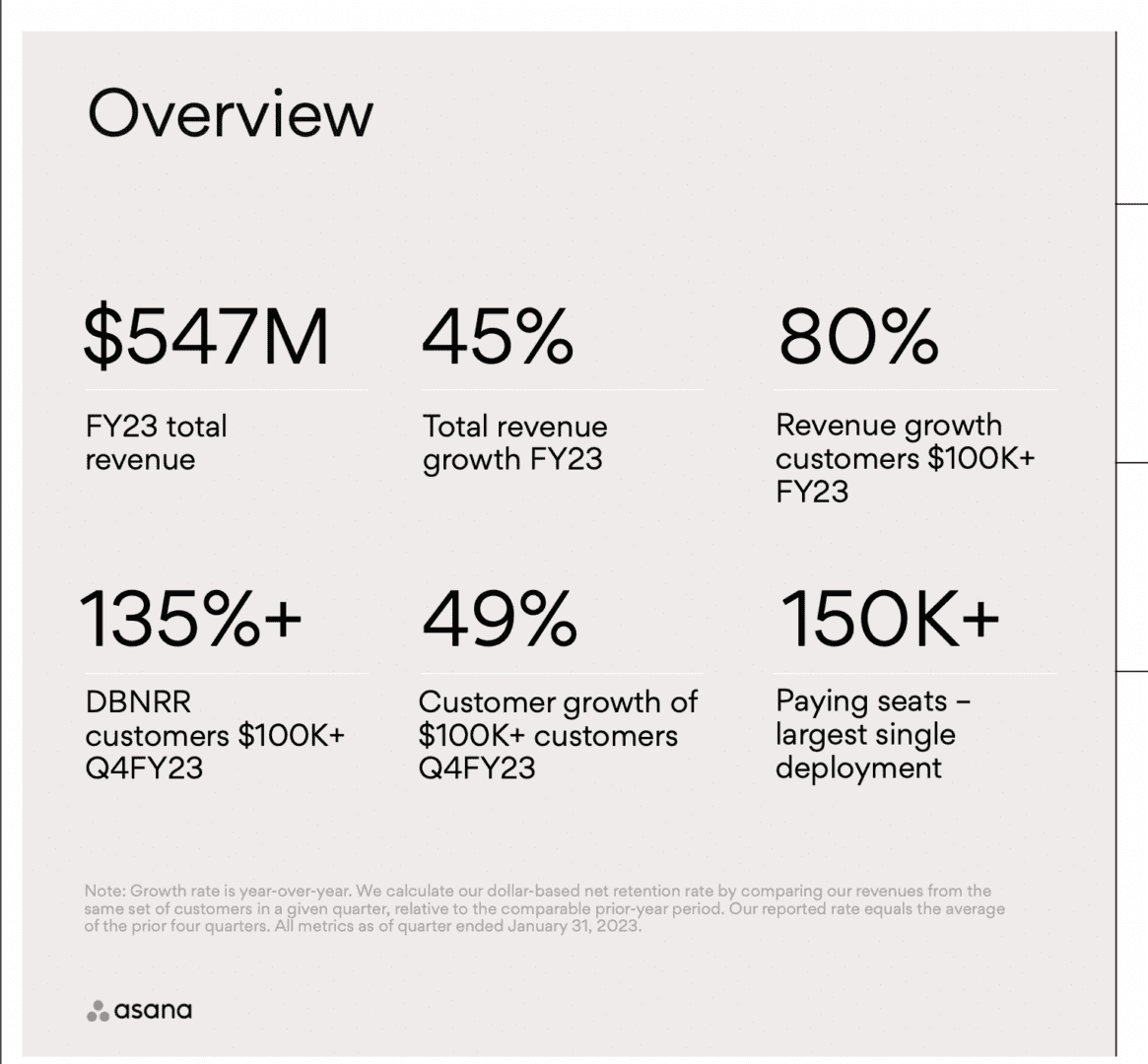

Asana is one of the leaders now, and they’ve cruised past $600m in ARR, growing a very healthy 34% — which will push them to one billion+ in ARR soon enough! Impressive, although as an overall barometer for tech and tech spending, it’s important to note that while growth is still very strong, it’s down substantially from a stunning 70% at $400m in ARR. Things are great at Asana, but still harder than it was at the peak of 2021 craziness as for most of us. In 2021, everyone was just buying everything.

5 Interesting Learnings:

#1. NRR staying high at 135% for bigger customers (although down from 145% at $400m in ARR) and 115% overall. While growth has slowed a bit, NRR hasn’t come down all that much. 135% NRR from larger customers and 120% for $5k+ customers remains top-tier, especially for a vendor with plenty of small SMB customers. A reminder that even when downgrades creep up along with churn in somewhat tougher times, NRR can still stay top-tier. Don’t let it drop much in more challenging times.

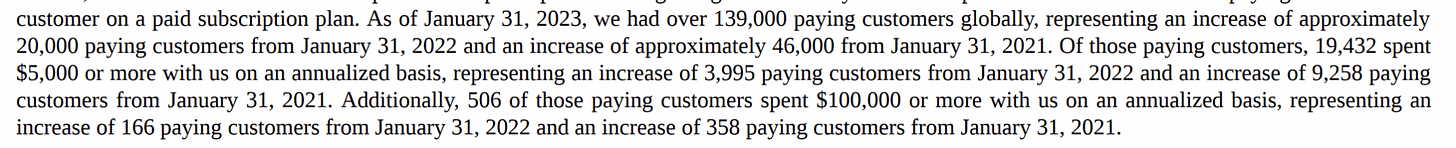

#2. Its 500+ $100k Customers Are Growing The Fastest — By Far. Asana is seeing 80% Growth from $100k+ Customers, of which it has just over 500 now. Asana isn’t totally enterprise, but its $100k+ deals are the top engine of growth. Not only are they 80% of that growth, but with far higher NRR (135%), they’ll be even more of the future. $5k+ customers are growing 26%, and the tinies customers the slowest of all for now.

#3. $5k+ customers are now 73% of revenue — up from 62% in 2021. Asana still has tiny customers, and plenty of them. But they are focused on the “less tiny” ones. $5k ACV is their line for a material customer, and what they see as a “larger” contract. Still, it’s impressive that even at $600m+ ARR, 27% of their revenue still comes from customers that pay less than $5k … That’s a long tail that truly has gone the distance.

#4. 39% of Revenue Outside U.S., but U.S. Growing Much Faster (For Now At Least). A good reminder to go global, because so much of SaaS is outside of North America. But also that in many cases, Europe and other geos are more impacted today than the U.S.

#5. 120,000 tiny customers (86% by count) make up 27% of revenue. So the long tail is material to Asana, and small customers regularly grow into larger ones. And interestingly, it’s both getting bigger by customer count, but smaller as a percent of total revenue. (Back when CEO Dustin Moskovitz came to SaaStr Annual 2017, they’d just crossed 20,000 customers).

And a few other interesting learnings:

#6. Salesforce integration becoming important: 50% increase in demand from top 100 customers.

#7. While seeing overall macro pressure and softness, not seeing a decline in Free-to-Paid conversion. Interesting to see if you’re seeing a decline in conversations from free … that Paid isn’t.

#8. The majority of Asana’s $100k+ customers also use its Goals product. Goals isn’t quite a separate product, but it’s an extra set of functionality limited to the enterprise edition. A s that one great way to drive up deals size and go upmarket is to create “a more enterprise” edition.

#9. Even with a PLG-motion and a large self-serve base, sales & marketing is still 62% of revenue. PLG and self-serve don’t automatically make you more efficient or profitable. Way too many founders think it automatically does, but many of the SaaS leaders with a large PLG and/or self-serve base aren’t more profitable than those that are sales-driven.

Wow, what a story! Asana will be at $1B in ARR in just a few years. The only question is just which quarter it will happen! We’ll make sure and check back in before then.

And a few other great sessions and deep dives with Asana:

How to Increase Revenue and Grow Your Customer Base by 10x with Asana COO Anne Raimondi

How Asana Incorporates Customer Insights Into Product Development, with Head of Research Experience

How 3 Data Points Can Drive Revenue with Asana Head of Revenue Marketing Jessica Gilmartin