5 Things That Can Make a Good VC Pitch Deck … Great

The frenzy to back the hottest startups led to so many corners being cut.

For a little while in the Peak of Late ’20-Early ’22, it almost seemed like you didn’t need a great pitch deck anymore. At least, sometimes. The frenzy to back the hottest startups led to so many corners being cut.

Well, a great pitch deck matters again. Funding at every stage is harder, and no one wants to invest in another FTX.

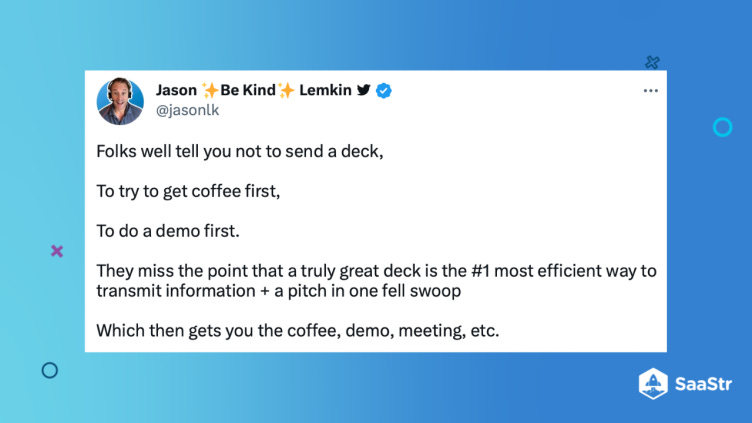

So how can you make your pitch deck better? Well, here’s what I love, that I don’t see enough. That makes a good pitch and deck … great.

A great email with the deck, that explains everything in the email itself, including Why and all the core metrics. This helps a ton when you forward it to other investors at the fund.

A one-slide deck. OK, I know this is controversial, but it shouldn’t be. The best verbal pitches are “elevator pitches”. The best PowerPoint decks and PowerPoint pitches, IMHO, are “one-slide decks.” This doesn’t mean literally one slide, but it means the first slide can totally stand on its own. What (you do — one line). Who. Why. Where (you are in terms of Progress). Next (you are going). If you can make an amazing 1-slide deck, you can also make an amazing 10 or 20 slides deck. But often not vice-versa. And also. If you can do a great 1-slide deck. You can do a great email intro & summary of the opportunity, too.

A summary of every metric that matters. And nothing hidden. Even at the earliest stages, SaaS is about metrics. Just put them all into 1 great slide.

Precise understanding of the next 12–18 months. There’s no excuse not to know all your hires, your ARR goal, your product goals for the next 12–18 months. If I don’t hear that, I’m out. If you don’t know … then there’s a lot more basic stuff you don’t know, either.

Clear path to $200m ARR. Tell me why, ideally with some simple bottom-up data, why you’ll get to $200m in ARR and beyond. TAM is great, but that’s not enough. Tell me why this is a pre-pre-unicorn. The best SaaS companies don’t IPO at $100m any longer, they IPO at $200m-$300m ARR. If you can tell a VC how you’ll get there for real, that’s impressive. The best can, even at seed stage.

What I hate, but can tolerate if the CEO is great:

Crappy design. Outsource it. Get the deck looking decent. It sends the signal you have a world-class product. But it’s OK to have no design at all if the business is on fire.

Rambling intro on The Market. No one needs 5-10 slides on how The Cloud is Changing Everything. These pitches are almost always No.

This edition sponsored by Secureframe.

Impractical operating plan, projections, and financials. This just creates lots of anxiety. But I can work through it if I have to. But 100% gross margins? Crazy numbers? A projection that makes no sense? Then … I’m out. Have someone smart that has done a venture-backed start-up stress test it for you.

Anything less than super-crisp analysis and discussion on the competition. We all have competition. The crisper you are here (and the less emotion you have in it), the more I know you may be a winner. Condescending views of successful competition? The opposite. I am pretty sure you will fail.

Thing is, many of the investments I’ve made had terrible pitches. You do get better.