Holy cr*p Shopify.

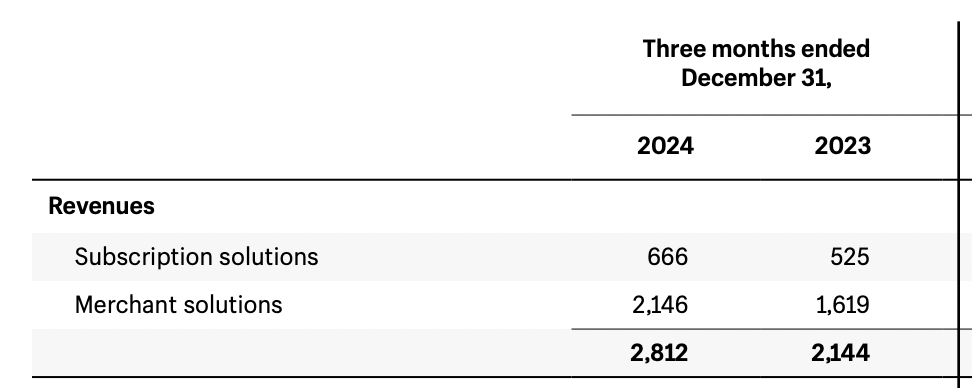

At an $11.2 Billion run rate (most of it not software, but that’s the revenue run rate), it’s growing at a stunning 31%. And it’s accelerating.

$11.2B run-rate

31% growth rate

22% free cash flow margins

12% share of U.S. e-commerce

It’s just stunning to see this sort of growth at this scale. Shopify has tripled since 2020 and is on path to do that again in just a few more years. Wow.

5 Interesting Learnings:

#1. Strongest Quarterly Growth in 3 Years.

That’s acceleration at scale.

#2. International Revenue Up +33%. 50% of Revenue Is Outside North America.

Go global as early as you can! Shopify has just 45% of its revenue in the U.S. (plus 5% in its home base of Canada,).

#3. Offline Revenue Up +33%, B2B Growth up 140%

While many think of Shopify as mainly an SMB online solution, it’s biggest growth now is in its largest customers, in its offline/ in-store business, and in B2B commerce. Relatively speaking, SMB online is softer.

#4. Just 23% of Revenue From SaaS / Software, Down From 26%

This isn’t new, but always helpful to see this over time. Shopify is an ecommerce fintech that is powered by a SaaS solution.

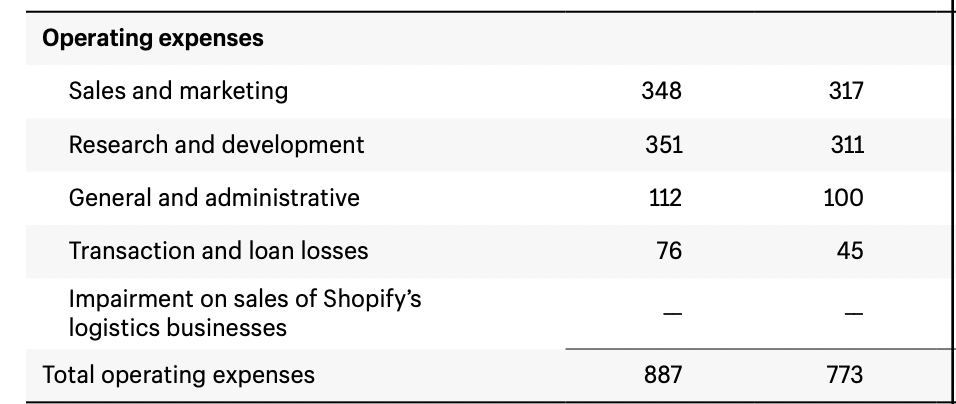

#5. Holding Almost All Expenses Just Above “Flat”

Even as it accelerates, Shopify is getting more profitable. How? It’s only growing sales & marketing 10%, engineering and product 12%, and G&A 12% even as it grows 31%. So Shopify is hiring and spending, but at a rate about a third of how fast revenue is growing.

And a few other interesting learnings:

#6. Effective NRR of Perhaps 105%-110%

Shopify doesn’t break down its NRR but it does present Revenue by Cohort which is a good proxy. As you can see, it’s well above 100%, even with its large SMB base.

#7. Stripe and PayPal Power 100% of Shopify Payments

It’s interesting Shopify has not chosen to bring this in-house even at their scale, even partially.

#8. Founder CEO Tobi Still Controls 40%-49% of All Shareholder Votes

Supermajority voting for founders (10:1 voting) hasn’t slowed Shopify down yet.

#9. 40% Gross Margins on Payments & Merchant Solutions, 81% on SaaS / Subscription Solutions

Not a surprise, but helpful to see it broken out for those with somewhat similar models.

Wow.