5 Interesting Learnings from Shopify at $8 Billion in ARR

"Interestingly, the SaaS side for now is growing faster than payments. It was the opposite in the past."

So Shopify at first was one of the biggest beneficiaries of lockdown, and like Zoom, rocketed from $1B to $4B in revenue in just about a year! Woah.

Then, well, the world reopened and growth slowed for a bit as ecommerce normalized. Fast forward to today though, ecommerce is back, gaining share every year, and Shopify is taking ever more of that share.

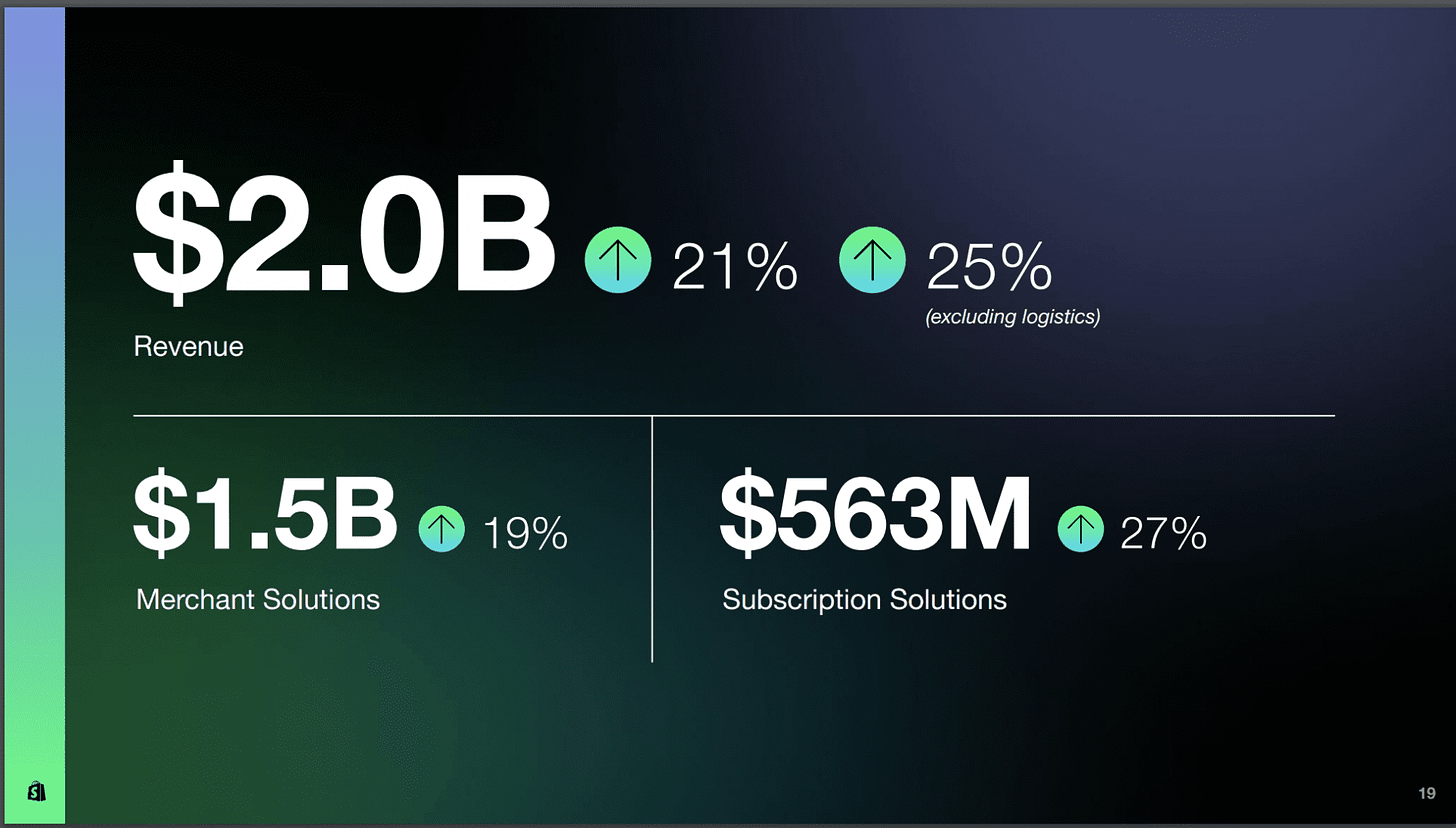

The result? Today it’s crossed a stunning $8 Billion in ARR (yes, a lot of this is payments, etc), growing a stunning 21% even at this scale (25% taking out the logistics business they are exiting), and more importantly — hold your beer — it’s predicting growth to accelerate going forward.

Good Times at Shopify, indeed.

5 Interesting Learnings:

#1. Expecting Revenue To “Grow at A Low-to-Mid-Twenties Percentage Rate on a Year-over-Year Basis”

Others are seeing some slowdown in ecommerce, but not category leader Shopify. Going a bit more upmarket and pushing into B2B have helped.

#2. Payments Still Majority of Revenue, But Subscriptions Actually Growing Faster

Shopify isn’t a pure SaaS company, and hasn’t been one in a very long time. In fact, “Subscription Solutions” are just $2.2B of that $8B. But the platform is the engine on which to monetize payments and other merchant services. Interestingly, the SaaS side for now is growing faster than payments. It was the opposite in the past.

#3. Enterprise Offering, “Shopify Plus”, Gaining Some Share — But SMBs Are Still Growing Just as Fast

This is an interesting thread in Shopify’s history and a challenge to folks that think going upmarket is always a 100% solution. Shopify has re-committed to bigger and enterprise customers and brands, and it’s working. And yet, the SMB segment of ecommerce is so big, and so strong, that Plus (i.e., enterprise) has still just grown one percentage point in overall revenue, from 30% to 31%.

#4. 51% Blended Gross Margins

Shopify’s SaaS has 82.8% gross margins, as one would expect from pure software at scale. Payments and Merchant Solutions are just 39.1%. That blends overall to 51.1%. Good for a mixed model, but not quite the 60%+ we expect from a “software” company. And indeed, Shopify arguably is more fintech than SaaS. But … but … the software is the engine. So while the business model may be a bit more fintech than SaaS, the product is more SaaS than fintech IMHO. Merchants don’t buy Shopify for payments per se, they buy it for a solution to manage their ecommerce site and platform.

#5. Stock-Based Compensation Has Come Way Down

Wall Street is demanding this as part of being truly profitable, and Shopify has responded, to under 2% of revenue.

And a few other interesting learnings:

#6. 16% Free Cash Flow Margins, Up From 6%

Shopify is becoming a cash generating engine. Albeit at a $8 Billion run rate!

#7. International Revenue Growing Even Faster, at +30%.

Just another reminder to go global as early as you can. This almost always pays off. Especially if you already have significant organic pull from customers outside North America.

Go Shopify, Go. It is the platform for e-commerce.

And a SaaStr deep dive into how Shopify uses AI here: