5 Interesting Learnings from ServiceTitan at $840,000,000 in ARR

"A reminder that while efficiency matters today, growth still matters much, much more."

ServiceTitan, the operating system for the trades, continues to scale impressively, with $772M in FY25 revenue, $800m+ ARR and a clear path to $1B ARR. It’s the vertical SaaS rocketship:

$840m ARR

Still growing a stunning 29% (!)

Just above non-GAAP break-even (3% non-GAAP margins)

110% NRR and 95% GRR

$10.5B market cap (12x ARR)

This is what a 12x ARR vertical B2B leader looks like today.

5 Interesting Learnings:

1. Net Dollar Retention >110% and GDR of >95%: The Power of Being a True Operating System

ServiceTitan’s NRR consistently exceeds 110%, even with SMB-heavy customers. That’s rare. The secret? They’ve built a true operating system for the trades—handling everything from CRM to payments to field service management. This breadth of functionality ensures customers are deeply embedded in the platform, making churn almost impossible.

Lesson for SaaS Founders: If you’re in vertical SaaS, aim to be the “OS” for your niche. The more workflows you own, the stickier your product becomes. But remember, this requires significant investment in product depth and breadth.

2. $60B+ in Payments Processed Annually: FinTech as a Revenue Driver

ServiceTitan processes over $60B in payments annually, and while software remains their primary revenue driver, payments are a critical growth vector. FinTech products like credit card processing, ACH, and consumer financing not only drive revenue but also deepen customer reliance on the platform.

ServiceTitan’s Pro products and FinTech offerings are driving significant incremental revenue, with high gross margins. These products, like “Fleet Pro” and “Dispatch Pro,” are not just add-ons—they’re strategically designed to deepen customer reliance on the platform while increasing ServiceTitan’s effective earn rate from 1% to 2% of GTV.

Lesson for SaaS Founders: If you’re in vertical SaaS, adding payments or FinTech capabilities can unlock massive revenue potential. Look at Toast, Shopify, and now ServiceTitan—they’re all proving that FinTech can be as big as SaaS itself.

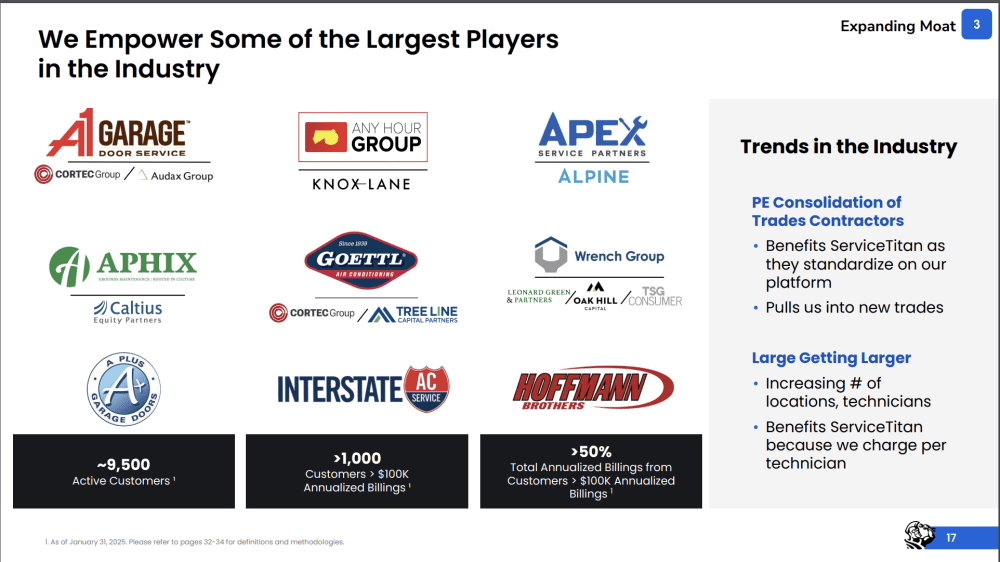

3. Moving Upmarket: $100K+ Customers Now Drive 50% of Revenue. And 1,000+ of Them.

While ServiceTitan started as an SMB-focused platform, they’ve steadily moved upmarket. Today, 50% of their revenue comes from customers with $100K+ in annual billings, and their $100K+ customer count has doubled in the past two years. This shift has been critical to scaling beyond $500M ARR.

This efficiency is driven by their tailored go-to-market engine, which includes high-velocity inbound marketing, strategic partnerships with private equity firms, and a dedicated sales team for upselling Pro products and FinTech solutions.

Lesson for SaaS Founders: SMBs are a great starting point, but scaling to $1B ARR often requires moving upmarket. Larger customers bring higher ACVs, better retention, and more predictable revenue. But this transition isn’t easy—it requires enterprise-grade features, dedicated sales teams, and a shift in go-to-market strategy.

4. CAC Payback of 21 Months: Efficient Growth Matters

ServiceTitan’s CAC payback period is 21 months, which is solid for a company of their scale. This efficiency is driven by a high-velocity inbound engine, strong community evangelism, and strategic partnerships with private equity firms consolidating trades businesses.

Lesson for SaaS Founders: Efficient growth is non-negotiable in today’s market. Focus on reducing CAC payback by optimizing your go-to-market engine, leveraging partnerships, and ensuring your product delivers immediate value. Remember, a long CAC payback period can kill your runway, especially in tougher funding environments.

5. Expanding TAM to $1.5T: The Importance of Market Expansion

ServiceTitan’s TAM is massive—$1.5T across all addressable trades and markets. But what’s more impressive is their ability to expand their SAM (serviceable market) by continuously adding new products and entering adjacent verticals. For example, they’ve added Pro products like Fleet Pro, Scheduling Pro, and Dispatch Pro, which increase their effective earn rate from 1% to 2% of GTV.

Lesson for SaaS Founders: TAM expansion isn’t just about entering new markets—it’s about increasing your share of wallet with existing customers. Adding complementary products or services can double your revenue potential without requiring new customer acquisition

And a few more interesting learnings:

6. Accelerating at Scale. This is So Impressive.

Subscription revenue has accelerated to 31%. This is rare approaching $1B in total ARR:

7. Rolling Our AI Products, But Still Early

ServiceTitan’s AI capabilities, like “Dispatch Pro” and “Marketing Pro,” are designed to automate tasks, drive insights, and increase customer ROI. But it’s early. AI is becoming table stakes in SaaS, so differentiation will depend on the tangible value these tools provide.

Dispatch Pro analyzes technician skills, sales performance, and proximity to jobs to optimize profitability.

Marketing Pro uses ad optimization to lower cost-per-lead and increase ROI.

Scheduling Pro leverages real-time customer data to demonstrate availability and improve efficiency.

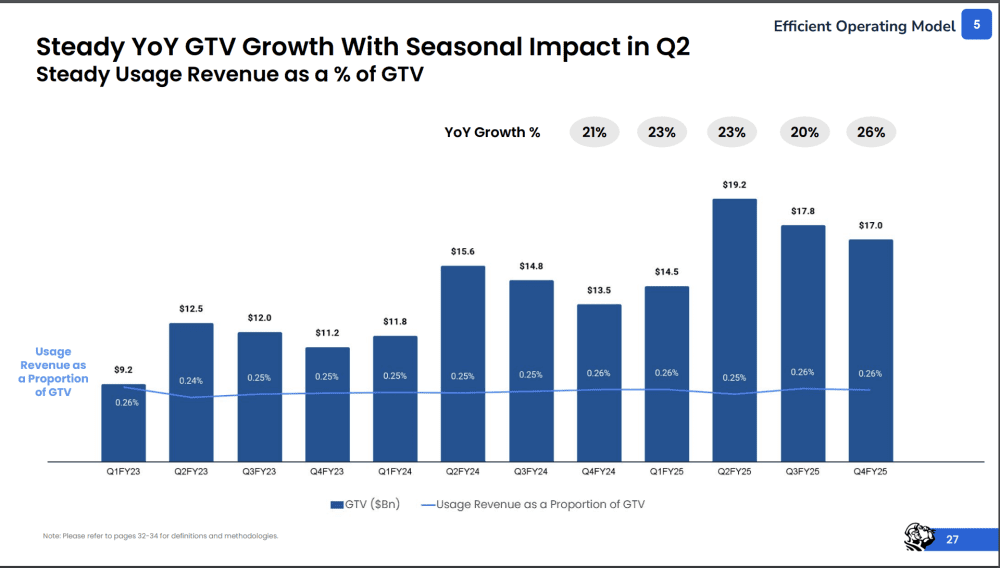

8. Real Seasonality in Business, With Q2 The Big Boost

Is seasonality real in SaaS and B2B? Yes, it can be. Just be careful not to use it as an excuse. But even as ServiceTitan looks to cross $1B in ARR, it’s still pretty seasonal, with its customer base.

#9. Profitable on a Non-GAAP Basis, But Not Wildly So

ServiceTitan’s growth is still epic coming up on $1B ARR, so it’s investing. It’s gotten to +3% non-GAAP margins, but it’s crazy profitable. Not yet. And a reminder that while efficiency matters today, growth still matters much, much more.