5 Interesting Learnings from Samsara at $1.26 Billion in ARR

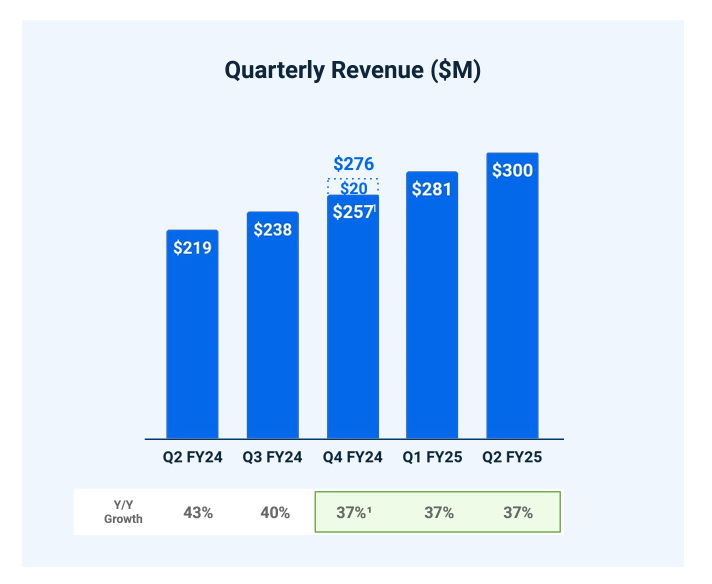

"Samsara has grown 37% for 3 straight quarters, period. No slowdown. No excuses."

So whose doing well in SaaS today — with almost no “macro” impacts? Folks that sell to the end economy in the U.S. Like Samsara. Powered by the overall strength of the U.S. economy, by shipping, by trucking, by industrial applications and more … there’s no downturn at Samsara. It hasn’t missed a beat:

It’s at $1.26B in ARR

Growing 36%

$24B Market cap, so almost 20x ARR (wow)

And cash-flow positive (4% FCF Margins)

That’s about as good as it gets.

5 Interesting Learnings:

#1. No Slowdown in Growth

Samsara has grown 37% for 3 straight quarters, period, and down just a bit from the 40%-43% from the prior quarters.

#2. $10k-$100k Customers Still 39% of Revenue, and < $10k Still 8%.

Samsara has steadily gone upmarket, but even as it has, almost half of its revenue is still from deals $10k-$100k and smaller. At $1.4B+ in ARR. A reminder that even as you go upmarket, not to leave the smaller ones behind.

#3. 67% of Lare Customers and 50% of Core Customers Use 2 or More Products

Another exampel of how going multi-product is critical at scale.

#4. 87% of New Bookings From Outside Their Original Vertical and ICP (Transportation)

This perhaps to me is most impressive of all. Samsara started off as a next-generation fleet tracking vendor, and still dominates there. But it had to expand its TAM to thrive at scale, and so it has. Today, 87% of its new bookings are outside its original vertical, transportation.

#5. Public Markets Demand Efficiency. But Strong Growth + Decent Efficiency is Fine.

Samsara like almost every SaaS and Cloud leader has gotten a lot more efficient. But it’s done so gently. Today, it’s cash-flow positive and has 6% non-GAAP operating margins. That’s “profitable” (outside of SBC) and efficient — but not nearly as efficient as some other leaders. But it’s growth is even faster than almost all of them at 36%. So the markets want you to be efficient, yes. But they’ll take top top tier growth + decent efficiency over good growth + even better efficiency. Roughly, both matter today, but growth is 2x as important. And Samsara shows that, trading at almost 20x ARR (!)