5 Interesting Learnings from Sailpoint at $820,000,000 in ARR

"One of the very founders who has gotten to IPO their company ... twice."

So IPOs are back in SaaS and Cloud. Look for many more in the coming 12-18 months. And a lot of what we talk about are the next generation — Databricks, Canva, Stripe, Wiz, etc. Amazing companies.

But there’s another huge batch of folks getting ready to IPO. Companies bought previously public and private bought out by Private Equity firms. Folks that used to be public and will likely be public again include Zendesk, Squarespace, Coupa, Anaplan, and many more. As soon as PE firms can hit their target gains — they likely take them public again.

A quieter example is Sailpoint in the identity and security space. It IPO’d in 2017 but then Thoma Bravo took it private in 2022.

And now it’s filed to IPO again at:

$813m in ARR

Growing 25%+ (financials are a bit complex)

114% NRR

Very profitable (Rule of “44”)

With the founder still CEO after 20 years!!

Let’s dig in a bit. 5 Interesting Learnings:

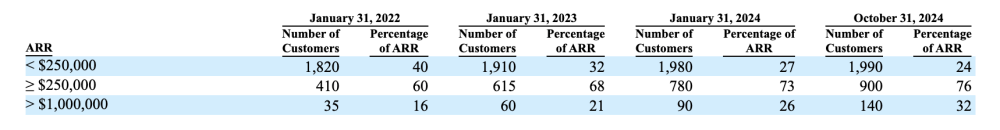

#1. $1m+ Customers Are The Focus

If you do them right, big deals can be more efficient than small ones. And they are for Sailpoint,. It has 140 $1m+ customers. And that’s the biggest growth vector.

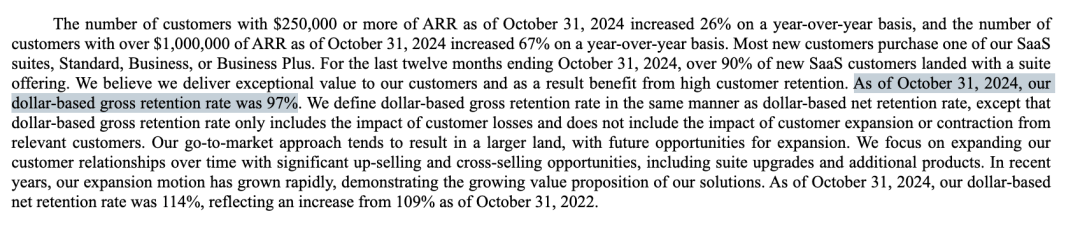

#2. NRR Only Going Up, From 108% in 2023 to 113% Today. And a Stunning 95% GRR.

Sailpoint may be in efficiency mode as part of Private Equity, but that hasn’t led to a drop in NRR. In fact, its gone up. And just as importantly, GRR is a stunning 97%. Folks just don’t leave Sailpoint. Note: contracts are typically 3 years in length. That helps 🙂

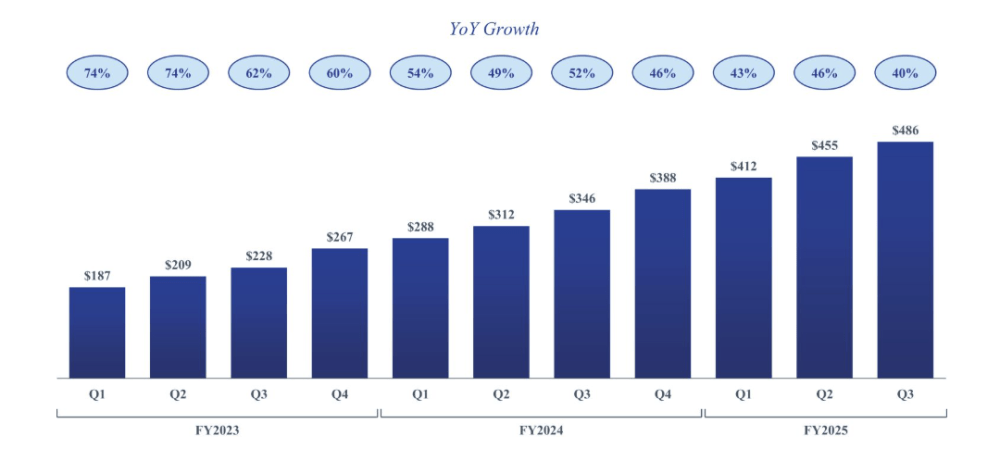

#3. SaaS Business Growing 40%

Sailpoint has transitioned to SaaS, and it’s now 60% of its total ARR, up from 40% 3 years ago. These transitions can be confusing, but in any event, overall revenue is growing 25%-30%, and the SaaS-ification is going well. The SaaS business is growing 40%.

#4. Founder Still CEO after 20 Years — Taking Company Public a Second Time!

Private Equity firms sometimes bring in new CEOs, but often they keep the existing founder CEO if they want to stay. When Vista bought Gainsight, for example, Nick Mehta is still running it. But I don’t know of two many where the founder CEO is still CEO at the second IPO.

This probably explains why NRR and retention is so high. I doubt an outside CEO would be able to keep an older player in the space current enough to keep so many customers after a PE buy-out.

Mark McLain founded the company in 2005, took it public in 2017, got bought out in 2022 for $6.9 Billion — and is getting to go public again in 2025! I’m kind of jealous 🙂

#5. Driving Deals Beyond $250k ACV is Key to Growth

$1m+ customers are the fastest growth, but as you can see below, 76% of revenue comes from $250k+ deals. Just 3 years ago, 40% of deals were below $250k. Going more and more upmarket has been keep to Sailpoint’s impressive growth — and something going private enabled it to invest more in.

A great story of a founder going long — and a PE firm potentially exiting a great investment in just 3 years. Good for SaaS if this one goes well.

Go Mark and Team!