5 Interesting Learnings from Procore at $1.2 Billion in ARR

"It can take Procore 3-7 years to build up to $1m ARR deal."

So Procore is the Vertical SaaS leader you need to follow if you’re in any type of Vertical SaaS. It took a while to take off, but then as mobile took off and more, it accelerated and grew to become the #1 player in construction SaaS.

Today they are at:

$1.2 Billion in ARR

Growing 19%

12% Free Cash Flow margins

And worth $11.6 Billion — an impresive 10x ARR

Procore is what a 10x ARR Vertical SaaS leader looks like.

5 Interesting Learnings:

#1. All Growth Today in $100k+ Customers

Procore serves stakeholders of all sizes — but the net new revenue growth is in $100k+ customers. They are growing 18% overall, versus a general flat customer count of ~17,000.

#2. 84% of Revenue From U.S.

Going global can take longer and can be harder in vertical SaaS.

#3. Patient Approach to Land-and-Expand

The average Procore customer buys 3-4 products and the average enterprise customer 5-6. But it doesn’t happen overnight. It can take 3-4 years to fully sell customers on the entire Procore suite, and it took 7 years for one of its biggest customers to hit $4.5m in ARR.

#4. Moving From Global GTM Operations to Region-Specific Ones

Interesting this was called out, that generalist AEs and a matrix org led to too much of a U.S.-focus

#5. Up to 9 Buyer Personas Per Deal

This is one of many reasons I see B2B sales execs and marketers that are used to selling to a few specific personas struggle in vertical SaaS. It’s not just a lot of stakeholders. It’s a lot of different personas and users who need and want different things from the vendor.

And a few other interesting notes:

#6. Continuing to Drive Up Efficiency and Non-GAAP Profits

Procore has gotten a lot more efficient since 2022 — as has almost even public SaaS leader — and is aiming for even more efficiency and 13% non-GAAP operating margins this year.

#7. World-Class GRR of 94%-95%

Get Vertical SaaS right, build the whole suite that your industry needs — and folks stay.

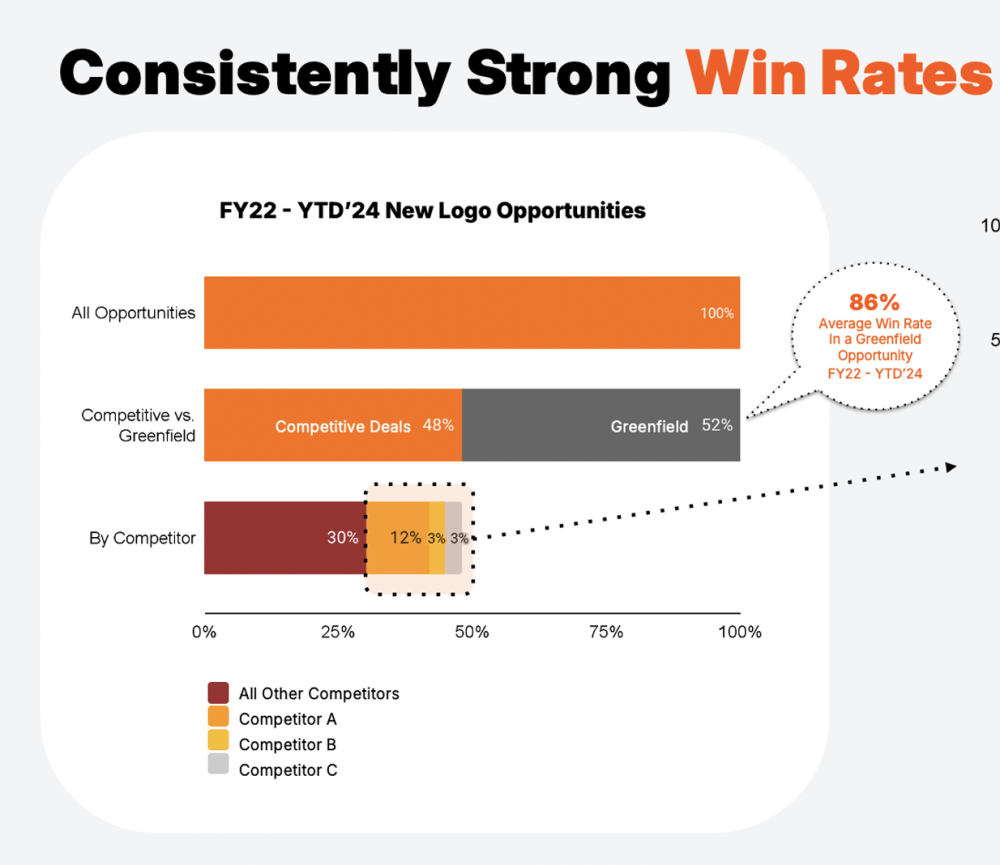

#8. 63% Win Rate Vs. Top 3 Competitiors Combined, 86% on Greenfield Opportunities

The best in Vertical SaaS aim not just for 10%, 20%,30% market share. They aim to own it all, or as close to is possible. For 80%+ market share.