5 Interesting Learnings from Palantir at $3.5 Billion in ARR

"So there's the 10x ARR club. And then ... there's Palantir."

So there's the 10x ARR club ... hard enough today in B2B and SaaS for public companies. And then there is Palantir. By far the most highly valued B2B software company. 78x ARR as we write this!

Why? It's just a powerhouse right now:

$3.5 Billion ARR

Growing a stunning 39% (!) ... and accelerating (!)

Fueled by AI demand, it closed 139 $1B+ deals last quarter ...

And 31 $10M+ deals ... in just 1 quarter

And ... it's raining cash. 24% GAAP profit margins!

Fire.

5 Interesting Learnings:

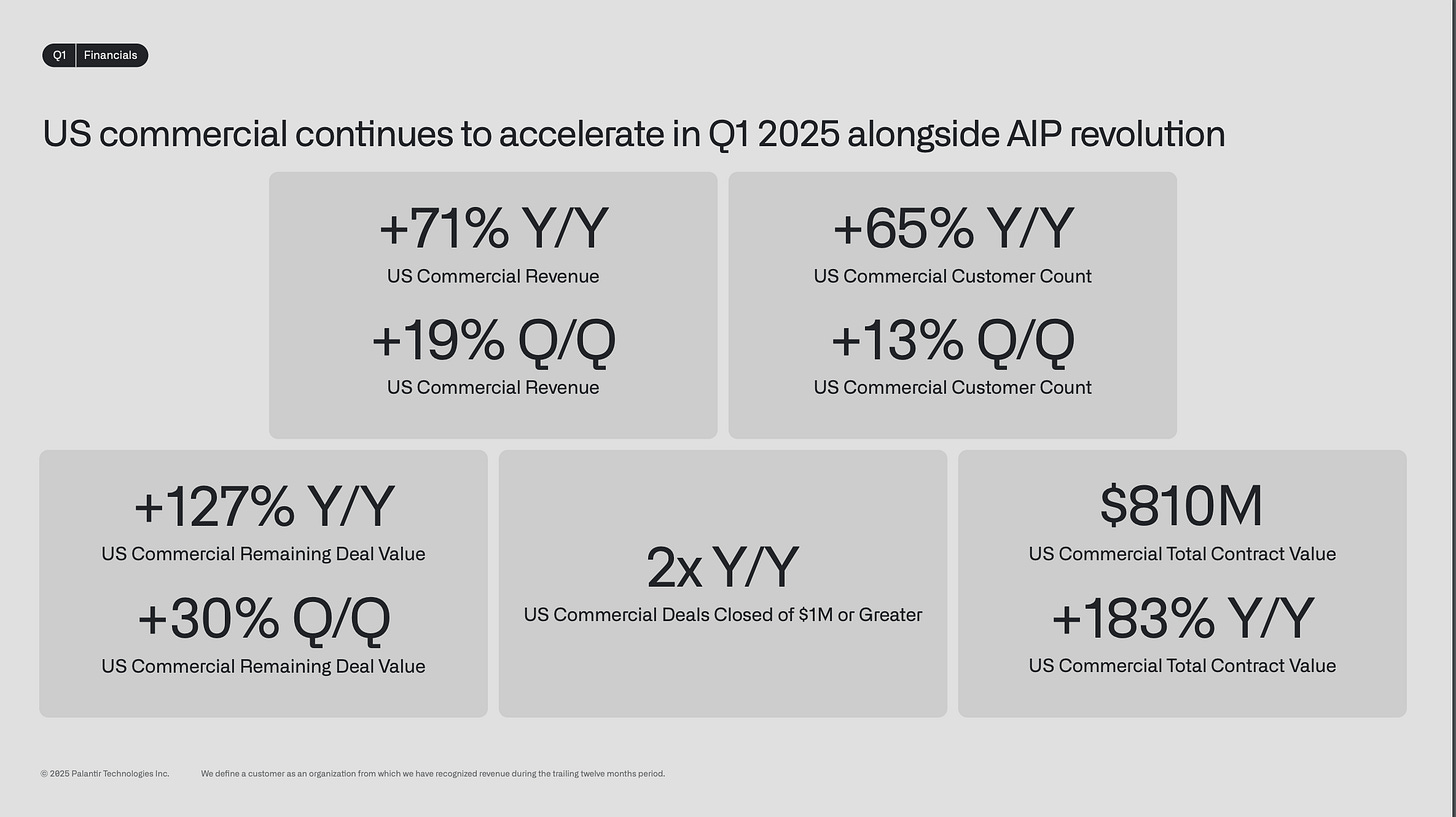

1. US Commercial Business is Exploding

Palantir's US commercial business is firing on all cylinders with remarkable growth metrics:

US commercial revenue grew +71% Y/Y and +19% Q/Q to $255 million

US commercial customer count increased +65% Y/Y and +13% Q/Q to 432 customers

US commercial remaining deal value ("RDV") grew +127% Y/Y and +30% Q/Q to $2.3 billion

Highest ever quarter of US commercial total contract value ("TCV") at $810 million, up +183% Y/Y

Palantir has dramatically evolved beyond its government roots. Their artificial intelligence platform (AIP) is driving significant commercial demand, with companies like Wendy's and Heineken showcasing dramatic efficiency improvements at their AIPCon event

2. The Rule of 40 Score Has Nearly Doubled in Two Years

Palantir has achieved an jaw dropping Rule of 40 score of 83%, up from 38% in Q2 2023. For context, the Rule of 40 is a benchmark for SaaS companies that adds revenue growth rate and profit margin, with 40% considered healthy.

With 39% revenue growth and 44% adjusted operating margin, Palantir is doubling the benchmark threshold. They've found both epic growth and epic profitability.

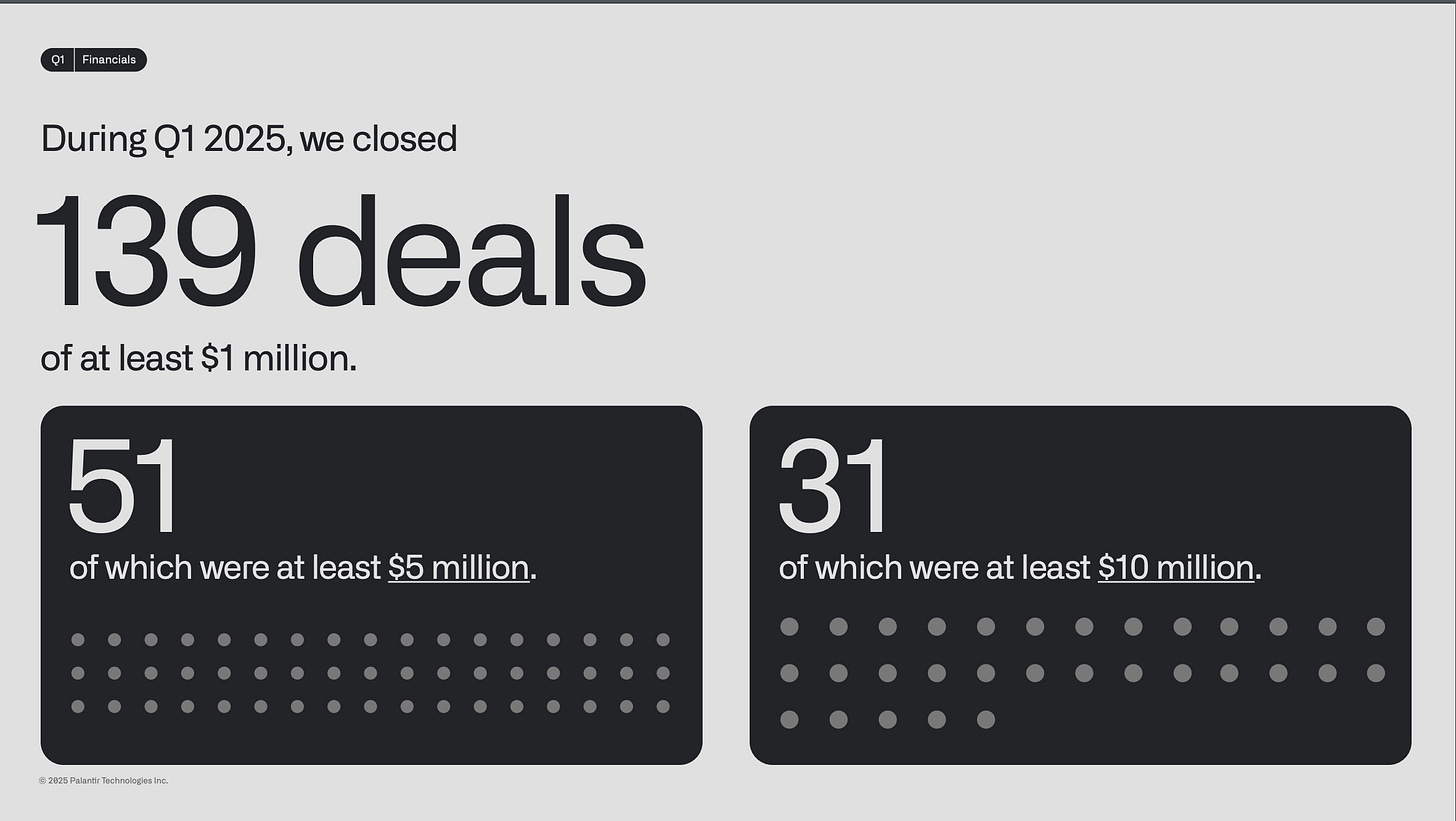

3. Enterprise Deal Velocity is Accelerating

The company closed:

139 deals of at least $1 million

51 deals of at least $5 million

31 deals of at least $10 million

With US commercial TCV growing 183% year-over-year, enterprise customers are making larger and larger commitments to the Palantir platform. Major enterprise wins including R1 RCM, Citigroup's Wealth division, and AIG, who expects Palantir's AI-powered underwriting solution to double its 5-year revenue CAGR from 10% to 20%.

4. Adjusted Free Cash Flow Margins Have Nearly Doubled

Palantir reported adjusted free cash flow of $370 million in Q1 2025, representing a 42% margin. This is an impressive jump from $149 million and 23% margin in Q1 2024. The company now sits on $5.4 billion in cash and equivalents with no debt.

The financial foundation is getting stronger while they maintain aggressive growth.

5. Multiple Growth Engines Beyond Just AI

While AI is a significant driver, Palantir has multiple growth vectors:

Government business continues to thrive with 45% Y/Y growth to $373 million

The TITAN program was ranked as a top-performing program by US Army leaders

Their Maven Smart System is being deployed to NATO warfighters

Warp Speed is "powering the re-industrialization of America" with manufacturing customers

Net dollar retention rate is strong at 124%, showing growing usage from existing customers

They've also launched a "Palantir Degree" program that recruits graduating high school students directly into internships with paths to full-time roles, bypassing traditional college education.

And a few more Interesting Learnings:

6. Manufacturing and Supply Chain Optimization is a Major Growth Driver

Palantir is making significant inroads into manufacturing and supply chain optimization, helping companies navigate on-shore manufacturing capabilities. Their "Warp Speed" product is being deployed by clients like Anduril, Epirus, L3Harris, and Panasonic Energy to accelerate manufacturing capabilities, optimize maintenance, and enable advanced fleet management. This vertical focus aligns with broader trends in re-industrialization and supply chain resilience.

7. Net Dollar Retention Hit 124% - Signs of Long Team Durable Growth

Palantir's net dollar retention rate of 124% in Q1 2025 indicates that existing customers are significantly expanding their usage year-over-year.

8. Revenue Per Customer is Growing Substantially

While Palantir doesn't explicitly provide this metric, we can calculate that their commercial revenue per customer has increased substantially. With 622 commercial customers generating $397 million in revenue in Q1 2025, the average revenue per commercial customer is approximately $638,000 per quarter. This continuous increase in revenue concentration indicates Palantir is successfully landing and expanding within enterprise accounts.

9. Innovative Deployment of Eval-Driven Automation in AIP

At DevCon 2, Palantir unveiled eval-driven automation in AIP, where users can leverage evaluation feedback loops within their Ontology to improve logic functions for more intelligent automated communication. This technical approach demonstrates how Palantir is pushing innovation in enterprise-focused AI automation, which could further differentiate their platform in the competitive AI landscape.

10. Epic Acceleration At Scale

While many today are decelerating from 2021 growth rates, Palantir is ... re-accelerating.

Wow.

Palantir has transformed from a government-focused data company to a commercial AI powerhouse with extremely strong financials. Their Q1 2025 results demonstrate successful expansion across commercial sectors while maintaining their government strength.

For 2025, they're projecting:

Revenue between $3.890 billion and $3.902 billion

US commercial revenue exceeding $1.178 billion (68%+ growth)

Adjusted free cash flow between $1.6 billion and $1.8 billion

If they continue executing at this level, particularly in commercial markets, Palantir will be one of the defining AI companies of this era.

It's already #1 in B2B and SaaS today.

Fire.