5 Interesting Learnings from Monday.com at $400,000,000 in ARR

at $400,000,000 in ARR … Monday is growing a stunning 91% (!)

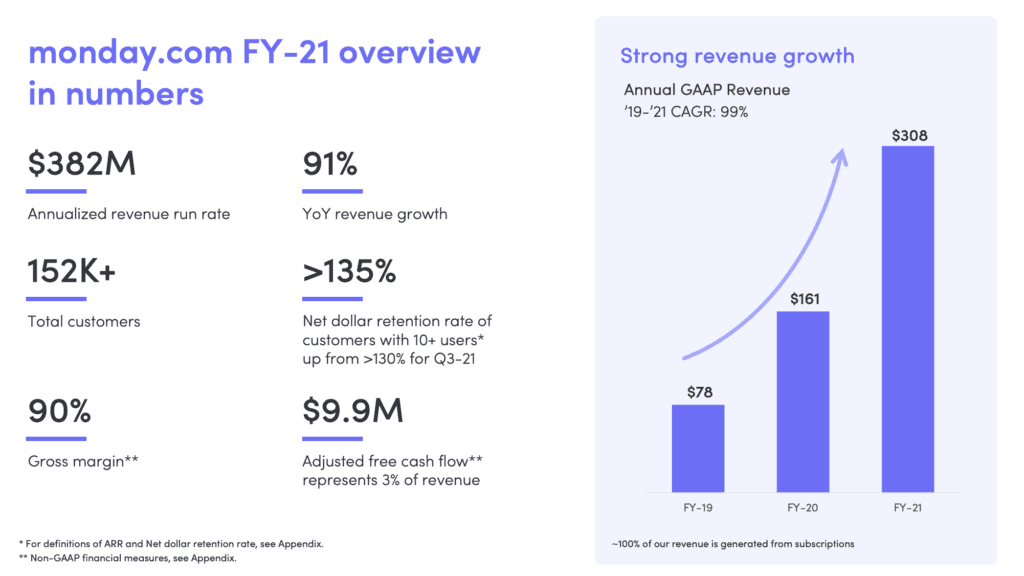

We last looked in on Monday.com at $240m ARR, but it’s grown so incredibly quickly, and so effectively, it’s worth checking in again at $400,000,000 in ARR.

Because at $400,000,000 in ARR … Monday is growing a stunning 91% (!) year-over-year. Goodness gracious!

5 Interesting Learnings:

#1. Revenue up 91%, Customer Count Up “Just” 34%. The math of going upmarket. I personally get a little worried when this ratio falls below 2:1, if only because sometimes upsell can mask lower growth in new accounts. The real story with Monday is going upmarket. $50k+ customers are up 200%, to 793 from 264 a year ago. That’s a key driver to Monday’s hyper-growth as it approaches $500,000,000 in ARR.

#2. 10+ Users the Sweet Spot now. As part of going upmarket, Monday’s 10+ seat customers are now 72% of total revenue, up from 63% just a year ago. Asana has seen similar dynamics, but Monday seems to be going upmarket even faster than Asana.

#3. New products keep coming. Monday keeps expanding its “surface area”, now adding Canvas and Workforms and Workdocs, products that compete with Miro and Typeform and Notion among others. Are these apps as rich today as some of their competitors? Perhaps not. But including them with Monday makes Monday even more valuable.

#4. NRR Keeps Going Up, Up and Up. From 105% in 2020 to 120% Today. Much of this is due to Monday going a smidge upmarket and adding more products, but it still shows there is no ceiling to NRR — even with mid-sized and smaller customers.

#5. Flipping into Cash-Flow Positive at $400m in ARR. SaaS companies go cash-flow positive and then profitable at different stages. Monday’s invested in its torrid growth, but as it approaches $500m in ARR, cash flow is now coming in. From -24% free cash flow to $11% today, Monday likely will be quite profitable as it approaches $1B in ARR.

And a few other interesting learnings:

#6. Almost $400,000 in revenue per employee. This is pretty darn efficient, and Monday leverages its self-service roots to scale pretty efficiently.

#7. Monday’s customer base remains 70% non-tech. The co-founders do a deep dive on why below in the SaaStr video. Contrast that with Asana, Atlassian, etc. who are nominal competitors (among others) but whose core ICP is Tech.

#8. Up to 2 seats are Free. Monday started off as self-serve but was “late” to Free and freemium. But it’s kept to it even as it grows faster than ever.

#9. A bit slow to add a marketplace, but now 109 apps on it. Monday waited until 2020 to add a marketplace, perhaps a little late given its torrid growth. But no matter! It’s working now, with over 100 apps already on the marketplace.

And a great deep dive from the co-founders here on the top lessons they learned from scaling Monday!!