5 Interesting Learnings from Microsoft at $260 Billion in ARR

"LinkedIn ultimately is at the heart of B2B spend, in both advertising and recruiting. And what are we seeing? Acceleration."

So Microsoft is hardly a newly minted public company, the frequest focus of our 5 Interesting Learning series. But it’s become so central to Cloud the past years, and both LinkedIn and GitHub (which Microsoft acquired) are at the pulse and heart of B2B and B2D, respectively. So it’s a great and important one for us all to learn from.

And at $260 Billion in ARR, what’s the #1 learning? Just about everything in Cloud, SaaS and AI is firing on all cylinders at Microsoft:

Azure and Cloud up +30% (!)

Overall Cloud up +22% (!)

Dynamics (its CRM and more) up +19% (!), even as Salesforce has seen growth slow to single digits

LinkedIn up +10%, and accelerating (!)

Office up +12% and seats up +7% (!)

GitHub has doubled in past 24 months to $2B ARR (!)

That’s breathtaking at Microsoft’s scale.

5 Interesting Learnings:

#1. LinkedIn Growth Accelerating — And No Downturn

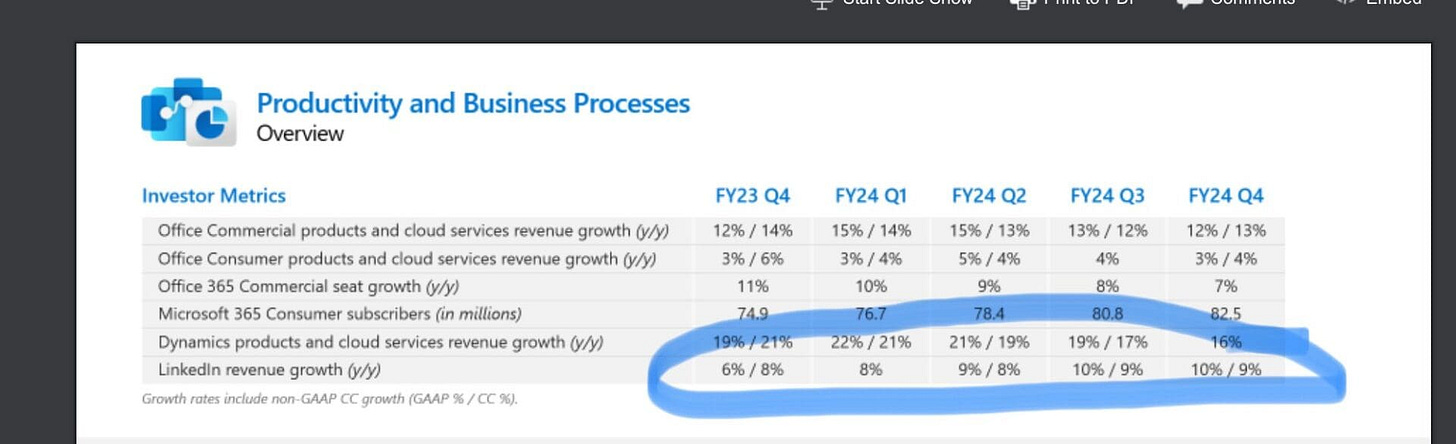

This might be the #1 learning for many of us in B2B, as LinkedIn ultimately is at the heart of B2B spend, in both advertising and recruiting. And what are we seeing? Acceleration. 5 quarters ago, LinkedIn was growing 6%. A year ago? 8%. And today? 10%. (Yes, the constant currency math confuses it a bit, but the acceleration is there).

#2. 60,000 AI-on-Azure Customers, and Accelerating — Up a Stunning 60% Year-over-Year

We all sort of knew this, but helpful to see the numbers here.

#3. GitHub ARR Over $2 Billion, Doubled in Past 24 Months

AI Co-Pilot is a big part of it, fueling 40% of growth, but so is the simple growth of SaaS and Cloud overall. GitLab has seen similar growth, and few to no “macro” effects. Interestingly, it also shows GitHub is about 3x the size of GitLab ($2B ARR vs. 700m ARR) and growing just as quickly.

#4. Paid Office Seats Are Up +7%, Paid Security Seats Up +10%

Many SaaS leaders in more impacted segments are citing seat contraction as one of the top reasons for slowing growth. But not Microsoft. Office 365 seats continue to grow, up +7% this year.

#5. Consumption Revenue and Usage Growing Even Faster Than Seat Growth

Many today are seeing consumption-based models suffer as customers cut back. MongoDB has been hit hard here for example, as customers moderate workflow spend. But not Microsoft. Their consumption growth is even faster than seats.

Not everything is perfect at Microsoft. Gaming growth has slowed, and its big purchase of Activision has seen very slow growth.

But the Cloud and AI side of Microsoft? It’s about as good as it gets, or has ever been at Microsoft.

Let that inspire you.