5 Interesting Learnings from Instructure at $620,000,000 in ARR

The SaaS company your kids probably know more about than you do

So there’s a vertical SaaS company at over $600m ARR that is extremely well known to its customers that you’ve probably never heard of — Instructure.

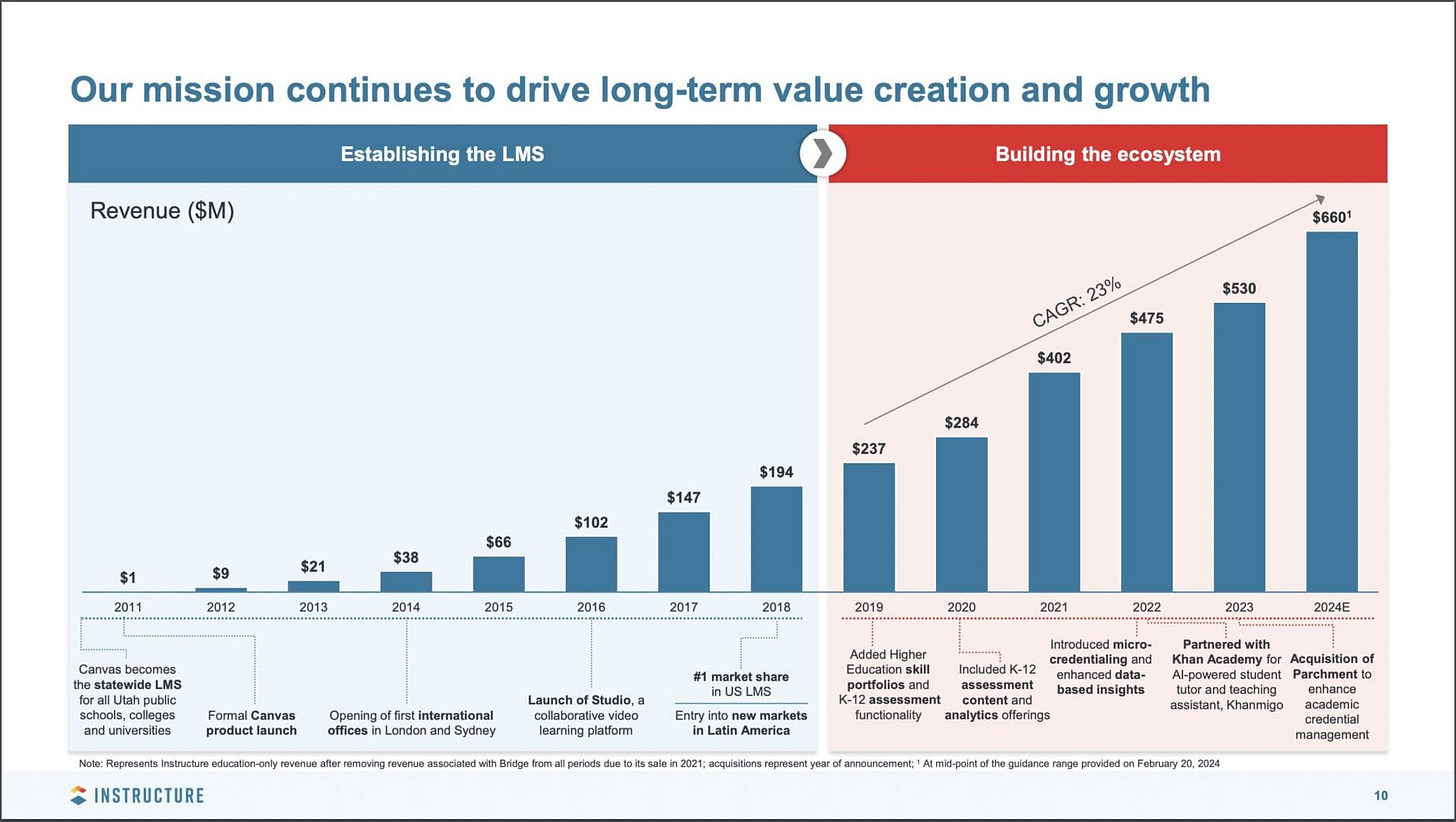

Instructure is one of the leading learning management systems for education with its Canvas product. Your kids may well use it. You may have in college, too. It was founded in 2008 but took a while to get going, hitting $1m in revenue in 2011 selling to Utah schools — and then scaled from there. It rocketed to $100m in ARR just 5 years later in 2016. And then hit $600m ARR in 2024. That’s the power of compounding revenue in SaaS!

One reason you may not have heard of them is after IPO’ing, they went private, then public again in a spin out, and now … are looking to go private once more. One reason is to deal with the massive amount of debt they took on.

The overall metrics are a mix of Good and A Bit Tougher:

$620m ARR

Growing 20.7% (but a big part is from a big acquisition — core business only growing 6.8%)

with a $3.5 Billion market cap

But, Instructure has

A lot, lot of debt to service. It took on $1.7 Billion in debt to go private and more. That’s a lot of debt to pay back and service. So it’s burning -$61m a quarter.

Projecting much slower growth ahead

5 Interesting Learnings:

#1. Core Canvas Product Has Hit 38% Market Share in North America

The good and bad in winning a market. By its calculations, Canvas / Instructure now has 38% market share in North America, way up from an already impressive 14% in 2015. That’s impressive, but also at the point where it gets much harder to grow share.

#2. 103% NRR, 93% GRR

Canvas is a sticky product.

#3. 11 Products and Modules, 80% of Customers Use 2 or More Products

A good reminder of the key to being multi-product at scale.

#4. Guiding to 9%-11% Growth Going Forward

Like so many in SaaS today, they’re guiding for lower growth going forward, down to 9%-11% overall, and as low as 5% for their original core product and core North American buyers.

#5. Even with Slowing Growth, Will Hit $1B ARR by 2028

The power of recurring revenue and NRR > 100%. Even with slowing growth, growth still … happens. Instructure can clearly predict $1B or more of ARR by 2028. With a goal of 40%+ adjusted EBIDTA margins.

And a few other interesting learnings:

#6. Paying Back $1.7 Billion in Debt is Eating Up Its Cash Flow. The Interest Rates Are Over 8%.

Instructure is generating significant cash now — before it services its debt. But interest rates have skyrocketed, and the interest on that debt is now 8.35%-8.68%. That’s about $100m a year in debt service for now. The. big balloon payment to pay it all off comes in 2028. And for now at least, the company has just $89m in cash and cash equivalents in the bank.

#7. 80% of Revenue Still in United States

Education is a localized, market-specific product. Instructure has worked hard to go global, with offices and teams across the globe. But it’s never as simple to “go global” with a market-specific product as it is with a HubSpot or Monday.

Instructure had a phase of incredible growth through its IPO, and it was stunning how quickly it went from $1m to $100m ARR in just 5 years!

#8. After Sales Reorg, Pushing CS Team to Deliver More Leads

This seems to be the common theme of the day, CS becoming part of sales, and less supercharged support. For better or worse.

#9. A Big Acquisition (Parchment) is Fueling Growth

Instructure buying adjacent vendor Parchment at $100m ARR accounts for a big chunk of their growth this year. Well timed as their organic growth has now slowed to 6.8%

#10. Driving Toward 40%+ Non-GAAP Operating Margins

Instructures financials are a bit confusing, but they are running at their core an efficient, mature business with relatively light investment in R&D. The company is aiming for a stunning $260m+ of adjusted unlevered free cash flow this year. That should be more than enough to service their debt, if not to make the balloon payment in 2028.

Instructure rocketed from $1m ARR to $100m ARR in just 5 years! That’s about as good as it gets! And then on to an IPO.

Today? Today it’s mature and spending its earnings servicing debt. A very different time and phase, indeed.