5 Interesting Learnings from GitLab at ~$700,000,000 in ARR

"Put simply, GitLab isn’t seeing any slowdown in forward bookings."

So one Cloud and SaaS leader that has held up well in today’s environment is GitLab. They’re at almost $700m in ARR, growing 33%, with 129% NRR, and 22% free-cash margin.

That’s the full package right there. Overall, everyone is still building a lot of software, some AI-native, some not, but almost all of it in theory benefitting GitLab.

And what’s it worth? Just over $8 Billion. Just about 12x ARR. Not too shabby!

5 Interesting Learnings:

#1. NRR Staying Consistently High at ~130%

To me this is the most impressive metric at all. While many “B2B2B” leaders like Salesforce, Asana, ZoomInfo and more have seen huge contractions in NRR, GitLab hasn’t. It’s NRR is the same today at $700m as it was at $400m ARR, when the markets overall were far stronger.

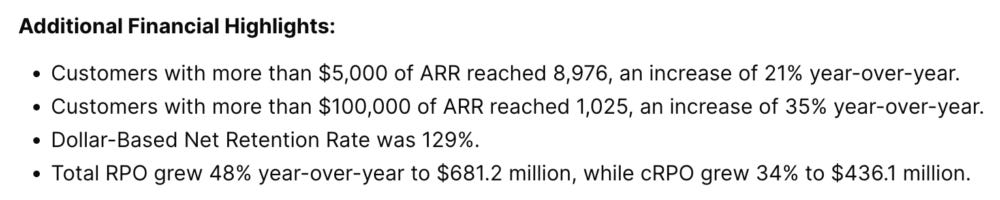

#2. Still Growing New Customers > 20% a Year, and $100k+ Customers Up 35%

This is the other key to growth at scale. Too many SaaS and Cloud leaders just aren’t growing their customer count enough anymore, or in some cases, at all on a net basis. But GitLab is still growing its customer count 20%+ even at $700m ARR. That, combined with 130% NRR, almost guarantees years of strong growth to come.

#3. Doubled $100k+ Customers Over Past 24 Months, To Over 1000

A similar story to other Cloud and SaaS leaders. Overall customer count is strong, but their $100k+ customers have grown even faster, doubling over the past 24 months.

#4. Generating Significant Free Cash Flow Now (+22%)

GitLab like almost every other SaaS and Cloud leader has gotten a lot more efficient the past 24 months. Growth remains strong (if not as strong as 2 years ago), but efficiency is way, way up. Free cash flow was up to 22% last quarter.

#5. RPO grew 48% year-over-year to $681.2 million, while “current” RPO grew 34% to $436.1 million

Put simply, GitLab isn’t seeing any slowdown in forward bookings. Current bookings are still up 34% — just as fast as current revenue growth of 33%. So GitLab’s bookings aren’t showing any slowdown. GitLab also noted “There weren’t any major macro changes from Q4 to Q1. Sales cycles and discounting were consistent.”

And a few other interesting learnings:

#6. “Single Tenant” SaaS Important for Some Big Accounts

Compliance is key in GitLab’s space and so they offer a dedicated single-tenant solution, GitLab Dedicated.

#7. 50% of NRR Growth Still Driven by Seat Expansion

While again many in “B2B2B” like Salesforce, Asana and ZoomInfo are still seeing customers scrutizine spend and reducing seat count — GitLab isn’t. It’s NRR remains at almost 130% and half of that still coming from seat expansion. Long live the per-seat model! When it works, at least.

There’s really nothing not to love with GitLab. ARR growth, NRR, new customer growth, free cash flow, it’s all there.