5 Interesting Learnings from Freshworks at $560,000,000 in ARR

"$50k+ Customers are the Fastest Growing Segment, are growing 30% and are 45% of Total Revenue."

So Freshworks is another in our line of “hero companies” in SaaS. While Freshworks is very much a global SaaS leader, its history as perhaps the first with deep roots in India to IPO in the U.S. makes it one we all root for as a break-out global leader.

It’s now at $560m in ARR, growing 23% on a constant-currency basis, and while that growth has slowed from the go-go pace of the last 2 years, it still beat Wall Street’s estimates for both revenue and adjusted profit!

Freshworks is doing a lot of things right in a challenging time for many “traditional” B2B segments like CRM, Support, etc. — so a great one to learn from!

5 Interesting Learnings:

#1. NRR Still Impressive at 107% Given Many SMB Customers, Although Down Year-over-Year from 115%. For those of us who sell to B2B customers small, medium, and larger, it can be super helpful to see what’s happening with a leader like Freshworks. Their NRR remains relatively strong, but has taken an 8% hit. Probably a fair way to model things in 2023 if you are similar to Freshworks. The biggest driver of NRR expansion is agent additions, and with many customers freezing hiring or shrinking, they predict 105% NRR later in the year.

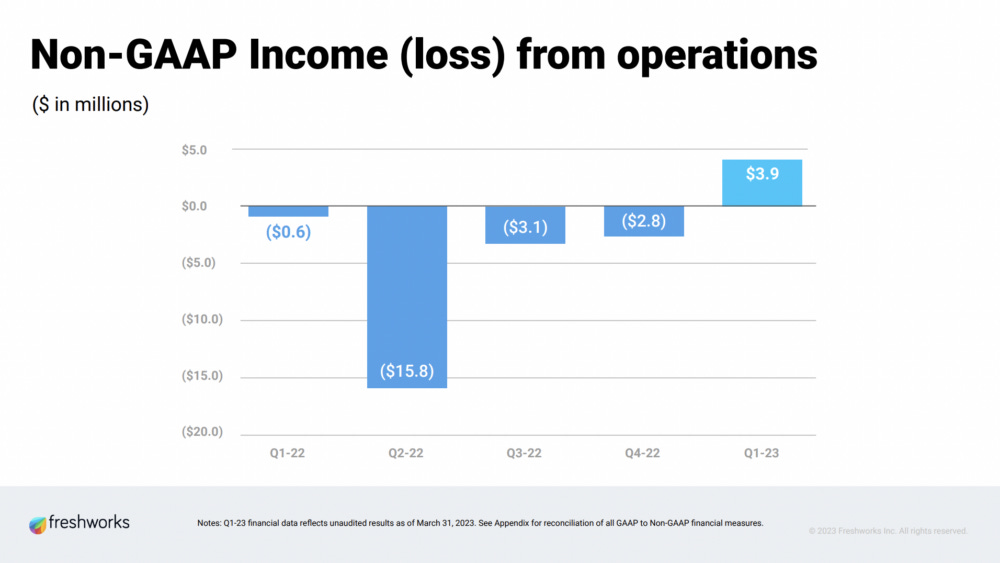

#2. First quarter of non-GAAP operating profit. Freshworks turned “profitable” at least on a non-GAAP basis and hit cash-flow positive in 2022. Yes, this excludes stock-based comp expenses and more, but is still an important milestone. Its burn was modest before, but crossing to both cash-flow positive and non-GAAP operating margin positive is an important step. And a reminder it can take a while in SaaS! And it’s another example of how almost everyone has gotten more capital efficient the past 12 months.

#3. North America continues to be the strongest geography, albeit only by a small margin. EMEA is the weakest, and we’ve seen this for other SaaS leaders as well. While it’s hard in the U.S., it’s harder for many in B2B in Europe.

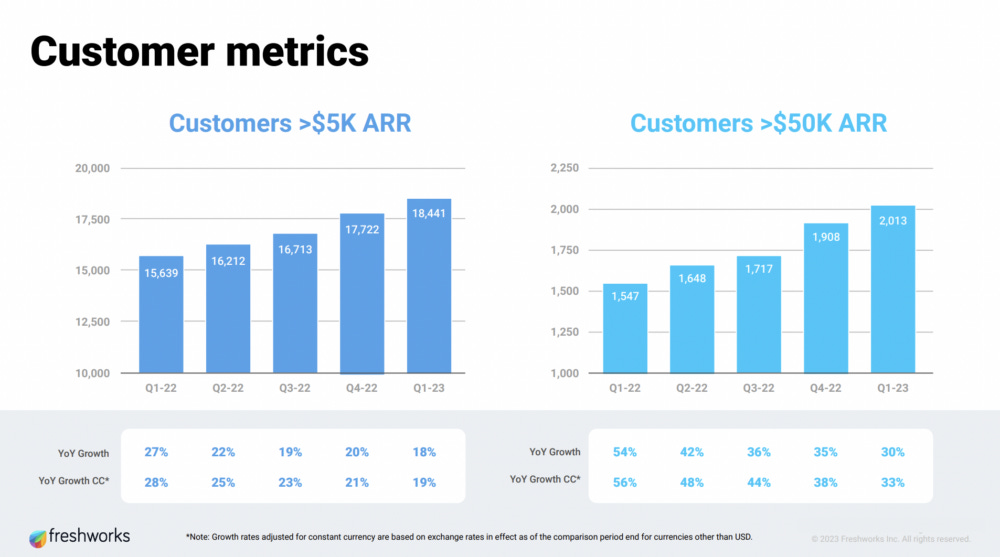

#4. 20% Revenue Growth from 11% Customer Count Growth. I always find it helpful to see this math and ratio. A 2:1 ratio is a pretty healthy ratio as you go upmarket. Much more than 2:1 means you are often relying too much on your existing base.

#5. $50k+ Customers are the Fastest Growing Segment, are growing 30% and are 45% of Total Revenue. Another case like Asana and other B2B leaders of slowly going upmarket. $50k+ customers are their fastest-growing segment, at 33% on a constant currency basis. With $5k+ customers growing 19%, that means like Squarespace, Zoom and other leaders, they are seeing the slowest growth in the tiniest customers.

And a few other interesting learnings:

#6. 70%+ of Customers (Not Revenue, but Customers) Still Under $5k ACV. While Freshworks’ smallest customers are the smallest segment of revenue, and the slowest growing today — they still make up the majority of customers by count. Only 18,441 of their 64,900 customers are over $5k. As you scale, the long tail often is less and less of your revenue. But it’s also an incredible, often low cost source of customers to both grow over time and spread the word.

#7. Headcount Flat Quarter-over-Quarter. This is how you get more efficient — grow revenue materially but keep headcount flat. They also feel for now, they have enough sales capacity to hit plan. Ultimately though, you do have to add capacity in sales. Having a majority of headcount in India also contributes to efficiency,

#8. Customers with <= 500 employees are handled inbound out of India, those over 500 are handled by field teams. Interesting to see how Freshworks divides this up. And they’ve now split sales into hunting and farming, with teams 100% focused on upsell.

#9. Raised prices about 4% in January for new and renewal customers, didn’t see much pushback. Not a huge price increase compared to some, but a material one.

Wow, Freshworks. What a great story! And one almost all of us can learn from.