5 Interesting Learnings from Elastic at $1.25 Billion in ARR

"At $1.25B in ARR, it has 3,000 employees, that's $420,000 per employee. That’s a lot more efficient."

So Elastic is the somewhat under-the-radar SaaS and Cloud leader that still almost everyone uses, at least for search. Go ask your developer 😉

It’s somewhat quietly crossed $1.2 Billion in ARR now, but like many, its growth has slowed substantially in the past year, to just 17%. That’s down from 44% growth at $700m in ARR. But it’s also gotten much more efficient. Again, like many.

Still, Wall Street seems to like its slower but efficient growth. It sent the stock price up 112% over the past 12 months!

In some ways, Elastic may be under some of the most theoretical threats of all from ChatGPT and the like. After all, ChatGPT is the first threat in search in many ways. But it seems to be doing just fine, and in fact has embraced AI.

5 Interesting Learnings:

#1. NRR Remains Solid at 110%, But Down From 130% in 2021

NRR remains healthy, but down materially from the Go Go Days of 2021, when at $700m ARR, Elastic had 130% NRR. It also is down a bit from 113% in the prior quarter.

#2. Radically More Efficient Than Just a Year Ago

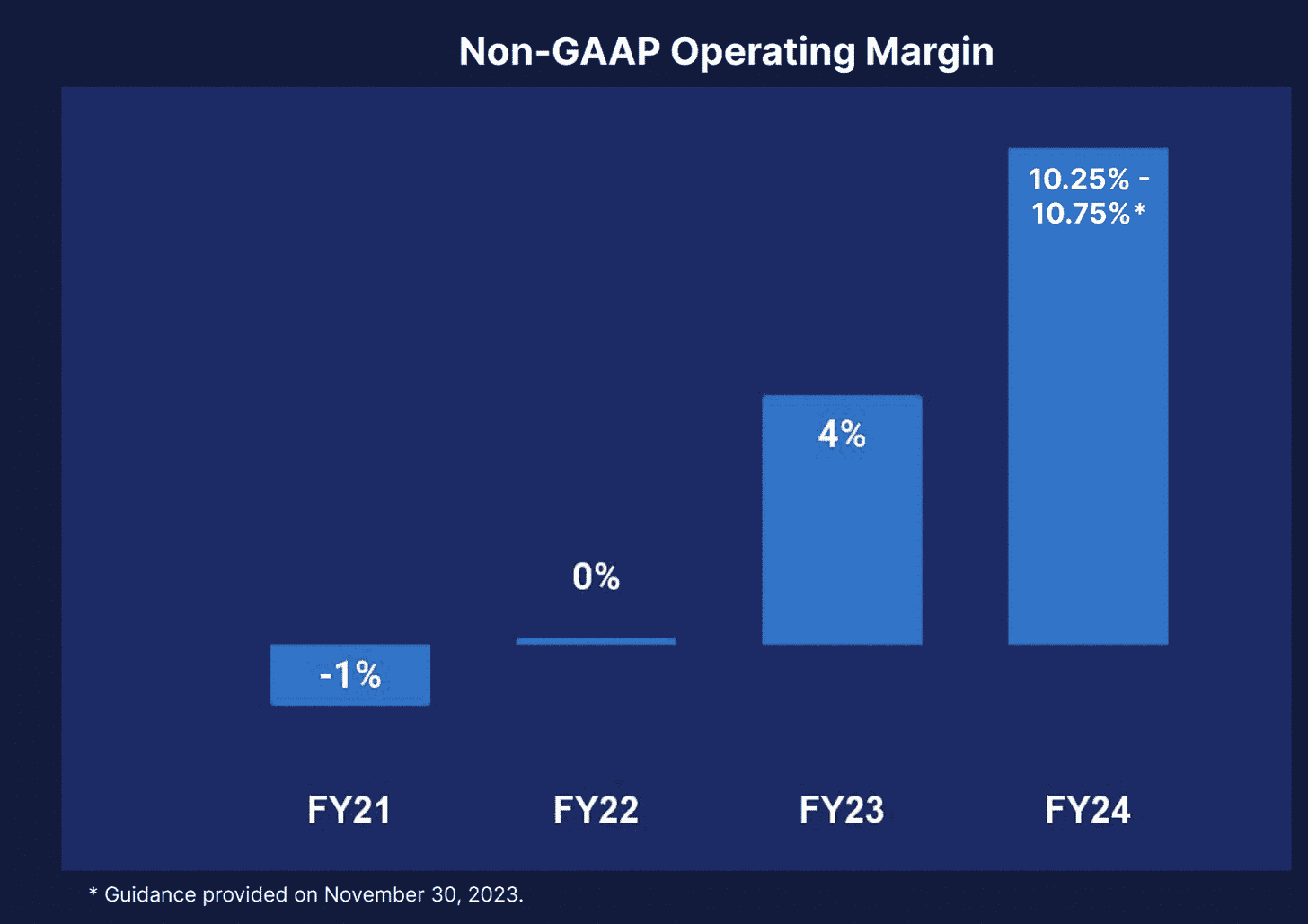

A common theme for 2023 in SaaS. Elastic got fitter and improved the bottom line — even as growth slowed. In 2022, Elastic broke even on a non-GAAP operating margin basis, then went +4% positive in FY23. Then last year, it held the line on costs and hiring, reduced the workforce by 13% (layoffs) … and got to 10%+ operating margins.

#3, 20,700 Total Paying Customers, With a Big Push on $100k Customers. They Have 1,220 of Those.

Elastic has seen continual growth in customer count, from 13,000 in 2021 to 20,700 at the end of 2023. That’s a solid +60% logo growth at scale. But the push to close 30-50 $100k+ deals has been a top priority. Elastic did see deceleration the last 2 quarters to 30 of these deals per quarter.

#4. Channel Sales Are Important. Its Top Customer (10%-15% of Revenue) is a Channel Partner.

At the low end, Elastic relies on self-serve, automation and Free trials and Cheap editions (starting at $95/month). But its bigger deals don’t sell themselves without humans — and partners. Their partner ecosystem drives a lot of their bigger deals.

#5. 3,000 Employees in 2023, Up From 2,100 in 2021

At $700m ARR, Elastic had 2,100 employees, so just under $330k per employee. Today, at $1.25B in ARR, it has 3,000 employees, so $420,000 per employee. That’s a lot more efficient.

SaaStr Annual will be back this Sept. 10-12, 2024!

SaaStr is the largest community of SaaS executives, founders, and entrepreneurs in the world and we bring them together each year at our flagship event—SaaStr Annual.

If you want leads, you want brand exposure, and/or you want to connect with your customers -- the SaaStr Annual is the #1 non-vendor event in the world. Period.

And importantly, we understand how much work “doing a show” is. We have designed the event so you will not just be exhibiting at the #1 event in the industry, but just as importantly, will have constant traffic.

Very interesting, thanks!