5 Interesting Learnings From DropBox at $2.6 Billion in ARR

"18,000,000 Paying Customers — But Customer Count Almost Maxed Out. AI is The Future Now."

So Dropbox was the fastest B2B app of the last era to rocket to $1 Billion in ARR. It seemed crazy at the time, and even in the age of OpenAI and Wiz, it still seems a bit crazy today.

Since then, it has IPO’d and transitioned to a new mature phase, where it’s highly profitable and focused on efficient scaling. And now it’s transitioning to its third phase, investing big in its more AI-focused business offering, Dash, while managing its classic but mature file sharing business efficiently.

Phase 3 of Dropbox: “We are evolving from traditional file sync and share to AI-powered universal search and content intelligence.”

Drew Houston has been CEO since Day 1 in 2008 and we’re super excited to have him speaking at 2025 SaaStr Annual, May 13-15 in SF Bay!

With that, we thought we’d do a 5 Interesting Learnings:

#1. 20.9% Market Share In Its Core / Original File Sharing Business

This is interesting data at a level most B2B leaders don’t share. DropBox sees itself as a bit behind Microsoft, and a bit ahead of Google in file sharing. And about 2.5x the size of Box. Given its customer count is fairly steady at 18.22m paying customers, presumably its market share is as well.

Dropbox likely owns the “pure play” segment though. Even Box really is an enterprise player, and much of Microsoft’s and Google’s usage is presumably package in and not paid for discretely.

#2. ARPU Continues to Slowly Increase Across 18.2 Million Paying Users

ARPU increased substantially from 2020 to 2023, and is up modestly again in 2024.

#3. 43% of Revenue Outside Of U.S.

This is what many B2B leaders see where the product isn’t regulated or in a specific vertical. More than 50% of HubSpot’s revenue is outside North America. And 43% of Dropbox’s is outside the U.S.

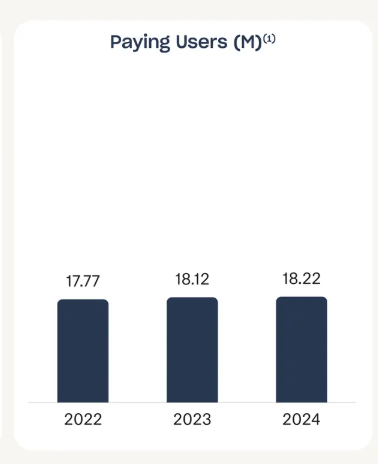

#4. 18,000,000 Paying Customers — But Customer Count Almost Maxxed Out. Did They Win The World?

Dropbox has a stunning 18 million paying customers, but that count is growing very modestly now. At some point, you own your niche. Even if it’s a huge one. Of those 18 million, about 500,000 are business customers.

#5. 36% Non-GAAP Operating Margins

Dropbox gets more and more efficient.

And a few other interesting learnings:

#6. Universal Search is the feature and product most resonating in its newer Dash product

Universal search has been a product dream since the early days of SaaS, and it seems like today is finally it’s time to be a true reality.

#7. File Sharing Moving More and More to Mobile, So Offering a Lower Cost Edition There

This is also leading to some pressure on ARPU.

#8. It’s Early, But Phase 3 of Dropbox is AI: Search and Content Intelligence

It will be interesting to watch how it plays out!