5 Interesting Learnings from Crowdstrike at $3.65 Billion in ARR

"A reminder to anyone even at $20m ARR to really, deeply start thinking about being multiproduct earlier."

So many outside of cybersecurity had barely heard of Crowdstrike before … it took down a big chunk of the Internet the other day.

But you should have. Why? That big miss aside, it’s one of the most incredible SaaS and Cloud leaders out there. The metrics are breathtaking (even if there may be some short-term challenges now):

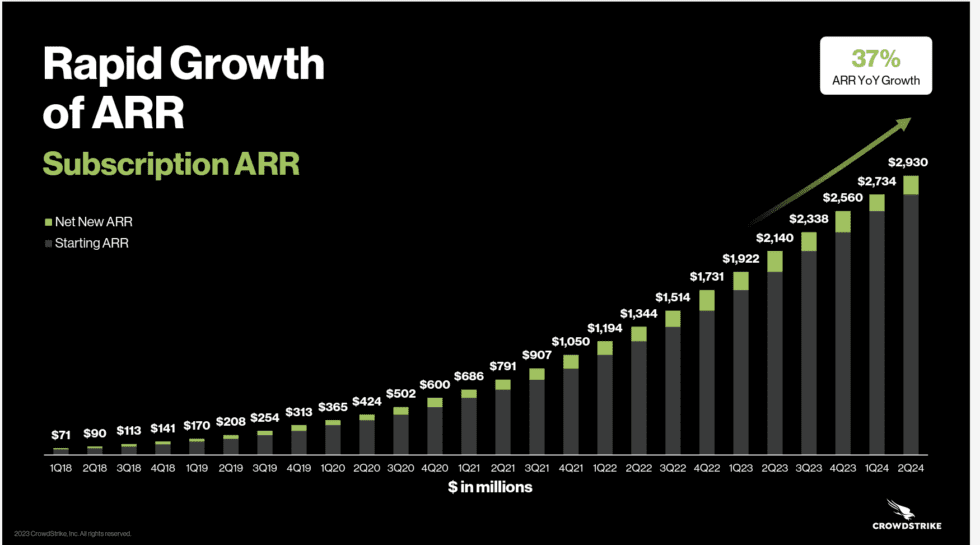

$3.65 Billion in ARR

120% NRR (estimate)

Still growing 33%

22% operating margins and 35% free cash flow margins

Even with the big miss the other day, it’s still worth $65 Billion. That’s down from $100 Billion+ before it took down the internet. But even at $65 Billion — that’s still almost 20x+ ARR.

That’s about as good as it gets, folks.'

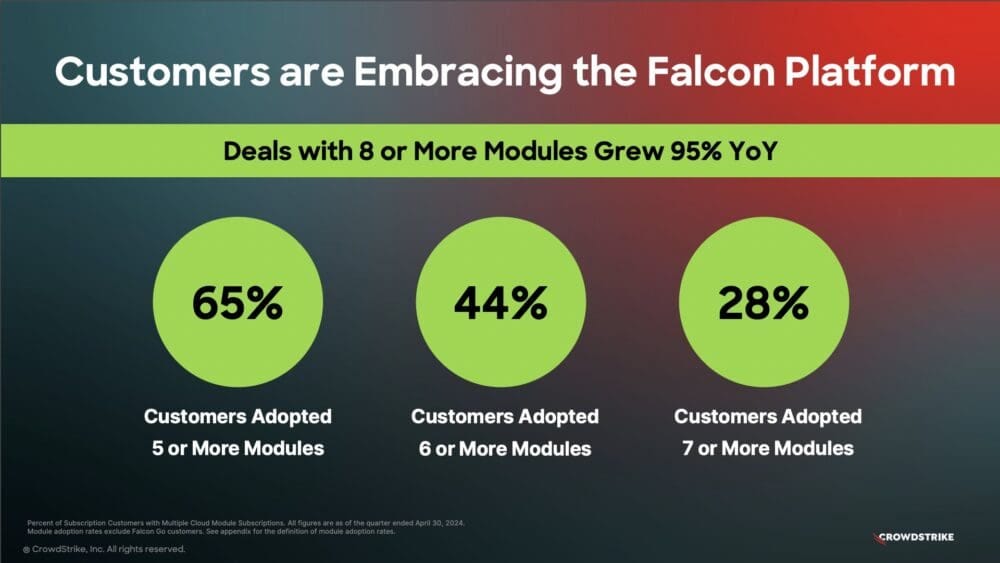

#1. Being MultiProduct is Key. 65% of Customers Use 5 or More Modules (Out of 28).

This should be no surprise per se. We see similar adoption at Datadog as well. But a reminder to anyone even at $20m ARR to really, deeply start thinking about being multiproduct earlier.

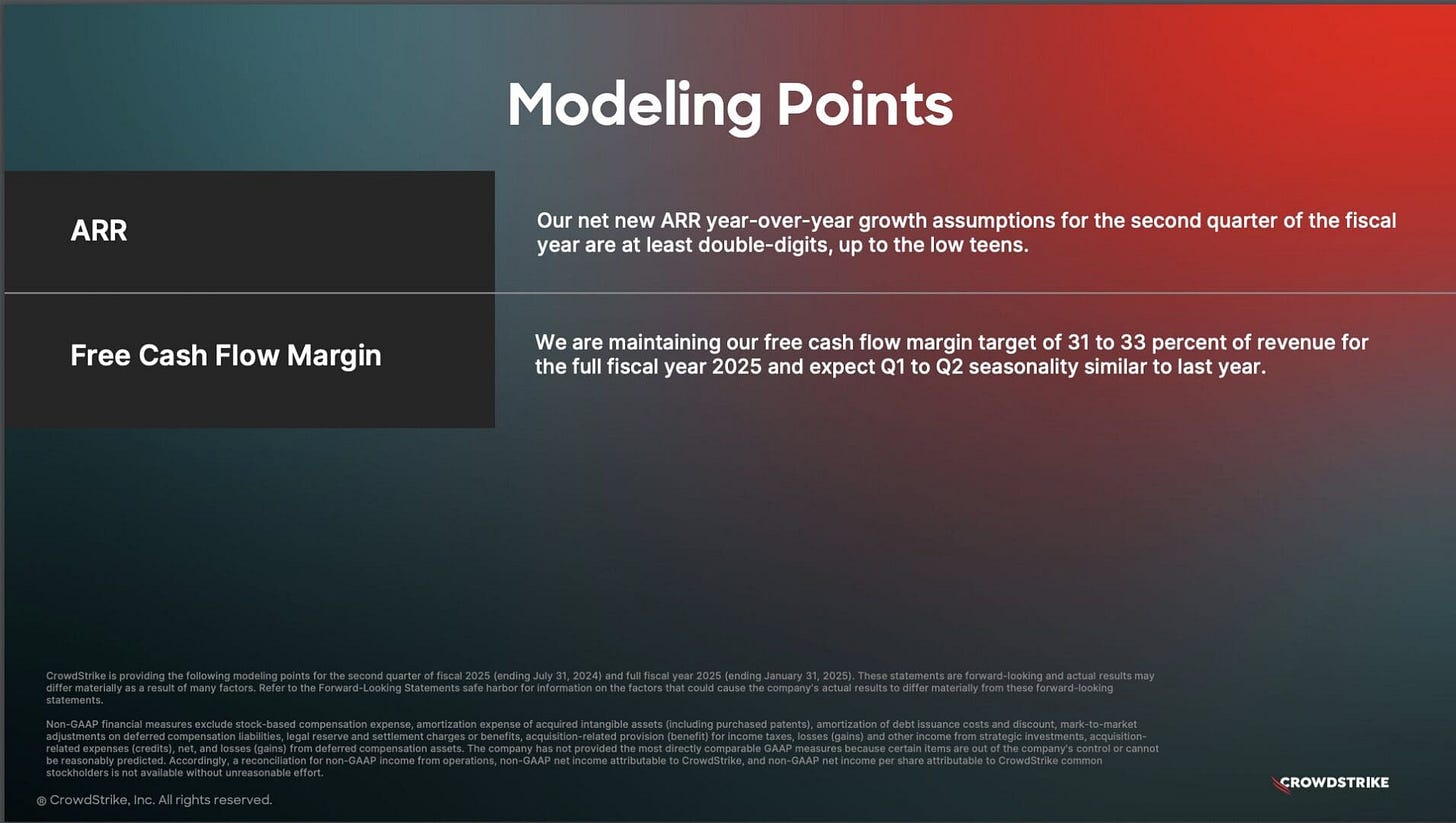

#2. Modeling Conservative Growth in the Teens To Come

I was a bit surprised to see this, but Crowdstrike is at least modelling growth to decelerate to the “teens”. That does seem a bit too conservative, but we’ll see.

#3. Not Disclosing NRR Anymore, But Likely 120%+

Crowdstrike used to share more metrics, but at $3 Billion ARR it had strong 120% NRR. It’s likely still close to that level.

#4. Most of Revenue Comes Through Partners, and $1 Billion Through CDW (A Big Reseller).

A reminder to not just focus 100% on selling direct through your own sales and marketing force.

#5. Predicting $10 Billion ARR in 5-7 Years

That’s the power of recurring revenue at scale.

They were only founded in 2011. From 0 to $3.6 Billion ARR in 13 Years.

Not too shabby.

And a bunch on Crowdstrike, Wiz and more here with me + Harry Stebbings: