5 Interesting Learnings from Atlassian at $4 Billion+ in ARR

"Atlassian has always been wildly efficient, and was bootstrapped all the way to IPO (it only sold secondary shares). But it got even more efficient the past year"

So Atlassian has cruised past $4 Billion in ARR, still growing a steady 21% in a very efficient fashion. It’s raining cash, with 27% free-cash flow margins.

The markets like this combination. Even with a few bumps, Atlassian is still trading at a $55 Billion market cap, so over 12x ARR. That’s twice the average of 6x ARR for public SaaS companies.

Efficient, steady, profitable growth at scale. The markets say Yes to Atlassian.

5 Interesting Learnings:

#1. 300,000 Total Paying Customers, With 43,000 Paying $10k or More

The vast majority of Atlassian’s customers pay less than $10k a year, but the $10k+ ones make up the bulk of the revenue. A reminder that the long tail really does work in collaboration. And also how important it is to go a smidge upmarket if you sell to SMBs and smaller customers.

#2. Loom Added Just 326 $10,000+ a Year Customers, But 33,000 Total Customers

So how much revenue did Loom add? They increased $10k+ customers by less than 1%. But they increased total customer count by 10%. Measured by that, Atlassian got a good deal! The big question will be how do Loom look in 3-4 years. If they can grow ACV like they have for their other products, it will be a steal. If not, it will likely be a minor addition in the end.

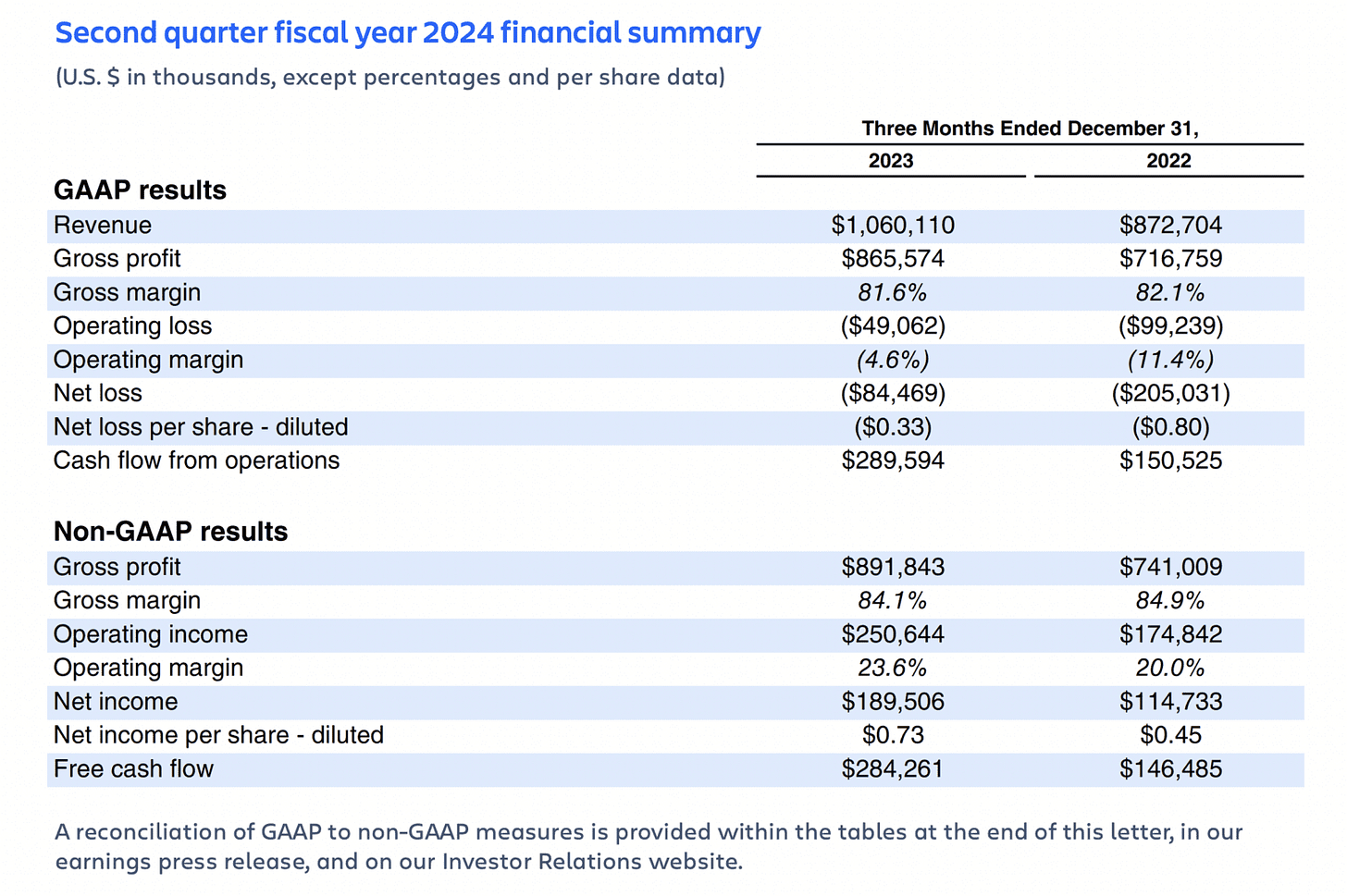

#3. Getting Even More Efficient, Like Almost Everyone Else

Atlassian has always been wildly efficient, and was bootstrapped all the way to IPO (it only sold secondary shares). But it got even more efficient the past year, growing operating margins from 20.0% to 23.6%!

A look back at Atlassian right after its IPO here:

#4. 50% of Revenue in North America, 50% in EMEA and APAC

Atlassian’s revenue base is split almost evenly between U.S./North America and the Rest of the World. Collaboration and developer-focused tools are very global by nature. Lean in there, if you can.

#5. Enterprise Doing Better than SMB

A common trend across many selling into tech. Enterprise leaders are the islands of strength today. Startups are struggling. It was the opposite in 2021 🙂

And a few other interesting notes:

#6. Sees Real Potential For Acceleration in 2H’24

Atlassian’s high end of its guidance assumes a material rebound later in 2024. They aren’t promising it, but they see the potential signs of a better second half to the year and an uptick in seat expansion.