The State of SaaS: Trends and Predictions with SaaStr CEO and Founder, Jason Lemkin

"“Don’t be suckered in by that great LinkedIn, or that great experience. There are so many veterans in SaaS now"

Recently at Pavilion’s CEO Summit, SaaStr CEO and Founder Jason Lemkin, took the stage to do something .. a little bit different. Typically on SaaStr.com, we try to focus our content on mistakes to avoid, lessons learned and how to scale faster, but for the CEO Summit, Jason addressed the audience with what’s most top of mind for him at the start of 2024.

“I really think we are in a new world as managers and as leaders,” Jason said to kick things off.

“2023 was nuts, right? At first, it seemed like the world would end for all of us. We’d all be bankrupt. That lasted about seven weeks, and then all of a sudden the world exploded. The backup of 2020 was great, 2021 comes in and somehow we have 600 unicorns and everyone can burn 500 million a year or have huge sales teams. And then at the end of 2021, all of a sudden the music stopped. HashiCorp went public but it all stopped after that.”

There were no IPOs from December 2021 until Klaviyo a couple of months ago, but even Klaviyo still barely IPO’d at almost $800 million in ARR.

In 2022 we were all playing catch-up and in 2023 we all had to become radically efficient. So what does all that mean for founders and leaders heading into 2024?

#1. The $300,000 Employee

So what will all the efficiencies we gained in 2023 mean for 2024?

Jason now has 5 investments at $200m+ ARR that are all cash-flow positive (which is necessary today), and there’s one clear trend he’s seen in today’s new efficient world: The New Normal is 700 Employees at $200,000,000 in ARR (or $300,000 per employee) at the average public SaaS company. This is so different than the days of 2021 when a $200M ARR company might’ve had 2,000 or more employees, and maybe a startup doing just $50M had 700 employees.

Backing into that equation, now that the world has changed, if you scale it down to earlier stages, the math per employee works out a bit like this:

350 employees at $100m ARR to stay efficient, maybe 450 if have cash to invest

175 employees at $50m ARR. This starts to get tough. Few are this efficient today.

88 employees at $25m ARR. This is pretty rare. But probably necessary if another round isn’t coming.

“We all had folks with hundreds and hundreds of employees at $10 million in ARR, at $15 million in ARR, and it just doesn’t work,” Jason explained. “So when you’re planning, I found that somehow this equation was helpful when I shared it with founders. Forget about how you get there: Bootstrapped, overfunded, underfunded. It all normalizes itself over time since at some point your business has to pay for yourself. We all thought we could have so many more people than we can, but you can’t change physics. This is the number you skate to.”

#2. Beware of the Lost Generation in 2024

“I think 90% of the candidates out there, you just have to rule out ’cause they’re done,” Jason explained as he went into his second prediction for 2024. “They’re burnt, they’re broken, they’re tired and they just won’t work.”

Let’s dive into this one a bit more, even though the quote likely speaks for itself. But the meta point is this, if you’re recruiting in 2024, beware of the “Lost Generation” candidate and persona you may come across. A few examples from recruiting and interviewing lately that Jason warns fellow founders against:

#1 Beware of the Managers vs the Do-ers. By this we mean, that Jason interviewed sales and events candidates recently and started to notice a pattern in the candidates he was speaking with. They simply didn’t want to be involved in the day-to-day work (being a Do-er) and just wanted to manage the team of 10 or bring in a playbook they thought would work. Jason warns not to hire this persona if what you need in 2024 are high-output, productive employees.

#2 Beware Sales / Customer Success Reps who don’t want to visit customers in person. It’s part of the job now. But most candidates have become complacent and will default to speaking to customers only virtually or on Zoom. It’s not good enough. Jason recently chatted with a Sales candidate in the SF East Bay who didn’t want to travel 45 minutes to visit customers in San Francisco in-person. Don’t hire this person as your head of sales or customer success in 2024.

#3 Beware of the Burnt Out Candidates. Lastly, Jason talked a couple of months ago to an AE that made over $400,000 last year and just quit with no job due to burn out.

“Don’t be suckered in by that great LinkedIn, or that great experience. There are so many veterans in SaaS now,” Jason warns. “Don’t hire the broken. Get back to only hiring the pirates and the romantics, only the people that are quirky enough to want to do the crap we do that doesn’t make sense.”

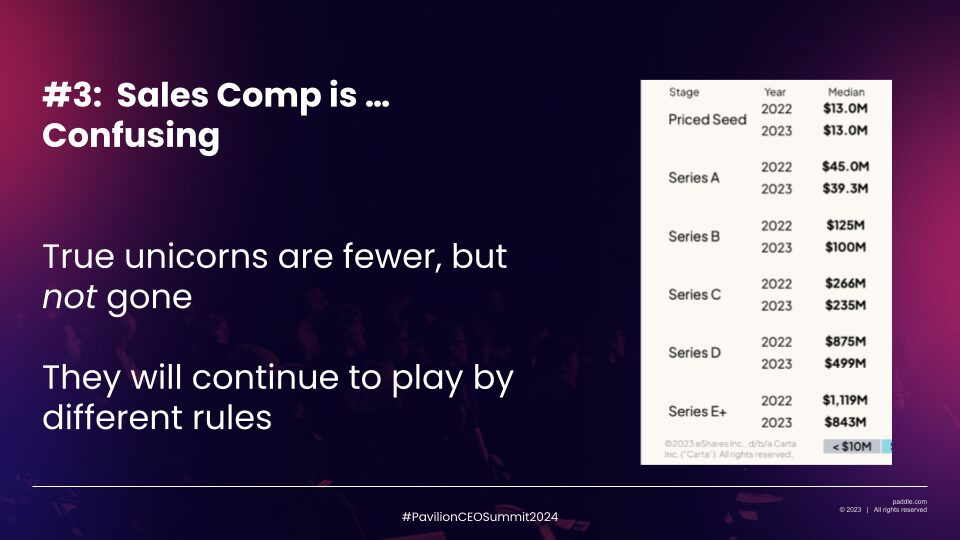

#3. Sales Comp is Confusing (at best)

While the Unicorns might be dying out in 2024 – they’re far from all gone. They may not necessarily raise another round anytime soon, but they’re definitely not out of the mix – so at best their presence in 2024 will make sales compensation even more confusing than it already is. Think about it, OpenAI can pay pretty much anything it wants right now for engineers.

“For every ‘Ex-Unicorn’ or ‘StruggleCorn’ or whatever, there’s one company that can pay candidates outlier rates and it’s going continue to warp how we think about sales compensation, and it’s going to continue to just ripple through the industry,” Jason warned.

Gone are the go-go-days of 2021 where you had to pay high-end of market because any single candidate likely had 11 other job offers. We all skipped the reference checks and due diligence out of fear the candidate would be swooped in by someone else. With Cloud spend projected to hit $1 trillion this year, the distorted outliers will make it confusing for the rest of us. They’ll have much more budget than the rest of us, and it will warp and distort sales compensation this year.

#4. The Generalist Role is Dying in SaaS

Whether we like to admit it or not, everyone’s trying to use AI for support and customer success in 2024. So while customer success used to be the “landing place” for the generalist persona in SaaS – it may be behind us now in 2024.

“I’m worried now that Customer Success has become apart of sales that CS has become weaponized. The goal of Customer Success was to get blood out of the base last year, and it destroyed the customer relationship, and as part of that, I just don’t think that there’s any great generalist role,” Jason warned. “There’s no great role for, ‘Hey, I’m a generalist. I’m gonna go into CS or support and just make customers happy.’ I’m worried the era of this generalist making customers happy is behind this and gone.

There’s a lot more we can touch on here, but catch up on Jason’s recent deep dive with Gainsight CEO Nick Mehta on the state of Customer Success in 2024.

#5. The “Downturn” Isn’t Evenly Distributed

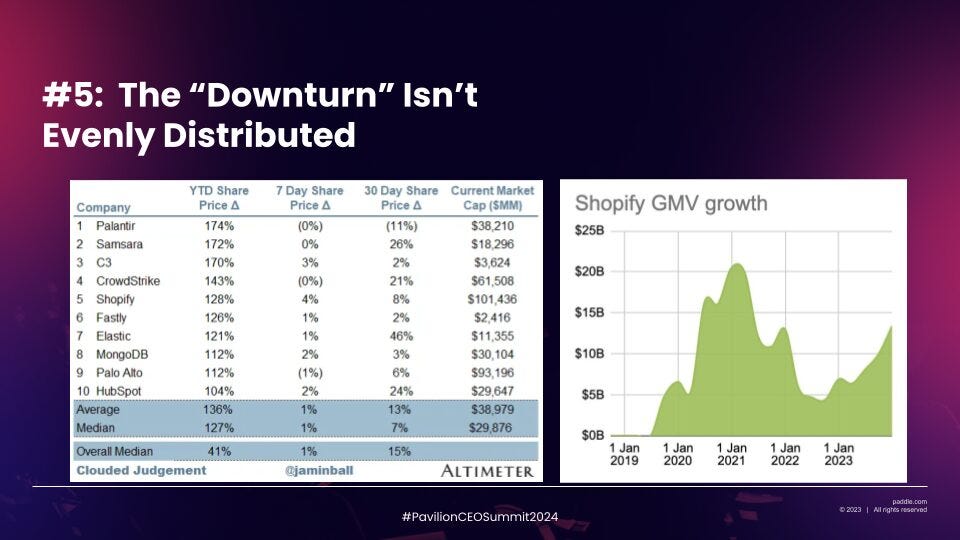

While most of the audience at Pavillion CEO’s summit raised their hands that they felt like they’re in a downturn, Jason’s take is that going into 2024, there is a bit of a downturn but it’s not evenly distributed in SaaS, and Cloud, and that’s what we can learn from.

The slide above has data from Jamin Ball of Altimeter and it shows that most public SaaS companies were actually UP last year, not down. Palantir, HubSpot, IBM, SAP – all UP! And on the right chart above, you’ll see Shopify’s growth. It was down for a bit but started actually bouncing back in 2023.

So the point of these charts is this, the downturn isn’t evenly distributed, which means budgets are going in all sorts of weird directions for 2024.

#6. The “Downturn” Isn’t in Overall Spend

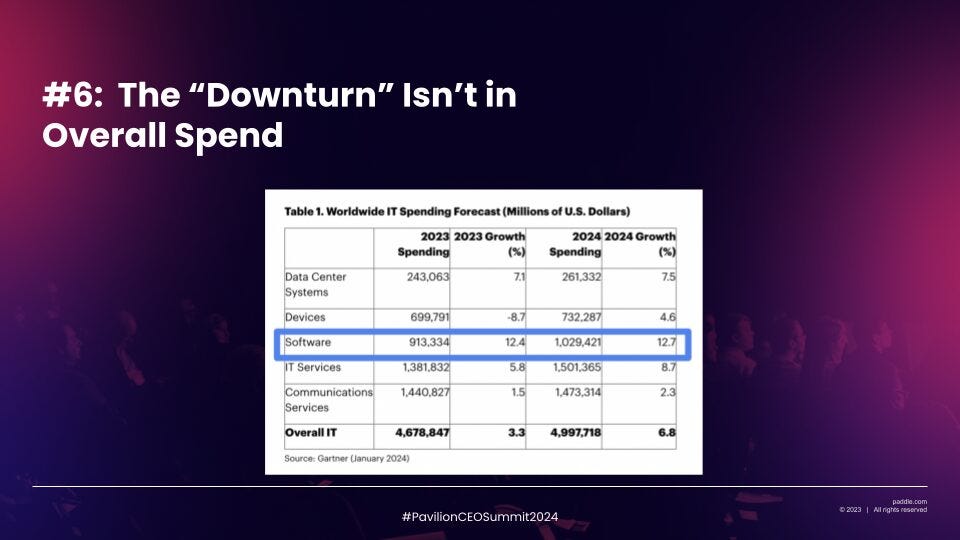

We wrote this up on saastr.com a few weeks ago, but Gartner recently reported that software spend will cross $1 trillion in 2024, or 12% growth from 2023. (See, told you things were up in 2024).

While some of that may be going to AI, or security, or cloud infrastructure – a lof of that spend will still go to good SaaS companies, if you have product-market fit in 2024.

Jason challenged the audience to, “Be honest, if you fell out a product-market fit. Spend is growing but there are thousands of SaaS vendors that can’t all succeed. Be honest.”

Ask yourself:

Did your product grow in the last three years?

Did you get more competitive or less competitive?

Did you grow faster than your competitors?

If you had a tough year and you grew 30% last year, but your number one competitor was flat, that’s a win. If you grew 30% last year, but your competitor grew 60%, you’re actually losing market share and that’s because you fell out of product-market fit.

#7. Year 3 Of The Multiple Downturn

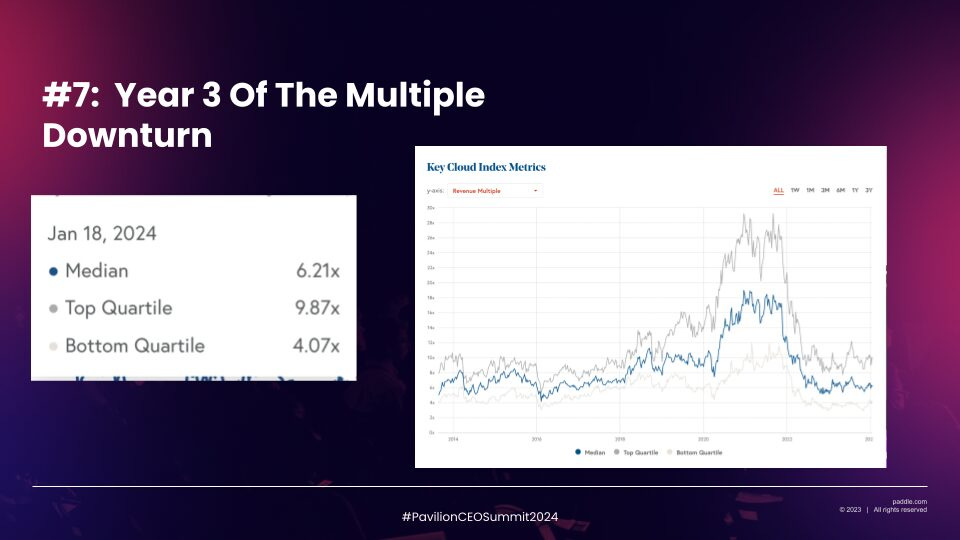

So while it’s not a straight down-turn in SaaS, it is however, yeah 3 of the multiple downturn in SaaS and Cloud. While most folks are predicting 2024 is bouncing back, if you look at the data above, as Jason points out it’s actually worse because companies are better than ever. There are more companies that are bringing in over a billion ARR a year out there.

People are buying more software than ever, but all the multiples are stuck around six X. So that’s not great.

“The companies are better,” Jason explained, “And in some cases, growth is lower, but not always. And it is year three of the multiple downturn. At some point we wanna be optimistic, but we have to be realistic, right? I hope we’re not stuck in a six x world. I hope we’re back to eight x and 10 x for good ones. But I am getting a smidge worried that we haven’t seen this rebound.”

#8. We Didn’t Actually Get Any More Efficient in Sales & Marketing

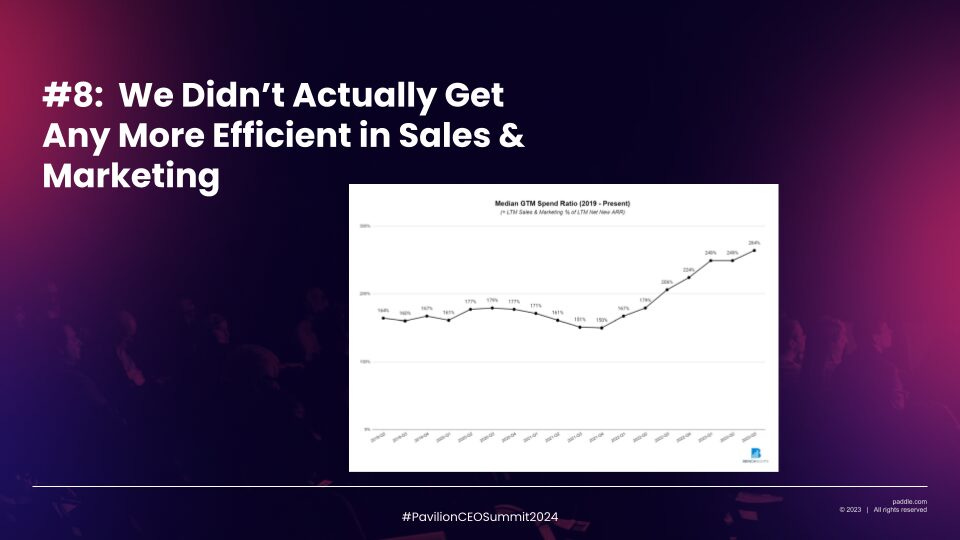

David Spitz of Benchsights created the chart above which effectively shows sales and marketing, go-to-market costs actually getting worse (not better) despite all the efficiencies of 2023.

We’ve all gotten more efficient all across the board by spending less in 2023, so much so that every single public company is radically more efficient than 18 months ago. They all were unprofitable and now their profit is either cash flow positive or positive operating margins.

But as this chart shows, we didn’t get any better at sales and marketing. We just leaned on our existing customer base and relied more on price increases and NRR. So, we’ve all actually gotten worse at sales and marketing. As we cut marketing expenses, as we got leaner, as we got profitable, intuitively you would think our sales and marketing costs must have gone down, right?

Nope, it’s gone up. We just grew more slowly and relied on our existing base. The challenge for 2024 will be to figure out how to get back to growth, spend more, and be more efficient at the same time.

#9. NRR Zombies

What’s an NRR Zombie? It’s a SaaS startup that basically fell out of product-market fit after the 2021 boom … but has enough revenue and high enough NRR to keep going.

These ‘zombie’ companies hide in their NRR in 2024, and not grow. In some ways, NRR Zombies are outputs of the actions of 2023, especially for venture-backed startups. Everyone had to cut, cut, cut — and was told to cut, cut, cut. That they had to get to cash-flow positive, because no more money was coming.

Everyone sort of got a pass for this state in 2023. There was so much panic and fear about not running out of money, and cutting the burn, and overfunded unicorns, that almost everyone got a pass on growth as long as the burn was low. But not only is that pass over, it’s time to recognize what world you’re in.

In 2024, it’s time to be honest and get past crisis mode. Don’t be an NRR zombie. Don’t rely on it. It’s time to get back to growth, and it’s supposed to be hard 🙂