10 Ways to Build a Moat in SaaS. But AI is Also Making Them Weaker.

"AI has led to an explosion of budget going to new apps and new discovery. This has weakened brand moats."

A while back we did an extra “Day 0” AMA session at SaaStr Annual and several hundred founders came. One asked what the top moats are in B2B and SaaS. At the time, I didn’t have a great answer. A lot of B2B apps don’t really have moats, I thought. But that’s wrong.

Time has gone on, and while moats in B2B may not seem quick as clear as in B2C, they are real. And you gotta at least try to build a few to go long and go big.

And we also need to acknowledge AI has weakened almost all of these moats … at least to some extent.

Let’s take a look at moats in B2B:

#1. Brand.

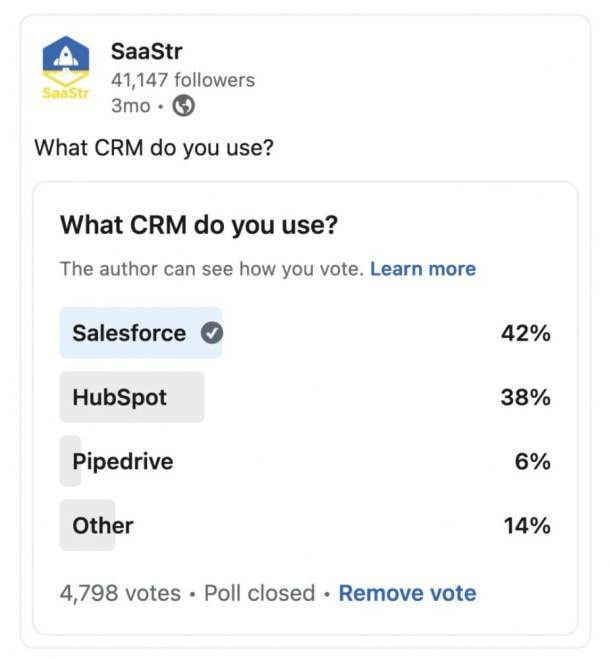

Brand can be a big moat in B2B, and still is for the most part. Most customers just want to pick the app they’ve used and heard of. We all underestimated this in the earlier days of SaaS. There may be 100+ CRMs today, but most of us just want to pick the one we know. In fact, most of us in CRM will still just pick HubSpot or Salesforce today, unless we need a vertical solution. Even OpenAI or Claude … why did you pick one? And how much energy will you have in a few years to keep trying new solutions? There’s a reason Sam Altman is everywhere. He’s investing in brand, at least in part.

But … but … AI has led to an explosion of budget going to new apps and new discovery. This has weakened brand moats. It’s put a lot of deals into play, as customers look at both new AI-first vendors and the classic folks.

#2. Data & Data Lock.

Data lock is real. LinkedIn owns the human record, Workday does in part in the enterprise as well.

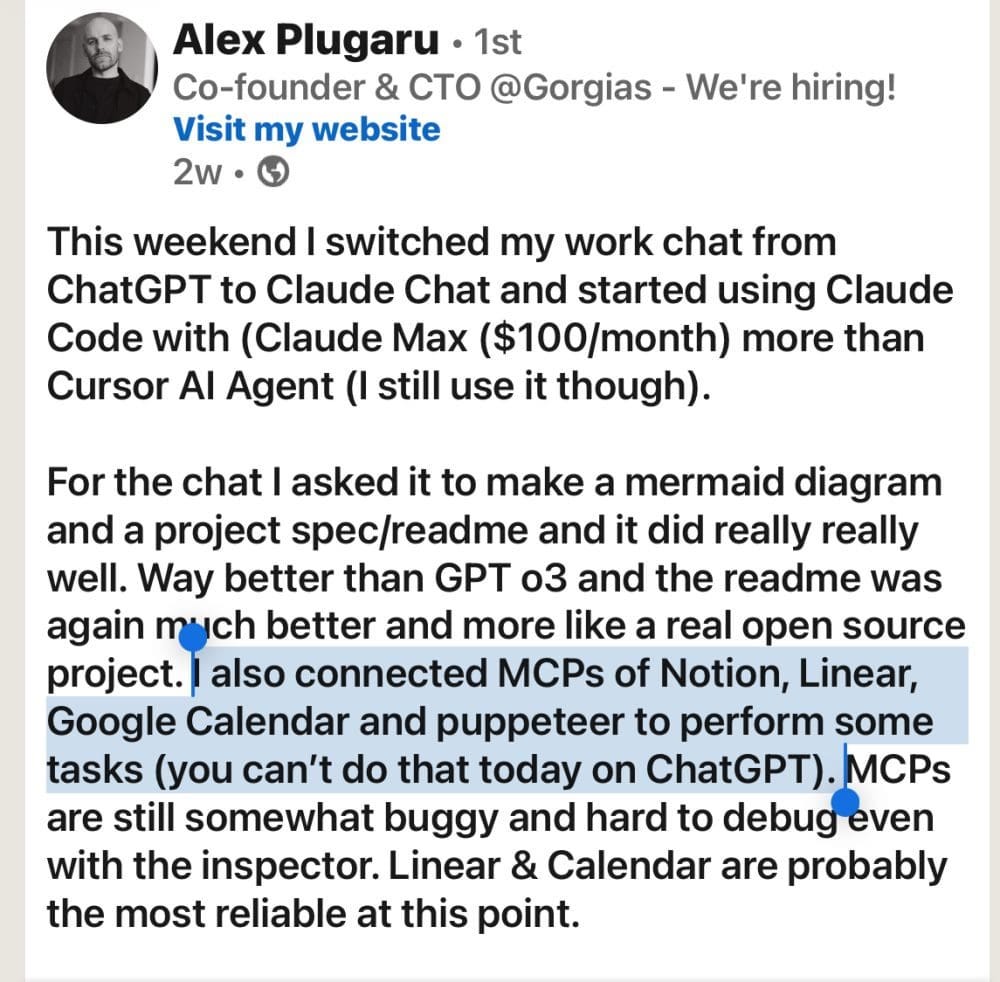

And yet … MCP is already beginning to weaken data moats. Just a bit, but it’s already begun. HubSpot allowing ChatGPT to access its data is just the start.

#3. Structured Data.

Even if data resides in many silos, structuring makes it unique. Exporting your Customer records from Salesforce or really almost any app is often a huge task.

Except … AI is making it far easier than ever to structure and re-structure data. What used to be a massive mapping and restructuring project can now just be given to OpenAI and other vendors running AI tools here.

#4. Partners + Ecosystem.

The top partners in the Salesforce, Shopify, etc. ecosystems do get most of the leads. And this compounds over time. The AEs, the biz dev folks, tend to send deals to the partner everyone trusts and knows.

This is still true, but the rise of new AI-native leaders has disrupted the classic 1 or 2 leaders that attach to each platform. There’s just so much more competition today, and the top partners are given the break-out leaders mind share too, not just the established ones.

#5. Integrations.

Most vendors only integrate one third party in each category, maybe two. Zapier is integrated everywhere. Maybe 10x more than anyone else … So also, build more of them. Before someone else does.

But again … MCP is already starting to change the game here, with 5,000+ MCP servers online since the beginning of the year.

#6. Agencies and Implementation Partners.

Third parties want to specialize in helping customers deploy just a handful of leading apps. This is a big part of HubSpot’s GTM, and of many leaders in the Shopify ecosystem. Own the agency relationships for SMBs, own that Accenture relationship in the enterprise, etc. — and it’s really tough for others to break in, absent strong organic customer demand.

And yet … agencies themselves are under threat as AI itself makes onboarding easier. Especially at SMB level. You can see in our SaaStr AI Summit 2025 deep dive with Yamini Rangan, CEO of HubSpot, that AI has already changed their relationships with agencies, and what those agencies do to drive value deploying HubSpot:

#7. Long-Term Contracts.

Yes, we hate this. But getting customers to sign 3+ year contracts does work if there’s enough value to earn it. It’s not perfect. Competitors can buy out these contracts, and break them. But 3-year contracts are a partial moat. They do slow down switching, because they add friction to switching.

But most AI leaders don’t force you into long-term contracts. At least not to get going.

#8. Using Massive Amounts of Capital To Play In Every Segment.

Dominant-dominant strategy is tough to play well, but being in every single segment when the competition can’t afford to be is a form of moat. The 2.0 version of this may well be Rippling, playing to win not just in multiple segments, but 25+ products at the same time from the get-go.

But … AI startups are soaking up 70%+ of all VC cash now.

#9. Being “The Most Enterprise” Vendor.

If you are the most secured, most trusted, most 2FA, most HIPAA, most SOC-2, most everything vendor … you will win where that matters. And it matters a lot in the enterprise.

Still a big moat, but the big push to bring AI into orgs is leading to more budget going to new vendors. And incrementally more risk being taken here. Enterprises are bringing in vendors like Decagon, Glean, Sierra, Loveable, Windsurf, etc. at a pace they wouldn’t have pre-AI.

#10. No Contract At All.

Yes, a long-term contract is a moat. But there’s a “carrot” flip-side: making it 10x easier to onboard than the competition does. Arguably, this was part of the wedge Apollo used to gain share over market leader ZoomInfo. A deep dive with their CRO below.

AI challenges this strategy by making it even easier to try — at least in many cases. Many AI leaders are a challenge to existing vendors here again with monthly payments and little drama when you off board. It’s just easier to pick them when you can leave easily anytime.

So the meta-point is there are actually a lot of moats in B2B, of various strengths. But … AI in many ways is making them all weaker.

As you plan for next year, maybe that’s a place to agree on an initiative or two. A company goal. And maybe a priority change here or there.

-> Ask the team at your next planning session — What’s Our Moat? And How Do We Reinforce it Next Year?

And see where that goes. It probably goes somewhere good. If you are going long, that is.

Companies that are winning now are building AI that gets better for each customer the more they use it. If they switched, it would mean starting over with an almost dumb tool that doesn't know your specific patterns and preferences.