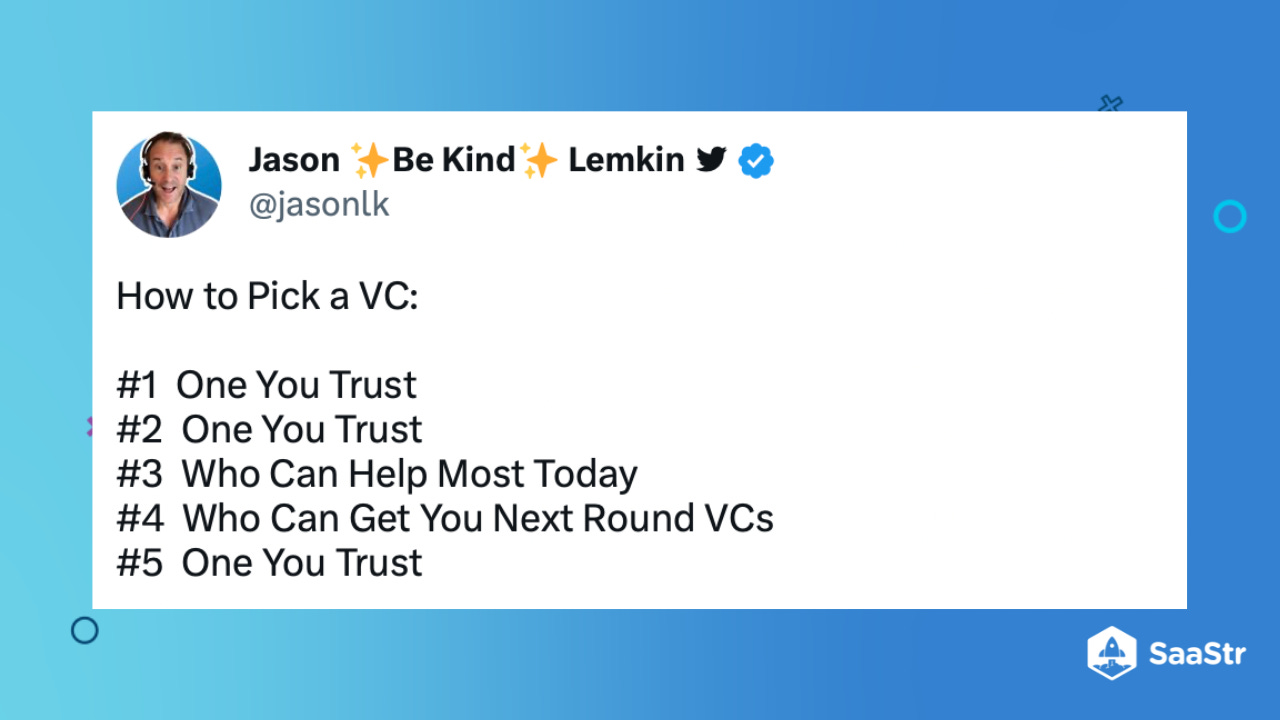

10 Criteria To Use To Pick Your Lead VC. If You Have Options.

"A different way to ask this question is — who will most have my back? If you aren’t sure, take your time and slow it down. Spend more time together."

My force-ranked list of criteria:

#1. Who do I truly trust the most? This doesn’t mean who is the “best guy”, or smiley-est, or nicest. In fact, be wary of “grin frackers”. Find out — who can I truly trust? If any of them. You will be so, so, so much better off if you pick the one VC you can truly, really trust. So, so much better off. A different way to ask this question is — who will most have my back? If you aren’t sure, take your time and slow it down. Spend more time together. Do another Zoom. You can slow things down at the end. It’s OK. More on that here.

#2. Who can truly help the most? In later rounds, this doesn’t matter much, but in the earlier ones, it does. Pick that one. Who can help me find that first VP of Sales? Who can help us the most with potential partners? Who can most help you build the company to the next stage at least? Many VCs really can’t actually do anything to help. But if you can find one that can move the needle, pick that one. You only have so many slots on the cap table, after all.

#3. Who will the Next Round VCs most want to follow? This is hard to know without really asking, but if you pick a VC that other great VCs want to follow, the next round will likely be much, much easier. This is one reason to pick a more successful VC. A lot of folks will want to invest in the next round of their startups. A lot of them. With a newer VC, or less successful one, it will be much more on you to find the next round of investors.

#4. Who can promote me the most and help me be Hot? Or At Least, Cool. Later this doesn’t matter but some VCs really can promote you and help attract the best hires, etc. This does help with recruiting and partnerships. There are just so many startups. Many employees really do want to join one they see a well-regarded and popular VC has invested in. Twitter matters. There are influencer VCs, and at the margin, it’s better to have one for recruiting and partnership building.

#5. Which partner has the most successes under their belt? Nothing wrong with a first-timer or new GP, but a GP without any wins under her belt yet is often … more … nervous. But as we noted above, it’s much easier for a successful VC to bring in other investors. And perhaps even more importantly, they don’t sweat a loss. Once a VC partner is up 3x-4x, any individual write-off won’t really matter. Think about it a bit. Let’s say a VC invests $3m into your start-up. If they are up, say, $100m in that fund, losing $3m won’t really matter. But if they aren’t up much yet, losing even $3m could be a really big deal.

#6. Who has a bigger checkbook? This doesn’t always matter, sometimes not at all. But it’s nice if they can give you more money, vs. being tapped out, or stressed about the next check. This is especially important if you aren’t going to be particularly capital efficient. If you don’t know — ask. Make sure you ask. “How much more can you invest in us? And when?” Also ask, “If we need a bridge, how much could you bridge?” Ask.

#7. Who do my existing investors recommend? They may not know, or have biases that you might want to ignore. You may need to ignore this advice. But if they are really experienced in the space … they’ll know. At least they have some G2 to help you decide. It’s a pretty small world, venture capital.

#8. Who will get out of the way? Sometimes, this is all you really want, especially in later rounds. To be left alone.

#9. Who makes the round structurally easier? This sometimes matters. Some funds want to invest so much, they want to crowd out all prior investors from the round, in whole or in part. This can create a lot of drama, especially when earlier investors are forced to waive their pro rata rights. It might be worth it. But at the margin, it’s just easier if your next round investor can accommodate the pro-rata rights of the earlier investors. It makes all your VCs friends. And that is important. More on why here.

#10. Can I also get a great mentor as well? The very best VCs truly can be mentors as well as investors. Most VCs claim they are great at this, but in reality, most founders will say just 1 of their investors really played this role. But if you can get it from a major investor, that’s special. Because you’ll be on that journey together. In many cases, for a decade or longer.

Finally, an important note that it really helps if you can build a diverse investor base early. It just gets harder if you don’t. And people will care. Your employees will care. Your cap table and your board should reflect the inclusiveness of your company — shouldn’t it? Of course it should.

SaaStr is committed to having the most inclusive community in Cloud and SaaS.

At SaaStr, our goal is for all of our events, and the community and companies who participate in them, to include, encourage, and recognize people of all races, ethnicities, genders, ages, abilities, religions, sexual orientations, and military service.

We believe that true innovation depends on hearing from, meeting with, and listening to people with a variety of perspectives and diverse backgrounds.

To help, we’ve set aside 500 no-charge passes to SaaStr Europa for members of underrepresented groups in the B2B / SaaS community. Please apply here or share if you can: APPLY HERE