10 Brutal Truths From Coatue About AI and Who Gets Left Behind: The Great Separation

"Recent IPOs Are Crushing It – 2025 Median Return 24% vs -52% in ZIRP Era."

Leading crossover VC firm Coatue recently put together its highly detailed East Meets West Conference overview of AI, Growth and Tech here.

A lot we know, but it’s a very good collection of data and optimism on AI + B2B going forward

The Great Separation: 10 Brutal Truths About AI, Growth, and Who Gets Left Behind in 2025

#1: 2025 is the “Year of Offense” – Growth Trumps Everything

Coatue’s decision matrix for 2025 is brutally simple and reveals the new rules of the game:

Growing >25% + Profitable? → File your S1 immediately

Growing <25% + Profitable? → Play offense aggressively

Growing >25% + Unprofitable? → Build fortress balance sheet

Growing <25% + Unprofitable? → Reinvent your business

Why This Matters: The window for going public with lower growth rates is wide open. Public markets are rewarding ANY profitable growth right now. Companies that hesitate and wait for “perfect metrics” will miss the easiest IPO environment in years.

Action Items: If you’re profitable and growing, don’t wait. If you’re unprofitable, get to breakeven fast or raise enough capital to survive the next wave. There’s no middle ground anymore.

#2: Growth Gets 13x Revenue Multiples vs 5x for Slow Growth – The Great Separation

The Math That Explains Everything

The valuation gap between fast and slow growers has never been wider:

>25% Growth Companies: 13x revenue multiples (based on just 8 companies – that’s how rare they are)

<25% Growth Companies: 4-5x revenue multiples (based on 163 companies)

The Scarcity Factor: Only 5% of public software companies are growing >25% today, down from 26% in 2021

Historical Context: We’ve gone from 17% median revenue growth (2021) to just 9% today. High-growth companies aren’t just getting premium valuations – they’re becoming unicorns in public markets.

The Brutal Reality: Growth isn’t just valuable – it’s becoming extinct. If you’re growing fast, you’re literally in the top 5% of all software companies. Public markets are treating you like the rare asset you are.

Action Items: If you’re growing >25%, leverage this scarcity for maximum valuation. If you’re growing <25%, understand you’re competing with 95% of the market for scraps.

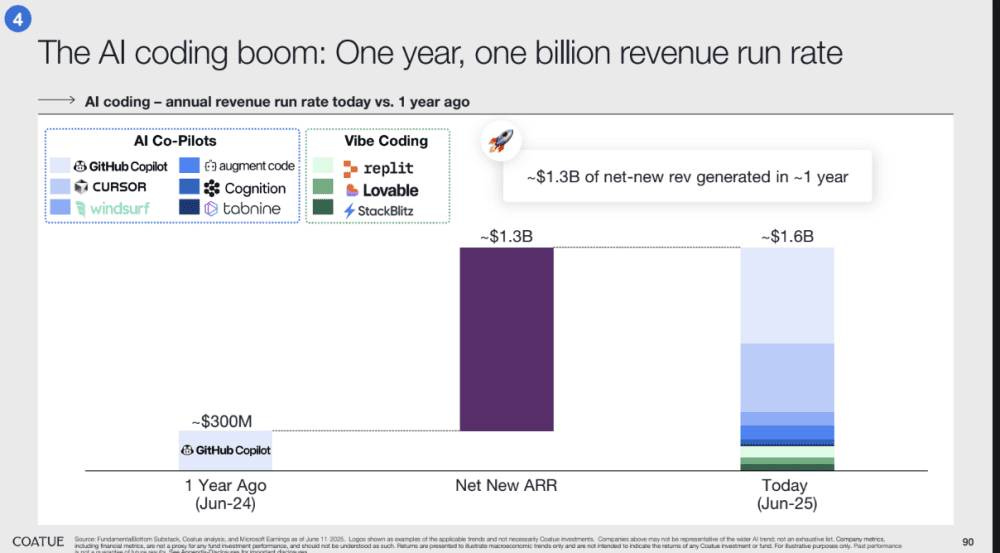

#3: The AI Coding Boom Generated $1.3B in Net-New ARR in Just 12 Months

The Most Explosive Category Growth in Software History

The AI coding market didn’t just grow – it exploded from almost nothing to $1.6B ARR in a single year:

Starting point (June 2024): ~$300M ARR (primarily GitHub Copilot)

Today (June 2025): ~$1.6B ARR across the ecosystem

Net new revenue generated: $1.3B ARR in 12 months

Key players driving growth:

AI Co-Pilots: GitHub Copilot, Cursor, Windsurf

Code Enhancement: Augment Code, Cognition, Tabnine

Developer Environments: Replit, Lovable, StackBlitz

Why This Matters More Than Any Other AI Category:

Developers are the highest-value users – willing to pay $20-100+ per month per seat

Immediate ROI is measurable – 30%+ productivity gains translate directly to cost savings

Network effects are massive – better AI attracts more developers, creating more training data

Bottom-up adoption – developers choose tools, then companies buy enterprise licenses

The Anthropic Parallel: While AI coding went from $300M to $1.6B ARR, Anthropic went $0→$1B ARR in 21 months, then $1B→$2B in 3 months, then $2B→$3B in just 2 months. Speed of execution in AI is unlike anything we’ve seen.

What This Means for Traditional SaaS: Your growth benchmarks are obsolete. While you’re celebrating 100% YoY growth, AI companies are achieving 500%+ growth rates and creating entirely new billion-dollar categories in months.

Action Items: If you’re building dev tools and not AI-first, you’re already obsolete. If you’re in any other SaaS category, study this playbook – AI integration isn’t optional anymore, it’s table stakes.

#4: Private Capital is Unlimited for Top Companies – OpenAI’s $40B Raise Bigger Than All 2018-2024 Combined

The Winner-Take-All Capital Market

The concentration of venture funding has reached extreme levels:

OpenAI’s $40B raise in 2025 is larger than the top fundraises from 2018, 2019, 2020, 2021, 2022, 2023, and 2024 combined

Top 10 companies now get 52% of all venture funding (up from 16% in 2015)

Historical context: We’ve never seen this level of capital concentration in venture history

What This Creates: A two-tier market where the best companies can raise unlimited capital and stay private indefinitely, while everyone else fights for the remaining 48% of funding across thousands of companies.

The Feedback Loop: Top companies use unlimited capital to hire the best talent, build better products, and grow faster – creating an insurmountable moat against competitors with limited resources.

Action Items: Either be exceptional enough to access tier-1 capital, or build a capital-efficient business that doesn’t need massive funding. The middle tier is disappearing.

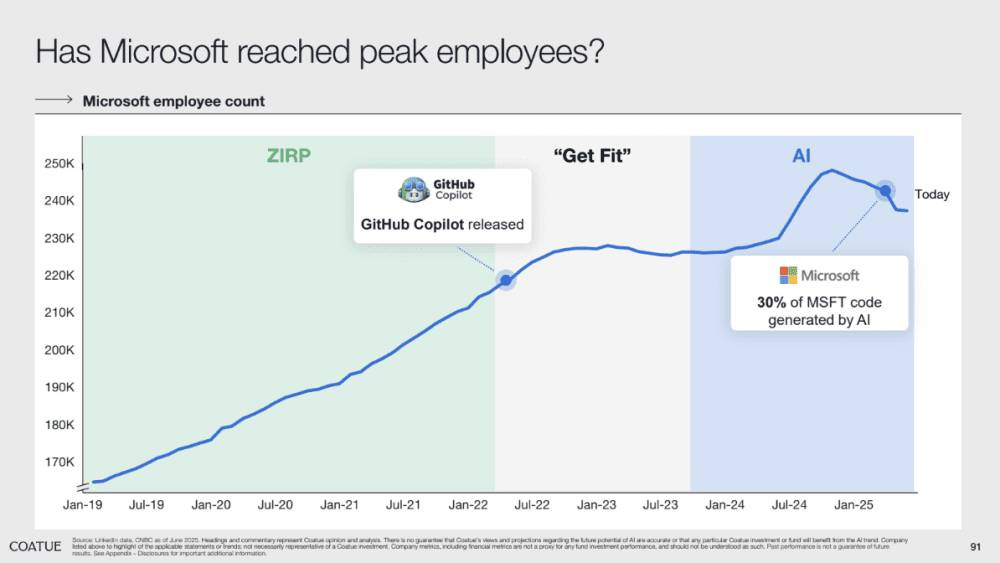

#5: Microsoft Hit Peak Employees While Revenue Grows – AI Drives Real Productivity

The Efficiency Revolution is Here

Microsoft’s transformation proves AI productivity gains are real, not hype:

Peak employment: Microsoft’s headcount peaked and is now declining

Revenue growth continues: While reducing headcount, revenue keeps growing

30% of Microsoft’s code is now generated by AI

AppLovin case study: Revenue per employee doubled from $3.6M to $7.6M while keeping headcount flat

Why This Matters: We’re entering an era where the best companies will generate more revenue with fewer people. This isn’t just cost-cutting – it’s a fundamental shift in how value is created.

The Competitive Advantage: Companies that embrace AI-driven productivity will have 2x+ the revenue per employee of their competitors, creating massive profit margin advantages.

Action Items: Measure and optimize revenue per employee aggressively. Implement AI tools across all functions, not just engineering. The companies that figure this out first will have unbeatable unit economics.

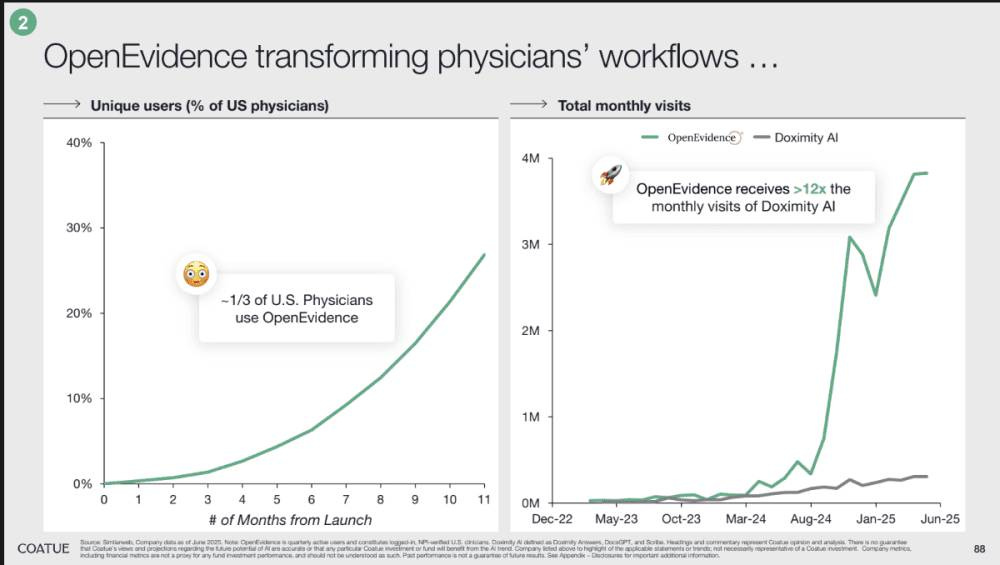

#6: Vertical AI is Crushing Horizontal – OpenEvidence Serves 1/3 of US Physicians

The Vertical AI Domination Playbook

Specialized AI tools are demolishing generalist solutions:

OpenEvidence: Serves 1/3 of all US physicians and gets >12x the monthly visits of competitors like Doximity AI

Harvey AI: Serves 34 of the AmLaw 100 firms with 240% YoY growth and 1.5x utilization increase year-over-year

Market penetration speed: These companies are capturing entire professional segments in months

Why Vertical Wins: Domain-specific AI can be 10x better than horizontal solutions because it understands industry-specific workflows, terminology, and problems. Generalist AI tools can’t compete on depth.

The Professional Services Gold Rush: High-value knowledge workers (doctors, lawyers, consultants) are early adopters willing to pay premium prices for AI that actually understands their work.

Action Items: If you’re building horizontal AI, pivot to vertical immediately. If you’re in a vertical market, build AI-first solutions for that specific industry. The window for generalist AI tools is closing fast.

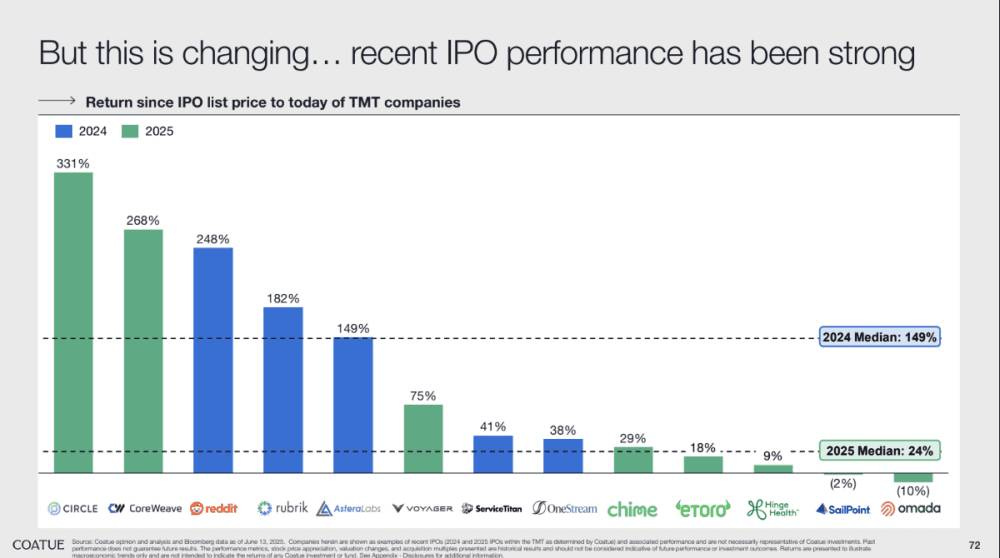

#7: Recent IPOs Are Crushing It – 2025 Median Return 24% vs -52% in ZIRP Era

The IPO Window is Wide Open for Quality Companies

The contrast between recent IPO performance and the ZIRP era is stunning:

2025 IPO performance: Circle (+331%), CoreWeave (+268%), Reddit (+248%)

2025 median return: 24% vs the -52% median for 2020-2021 vintage IPOs

2024 median return: 149% – showing consistent strong performance

What Changed: Markets are rewarding real businesses with real revenue and clear paths to profitability. The “growth at any cost” era is over, replaced by “profitable growth at reasonable valuations.”

The ZIRP Hangover is Healing: Companies are no longer being punished for the sins of 2021’s overvalued IPOs. Quality companies with good metrics are being rewarded immediately.

Action Items: If you have strong unit economics and >25% growth, don’t wait for perfect conditions. The IPO market is as receptive as it’s been in years for quality businesses.

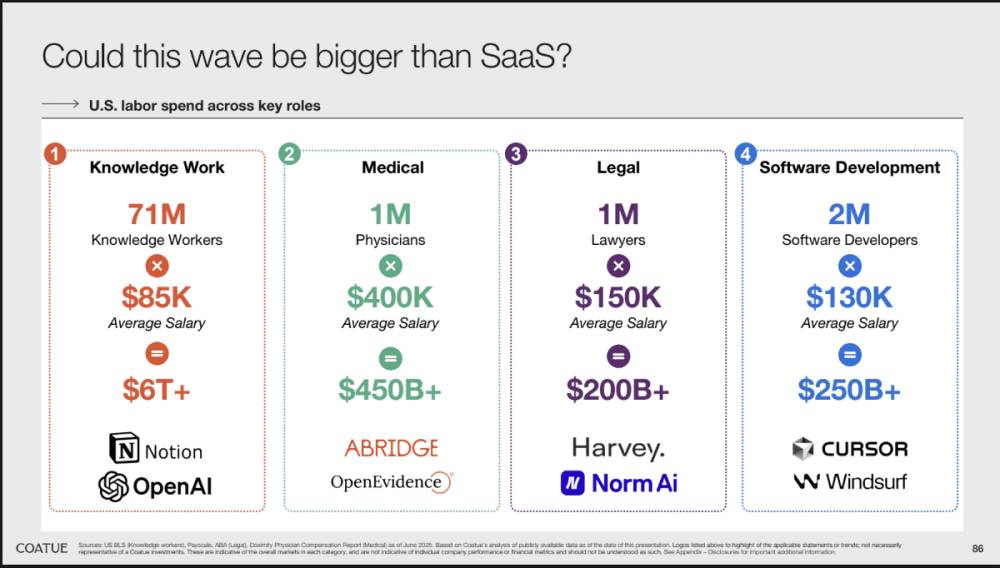

#8: AI TAM Could Be 10x Bigger Than SaaS – $1+ Trillion Market Incoming

The Trillion-Dollar Opportunity Hidden in Plain Sight

The addressable market for AI isn’t just bigger than SaaS – it’s bigger than entire industries:

Knowledge Work: 71M workers @ $85K average salary = $6+ trillion market

Medical: $450B+ addressable market

Legal: $200B+ addressable market

Software Development: $250B+ addressable market

This Isn’t About Productivity Tools: We’re not just making existing work more efficient – we’re replacing entire job functions with AI. The TAM isn’t “software” – it’s “human labor.”

The Replacement vs Enhancement Debate: While everyone debates whether AI will enhance or replace workers, the market is pricing in full replacement scenarios across massive job categories.

Action Items: Think about your AI strategy in terms of job replacement, not tool enhancement. The biggest opportunities are in completely automating workflows, not just making them 20% more efficient.

#9: Mega Private Companies Have Grown 27x in 10 Years – $51B to $1.357T

The Creation of a Parallel Economy

Private markets have become their own stock exchange:

Combined market cap of private companies valued at $50B+ has exploded from $51B (2015) to $1.357T today

27x growth in the mega-private company category in just 10 years

Scale comparison: These companies rival public market giants in size and importance

What This Enables: The best companies no longer need public markets for growth capital. They can achieve massive scale while maintaining private company advantages (long-term focus, less regulatory burden, strategic flexibility).

The Liquidity Revolution: Secondary markets for private company shares are creating liquidity without the overhead of being public. Employees and early investors can get liquidity while companies stay private.

Action Items: Plan for potentially staying private longer than previous generations of companies. Build secondary market strategies for employee liquidity. Don’t assume you need to go public to reward stakeholders.

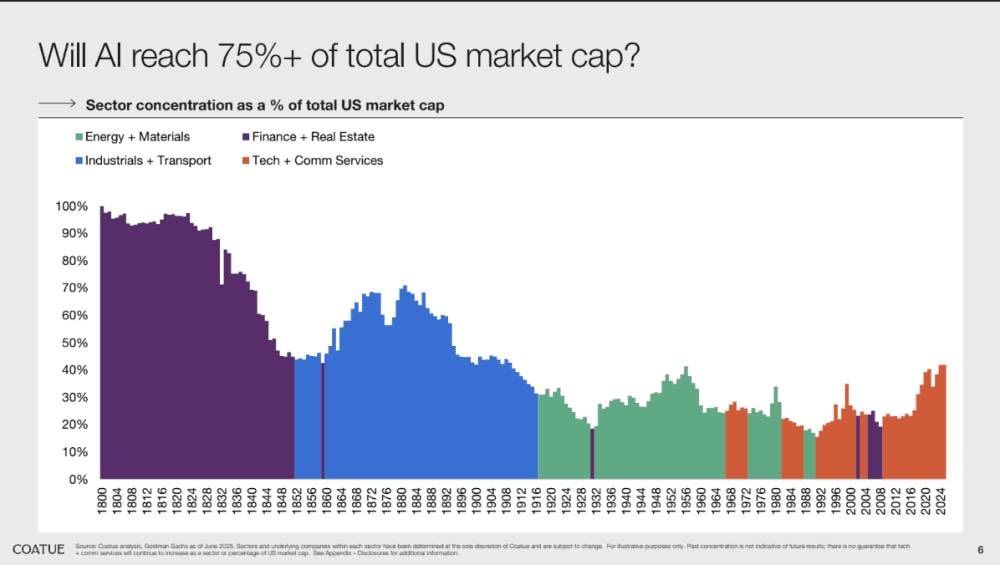

#10: AI Will Reach 75%+ of Total US Market Cap – This is the Biggest Wave Ever

Historical Context Shows This is Just the Beginning

Looking at past technology waves reveals the scale of what’s coming:

Previous waves: Tech went from <10% to 45% of total US market cap

AI trajectory: Positioned to drive tech to 75%+ of market cap – the largest sector concentration in history

Historical precedent: Dell achieved 97% price CAGR during the PC revolution (vs 25% for Nasdaq, 15% for S&P)

Every Sector Becomes a Tech Sector: This isn’t just about “tech companies” – every industry will be transformed by AI, making the distinction between “tech” and “non-tech” companies meaningless.

The Winners Take Everything: Like previous waves, the leaders will achieve outsized returns while laggards get left behind completely. There’s no participation trophy in platform shifts.

Action Items: Position your company to ride this wave rather than resist it. The companies that lead AI transformation will see historic returns. Everyone else becomes a footnote.

The Ultimate Bottom Line

We’re witnessing the most dramatic transformation in tech history. AI is creating trillion-dollar markets at unprecedented speed, while traditional metrics and timelines become obsolete. The companies that embrace this new reality – with AI-first strategies, aggressive growth targets, and willingness to reinvent themselves – will achieve historic returns.

The companies that don’t will simply disappear.

The great separation is happening now. Which side will you be on?

Key takeaway: Be AI-first, grow >25% at scale, get into the top tier, or become irrelevant.